PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741010

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741010

Circular Connector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

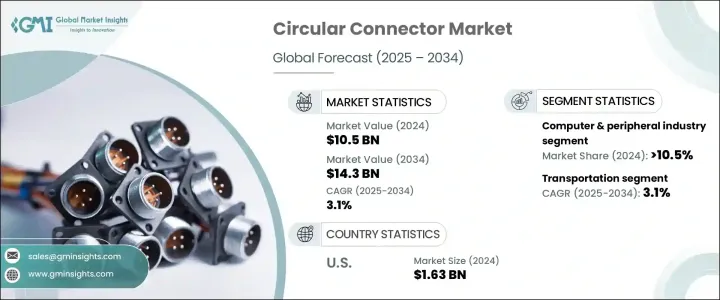

The Global Circular Connector Market was valued at USD 10.5 billion in 2024 and is estimated to expand at a CAGR of 3.1% to reach USD 14.3 billion by 2034. This growth trajectory underscores the increasing importance of circular connectors in ensuring stable and efficient transmission of data signals and electrical power, particularly in harsh and demanding environments. As industrial automation and digital transformation continue to accelerate worldwide, these connectors are emerging as crucial components in enabling seamless and secure operations across a variety of applications. Circular connectors offer high reliability, rugged design, and superior resistance to environmental challenges-traits that are becoming indispensable in today's high-performance industrial and electronic systems.

The surge in smart manufacturing, growth of Industry 4.0, and advancements in embedded systems are all contributing to the heightened demand. From robotics and factory automation to aerospace and defense, circular connectors are providing the backbone for uninterrupted connectivity. Furthermore, with the rise of edge computing, IoT, and real-time analytics, systems are under increasing pressure to transmit larger volumes of data without failure, elevating the need for robust connector technologies. Global trends such as digital infrastructure expansion, miniaturization of components, and the rising focus on system reliability further solidify the integral role of circular connectors in modern innovation ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.5 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 3.1% |

As automation technologies gain ground across sectors, circular connectors are playing a key role in enabling real-time communication and seamless operation of complex machinery. Rapid industrial growth and the expansion of intelligent infrastructure-such as factory automation and process control systems-are directly fueling market demand. Continuous innovation in telecommunications, automotive systems, and military equipment is also driving the need for highly durable, precise, and high-performance interconnect solutions.

The ongoing rollout of 5G infrastructure and the growing integration of high-speed data transmission capabilities have emerged as major drivers of adoption. Modern communication networks demand connectors that can maintain integrity and performance even under high-frequency loads, and circular connectors are uniquely engineered to meet these stringent requirements. In addition, the defense industry remains a significant contributor to market growth, propelled by its consistent need for weather-resistant, shock-proof, and highly reliable components that perform in extreme operational settings.

However, the market does face certain challenges. Shifting global trade policies and fluctuating tariff structures have disrupted supply chain continuity, causing temporary shortages and compelling manufacturers to explore regionalized production strategies. While such a shift supports long-term stability, it also requires substantial capital investments and longer timelines to implement effectively.

In 2024, the transportation sector demonstrated notable momentum within the circular connector market. With projections estimating a steady CAGR of 3.1% through 2034, growth in this sector is driven largely by surging investments in electric vehicle (EV) infrastructure. Strong government support for the nationwide deployment of high-speed charging networks is fueling demand for connectors capable of handling high voltages, harsh weather, and frequent use. Circular connectors are becoming essential components of EV charging stations and onboard systems due to their robust build, efficient power transfer capabilities, and compatibility with fast-charging technology.

Segmenting the market by end-use highlights a broad range of applications spanning telecom, industrial automation, military, automotive, computers and peripherals, transportation, and other niche sectors. In 2024, the computer and peripherals segment captured a 10.5% market share, driven by growing demand for high-speed and dependable data transfer in devices like smartphones, laptops, servers, and routers. The widespread adoption of cloud computing, advanced data centers, and IoT technologies continues to boost demand in this segment.

The United States Circular Connector Market generated USD 1.63 billion in 2024, propelled by significant public and private investments in sustainable transportation and electric mobility infrastructure. As consumers increasingly demand cleaner, tech-enabled mobility solutions, the need for rugged and high-performance circular connectors is rising-positioning the U.S. as a major driver of global market expansion.

Key players in the global circular connector space include Yazaki, Lapp Group, Fischer Connectors, Mencom, TE Connectivity, Amphenol, Molex, Aptiv, AVX, Phoenix Contact, GTK, Hirose Electric, 3M, Japan Aviation Electronics, Rosenberger, Ametek, Foxconn, and Luxshare Precision. These companies are focusing on expanding production capacity, investing in R&D for next-gen product development, and forming strategic alliances across multiple industries. Many are also pursuing acquisitions to access innovative technologies and broaden their offerings. A strong pivot toward regional manufacturing is also gaining traction, aimed at minimizing supply chain risks and catering to local market demands with greater speed and efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End Use, 2021 - 2034 (Million Units, USD Billion)

- 5.1 Key trends

- 5.2 Telecom

- 5.3 Transportation

- 5.4 Automotive

- 5.5 Industrial

- 5.6 Computer & peripherals

- 5.7 Military

- 5.8 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (Million Units, USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 3M

- 7.2 Ametek

- 7.3 Amphenol

- 7.4 Aptiv

- 7.5 AVX

- 7.6 Fischer Connectors

- 7.7 Foxconn

- 7.8 GTK

- 7.9 Hirose Electric

- 7.10 Japan Aviation Electronics

- 7.11 Lapp Group

- 7.12 Luxshare Precision

- 7.13 Mencom

- 7.14 Molex

- 7.15 Phoenix Contact

- 7.16 Rosenberger

- 7.17 TE Connectivity

- 7.18 Yazaki