PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892854

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892854

Reciprocating Power Generating Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

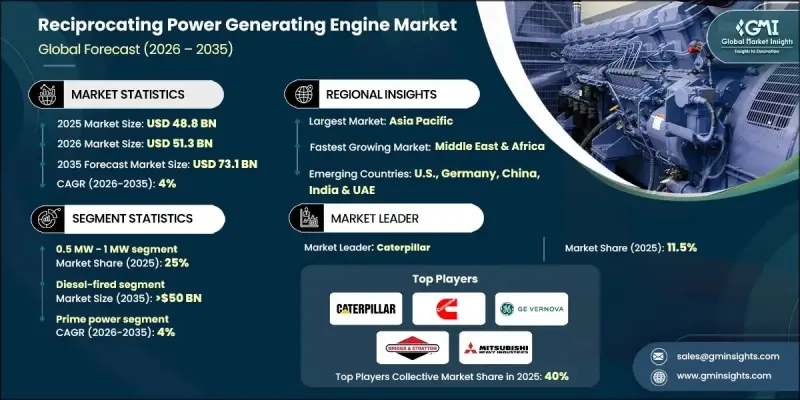

The Global Reciprocating Power Generating Engine Market was valued at USD 48.8 billion in 2025 and is estimated to grow at a CAGR of 4% to reach USD 73.1 billion by 2035.

The market growth is propelled by expanding microgrid initiatives and rural industrial electrification programs, which drive the need for scalable and reliable power solutions. Reciprocating engines are highly valued for their fast start-up, efficiency, and adaptability, making them suitable for delivering dependable electricity in both urban centers and remote locations. These engines convert the linear motion of pistons into rotational mechanical energy, producing electricity through controlled fuel combustion in cylinders. Growing investments in data centers, mining, and oil & gas operations, along with rising energy resilience requirements in emerging economies, are fueling demand. The ability of these engines to operate on diverse fuels, manage variable loads, and provide standby or peaking power further strengthens their market relevance. Technological advancements and the integration of renewable energy sources are expanding their role as flexible complements to intermittent power generation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $48.8 Billion |

| Forecast Value | $73.1 Billion |

| CAGR | 4% |

The 0.5 MW - 1 MW engine segment accounted for a 25% share in 2025 and is expected to grow at a 3.5% CAGR through 2035. Demand for compact, cost-efficient, and versatile industrial power units is rising, driven by the growing need for reliable backup solutions across multiple sectors.

The gas-fired reciprocating engines segment reached USD 11.2 billion in 2025, reflecting a surge in demand due to improved operational efficiency, environmental compliance, and renewable energy integration. These engines serve as dependable solutions to support variable and distributed energy generation.

U.S. Reciprocating Power Generating Engine Market held a 70% share in 2025, generating USD 6.7 billion. Market growth is supported by the rising requirement for backup power, aging grid infrastructure, adoption of distributed energy solutions, regulatory support for cleaner fuels, and increasing industrial and data center activity.

Key companies operating in the Global Reciprocating Power Generating Engine Market include Wartsila, Mitsubishi Heavy Industries, IHI Corporation, Honda Motor, Cummins, Scania, Rolls-Royce, Caterpillar, Deutz AG, Kawasaki Heavy Industries, Deere & Company, Kirloskar, TRITON DURO, Ashok Leyland, Briggs & Stratton, Enerflex, GE Vernova, Escorts Kubota Limited, and Guascor Energy. Companies in the Reciprocating Power Generating Engine Market are strengthening their position by investing in R&D to enhance fuel efficiency, emissions compliance, and operational flexibility. Strategic partnerships with utilities, industrial firms, and microgrid operators enable wider adoption and service integration. Manufacturers are expanding global service networks and offering customized solutions to meet regional energy needs. Technological innovation, such as hybrid and gas-capable engines, supports compliance with environmental regulations and renewable integration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Fuel type trends

- 2.1.3 Rated power trends

- 2.1.4 Application trends

- 2.1.5 End use trends

- 2.1.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of reciprocating power generating engines

- 3.8 Price trend analysis (USD/MW)

- 3.8.1 By region

- 3.8.2 By rated power

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization and IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Disruptive trends & future outlook

- 3.11 Market evolution & historical context

- 3.12 Technology fundamentals & performance characteristics

- 3.12.1 Engine speed types & configurations

- 3.12.2 Efficiency curves & operational parameters

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel Type, 2022 - 2035 (USD Million, MW & Units)

- 5.1 Key trends

- 5.2 Gas-fired

- 5.2.1 0.5 MW - 1 MW

- 5.2.2 > 1 MW - 2 MW

- 5.2.3 > 2 MW - 3.5 MW

- 5.2.4 > 3.5 MW - 5 MW

- 5.2.5 > 5 MW - 7.5 MW

- 5.2.6 > 7.5 MW

- 5.3 Diesel-fired

- 5.3.1 0.5 MW - 1 MW

- 5.3.2 > 1 MW - 2 MW

- 5.3.3 > 2 MW - 3.5 MW

- 5.3.4 > 3.5 MW - 5 MW

- 5.3.5 > 5 MW - 7.5 MW

- 5.3.6 > 7.5 MW

- 5.4 Dual fuel

- 5.4.1 0.5 MW - 1 MW

- 5.4.2 > 1 MW - 2 MW

- 5.4.3 > 2 MW - 3.5 MW

- 5.4.4 > 3.5 MW - 5 MW

- 5.4.5 > 5 MW - 7.5 MW

- 5.4.6 > 7.5 MW

- 5.5 Others

- 5.5.1 0.5 MW - 1 MW

- 5.5.2 > 1 MW - 2 MW

- 5.5.3 > 2 MW - 3.5 MW

- 5.5.4 > 3.5 MW - 5 MW

- 5.5.5 > 5 MW - 7.5 MW

- 5.5.6 > 7.5 MW

Chapter 6 Market Size and Forecast, By Rated Power, 2022 - 2035 (USD Million, MW & Units)

- 6.1 Key trends

- 6.2 0.5 MW - 1 MW

- 6.3 > 1 MW - 2 MW

- 6.4 > 2 MW - 3.5 MW

- 6.5 > 3.5 MW - 5 MW

- 6.6 > 5 MW - 7.5 MW

- 6.7 > 7.5 MW

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million, MW & Units)

- 7.1 Key trends

- 7.2 Industrial

- 7.3 CHP

- 7.4 Energy & utility

- 7.5 Landfill & biogas

- 7.6 Oil & gas

- 7.7 Others

Chapter 8 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million, MW & Units)

- 8.1 Key trends

- 8.2 Backup

- 8.2.1 0.5 MW - 1 MW

- 8.2.2 > 1 MW - 2 MW

- 8.2.3 > 2 MW - 3.5 MW

- 8.2.4 > 3.5 MW - 5 MW

- 8.2.5 > 5 MW - 7.5 MW

- 8.2.6 > 7.5 MW

- 8.3 Prime power

- 8.3.1 0.5 MW - 1 MW

- 8.3.2 > 1 MW - 2 MW

- 8.3.3 > 2 MW - 3.5 MW

- 8.3.4 > 3.5 MW - 5 MW

- 8.3.5 > 5 MW - 7.5 MW

- 8.3.6 > 7.5 MW

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Million, MW & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Russia

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.3.8 Denmark

- 9.3.9 Norway

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Thailand

- 9.4.7 Singapore

- 9.4.8 Indonesia

- 9.4.9 Malaysia

- 9.4.10 Philippines

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 Saudi Arabia

- 9.5.3 Qatar

- 9.5.4 Oman

- 9.5.5 Kuwait

- 9.5.6 Iran

- 9.5.7 Egypt

- 9.5.8 Turkey

- 9.5.9 Jordan

- 9.5.10 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

- 9.6.4 Peru

Chapter 10 Company Profiles

- 10.1 Ashok Leyland

- 10.2 Briggs & Stratton

- 10.3 Caterpillar

- 10.4 Cummins

- 10.5 Deere & Company

- 10.6 Deutz AG

- 10.7 Enerflex

- 10.8 Escorts Kubota Limited

- 10.9 GE Vernova

- 10.10 Guascor Energy

- 10.11 Kawasaki Heavy Industries

- 10.12 Kirloskar

- 10.13 MAN Energy Solutions

- 10.14 Mitsubishi Heavy Industries

- 10.15 Rehlko

- 10.16 Rolls-Royce

- 10.17 Scania

- 10.18 TRITON DURO

- 10.19 Wartsila

- 10.20 Yanmar Holdings

- 10.21 Honda Motor

- 10.22 IHI Corporation