PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750277

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750277

Vitamin K2 Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

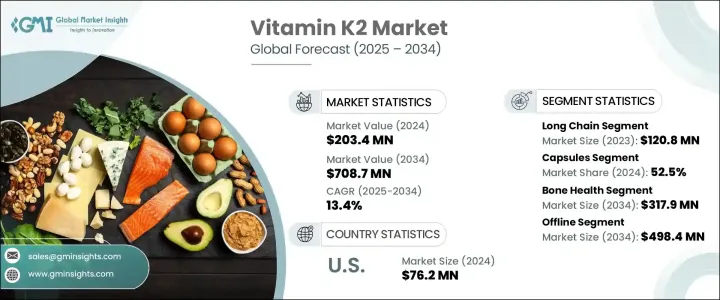

The Global Vitamin K2 Market was valued at USD 203.4 million in 2024 and is estimated to grow at a CAGR of 13.4% to reach USD 708.7 million by 2034, driven by the rising occurrence of chronic illnesses such as osteoporosis, heart disease, and certain cancers. The growing awareness of vitamin K2's benefits, especially in maintaining cardiovascular and bone health, has played a major role in increasing supplement consumption across all age groups. As more consumers focus on nutrition and preventive care, demand for targeted supplements continues to rise. The increased emphasis on bone density health and the management of conditions like osteoporosis is also accelerating the uptake of vitamin K2 products.

Furthermore, growing medical concern surrounding vitamin K deficiency in newborns, particularly the risk of late-onset bleeding, have prompted healthcare authorities to strengthen recommendations for supplementation at birth. This has led to an uptick in the use of vitamin K2 in pediatric care, opening a rapidly emerging segment focused on infant health. As awareness increases among parents and caregivers about the importance of early-life nutrition, the demand for safe, effective, and well-tolerated vitamin K2 formulations tailored for infants is expanding. Pediatric supplements are now being offered in gentler forms such as drops or oral solutions, which are easy to administer and designed specifically for neonatal needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $203.4 million |

| Forecast Value | $708.7 million |

| CAGR | 13.4% |

The long-chain form, MK-7, dominated the product category in 2024 due to its superior absorption and extended half-life in the body. MK-7 has gained trust among healthcare professionals who now prefer it for managing bone fragility and reducing cardiovascular risk. Increased clinical research supporting the role of MK-7 in preventing fractures and improving bone mineral density has further propelled its popularity, particularly among aging adults seeking natural solutions. As awareness of organic, plant-based supplements grows, demand for MK-7 sourced from natural ingredients continues to rise.

The capsules segment led the market in terms of dosage form, holding 52.5% share in 2024. The flexibility in formulating capsules, combined with their high absorption rate, has contributed to this growth. Soft gel variants are praised for their ability to improve the bioavailability of fat-soluble nutrients like vitamin K2, resulting in better compliance and faster action. Regulatory backing for soft gel formats from health authorities also supports their expanding use in over-the-counter supplements.

United States Vitamin K2 Market was valued at USD 76.2 million in 2024, driven by the rising interest in bone health, especially among older adults, alongside broader awareness campaigns. The growth of online sales channels has made vitamin K2 products more accessible, offering consumers a wider selection and convenient delivery options. Additionally, efforts to educate the public on the role in preventing bone and heart issues continue to drive market expansion in the country.

Key players in the Global Vitamin K2 Market such as Zenith Nutrition, Carlyle Nutritionals, Doctor's Best, Health Veda Organics, Vlado's Himalayan Organics, Amway Nutrilite, NattoPharma, Pharma Cure Laboratories, Kappa Biosciences (Balchem Corporation), WOW Lifesciences, Smarter Vitamins, Innovix Labs, Phi Naturals, and Mary Ruth Organics are employing strategic approaches to enhance their market position. These include the development of clean-label and organic products, investment in scientific research to validate health claims, expanding their digital presence, and forming distribution partnerships to boost global reach. Many also focus on product differentiation through enhanced bioavailability and unique delivery forms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing aging population and lifestyle related disorders

- 3.2.1.2 Rising awareness of bone and cardiovascular health

- 3.2.1.3 Increasing shift toward preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and quality concerns

- 3.2.2.2 Availability of alternative products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Short chain (MK--4)

- 5.3 Long chain (MK-7)

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Capsules

- 6.3 Tablets

- 6.4 Drops

- 6.5 Other dosage form

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bone health

- 7.3 Heart health

- 7.4 Blood clotting

- 7.5 Other indications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Offline

- 8.2.1 Pharmacies and drug stores

- 8.2.2 Supermarkets/ hypermarkets

- 8.2.3 Other offline stores

- 8.3 Online

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amway Nutrilite

- 10.2 Carlyle Nutritionals

- 10.3 Doctor's Best

- 10.4 Health Veda Organics

- 10.5 Innovix labs

- 10.6 Kappa Biosciences (Balchem Corporation)

- 10.7 Mary Ruth Organics

- 10.8 NattoPharma

- 10.9 Pharma Cure Laboratories

- 10.10 Phi Naturals

- 10.11 Smarter Vitamins

- 10.12 Vlado's Himalayan Organics

- 10.13 WOW Lifesciences

- 10.14 Zenith Nutrition