PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750303

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750303

Robotic Combat Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

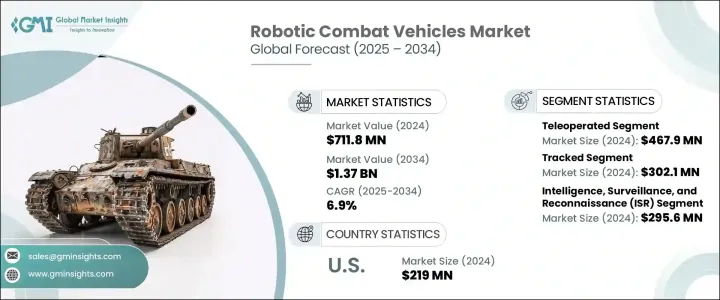

The Global Robotic Combat Vehicles Market was valued at USD 711.8 million in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 1.37 billion by 2034, driven by rising global defense budgets and advancements in artificial intelligence (AI) and autonomous technologies. As countries continue to increase their defense spending, there is a heightened focus on modernizing military capabilities and enhancing force effectiveness. RCVs are becoming increasingly integral to military strategies globally due to their ability to significantly reduce the risk to human personnel while enhancing operational capabilities.

By enabling missions in high-risk environments with minimal human intervention, robotic combat vehicles are reshaping the battlefield. Their use allows military forces to conduct complex operations more efficiently, from reconnaissance to direct combat, without exposing soldiers to unnecessary danger. These vehicles are equipped with advanced sensors, AI systems, and weaponry that enable them to perform tasks traditionally carried out by human soldiers, such as surveillance, search-and-rescue, and even offensive operations. The growing demand for these advanced unmanned systems is driven by the increasing complexity of modern warfare. Military operations today require more versatile and dynamic solutions, especially in situations where the terrain is challenging or the enemy is highly adaptive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $711.8 Million |

| Forecast Value | $1.37 Billion |

| CAGR | 6.9% |

The market is segmented by the mode of operation into autonomous and teleoperated systems. The teleoperated RCVs segment generated USD 467.9 million in 2024, due to the demand for systems that require real-time control in complex environments, such as urban combat or dynamic combat zones. These systems offer military personnel greater flexibility while still retaining human control, which is vital for mission reliability and ethical considerations. As militaries transition toward fully autonomous systems, teleoperated RCVs serve as an important intermediary step in adapting to these technologies.

In terms of mobility, the market is divided into wheeled, tracked, and hybrid vehicles. The tracked RCV segment generated USD 302.1 million in 2024. These tracked vehicles offer superior mobility on rugged terrain, making them ideal for frontline operations and combat situations in difficult environments. Their ability to carry heavier payloads, including advanced weaponry and sensor equipment, further increases their demand in direct combat and fire support roles. Additionally, tracked vehicles provide greater stability and recoil absorption, making them well-suited for rapid maneuvers and live-fire scenarios.

U.S. Robotic Combat Vehicles Market was valued at USD 219 million in 2024 due to substantial government spending on defense programs and initiatives, such as the military's focus on unmanned systems for ground and aerial operations. Furthermore, programs like the Army's Robotic Combat Vehicle initiative and the Navy's unmanned systems roadmap contribute to the growing interest in these technologies. The increasing need to reduce risks to military personnel, coupled with evolving threats, further fuels demand for RCVs in the U.S.

Several key players in the Robotic Combat Vehicles Market are actively enhancing their offerings by integrating AI-driven capabilities and improving the robustness of their robotic systems. Companies like General Dynamics Land Systems, BAE Systems, and Teledyne FLIR are leading the way in advancing the functionality and autonomy of these vehicles. They are also focusing on expanding their product portfolios to cater to diverse military needs, such as reconnaissance, surveillance, and logistics. Collaborations with government agencies and defense contractors are another strategy used by these players to secure long-term contracts and reinforce their market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global defense budgets

- 3.3.1.2 Advancements in ai and autonomous navigation

- 3.3.1.3 Development of modular combat platforms

- 3.3.1.4 Demand for unmanned solutions in high-risk zones

- 3.3.1.5 Increasing military modernization programs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development and operational costs

- 3.3.2.2 Cybersecurity vulnerabilities

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Autonomous

- 5.3 Teleoperated

Chapter 6 Market Estimates and Forecast, By Mobility, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Wheeled

- 6.3 Tracked

- 6.4 Hybrid

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Intelligence, surveillance, and reconnaissance (ISR)

- 7.3 Direct Combat & Fire Support

- 7.4 Combat Engineering

- 7.5 Medical Evacuation

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BAE Systems

- 9.2 Elbit Systems

- 9.3 General Dynamics Land Systems

- 9.4 HDT Global

- 9.5 Israel Aerospace Industries

- 9.6 Kratos Defense and Security Solutions

- 9.7 Milrem Robotics

- 9.8 Nexter Systems

- 9.9 Oshkosh Defense

- 9.10 Qinetiq

- 9.11 Rheinmetall

- 9.12 Teledyne FLIR

- 9.13 Textron Systems