PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836537

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836537

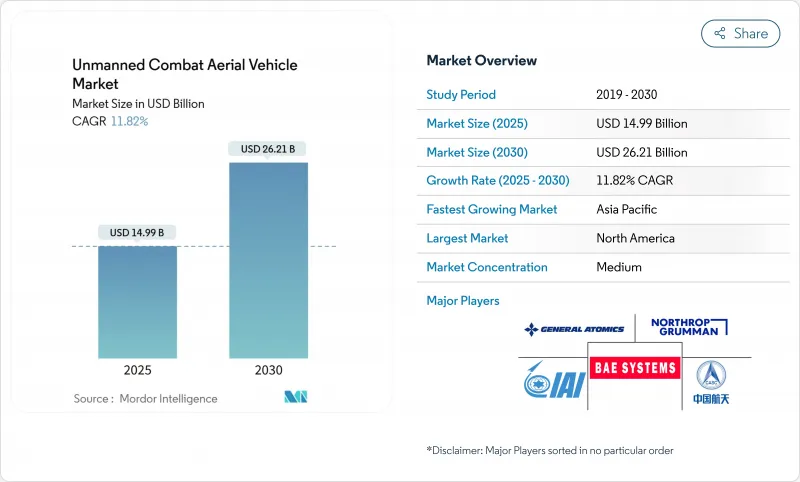

Unmanned Combat Aerial Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The unmanned combat aerial vehicle (UCAV) market size is valued at USD 14.99 billion in 2025 and is forecasted to reach USD 26.21 billion by 2030, translating into an 11.82% CAGR.

Demand is accelerating as defense ministries scale budgets, embed autonomous concepts in doctrine, and move AI-enabled teaming projects from prototypes to purchase orders. North America's lead flows from large US programs such as the 1,000-unit Collaborative Combat Aircraft plan. At the same time, Asia-Pacific's double-digit expansion mirrors rapid force modernization in China, India, and South Korea. Fixed-wing designs, turboprop propulsion, and 6-24 hour endurance profiles continue to anchor fleet decisions because they balance range, payload, and lifecycle cost. In parallel, miniaturized precision munitions, low-latency satellite links, and self-learning autonomy push performance boundaries, broadening use cases and sharpening the competitive tone across the unmanned combat aerial vehicle market.

Global Unmanned Combat Aerial Vehicle Market Trends and Insights

Institutionalization of Manned-Unmanned Teaming Doctrines

The operational shift toward formal manned-unmanned teaming (MUM-T) is no longer conceptual; it is being written into acquisition contracts, training syllabi, and even the tail-number nomenclature of front-line squadrons. The US has set the initial pace through its Collaborative Combat Aircraft (CCA) program, awarding parallel April 2024 contracts to Anduril and General Atomics that call for more than 1,000 autonomous wingmen by 2028. The newly assigned designations-YFQ-42A "Gambit" and YFQ-44A "Fury"-place these drones inside the traditional "F-series" taxonomy, signaling that they will occupy roles once reserved only for crewed fighters.

Across the Atlantic, the UK validated its approach in April 2024 when QinetiQ, the Defense Science and Technology Laboratory, and the Royal Navy flew a jet trainer in formation with an autonomous Banshee Jet 80 at 350 knots. Lessons from that sortie now feed directly into the Autonomous Collaborative Platform (ACP) concept, which stresses goal-based autonomy and electronic-attack flexibility. Similar doctrinal pivots are underway on the European continent-through the Franco-German Spanish Future Combat Air System (FCAS)-and in the Indo-Pacific, where Australia's MQ-28 Ghost Bat is evolving from demonstrator to operational asset. Collectively, these programs confirm that MUM-T has become a core element of Tier-1 air-power planning.

Integration of AI-Enabled Swarm Capabilities

Demonstrations in early 2025 showcased UCAV swarms autonomously coordinating reconnaissance, electronic attack, and kinetic strike roles, illustrating how distributed algorithms can generate combat mass without increasing proportional costs. Saab's AUKUS Project Convergence trial, which used BlueBear's open architecture mission system to "hot swap" algorithms in flight, implicitly revealed that procurement agencies may prioritize software reusability over bespoke airframes. The US Air Force's USD 100 million award to Firestorm Labs for Tempest 50 swarm drones confirms institutional confidence that algorithmic behaviors can meet stringent rules of engagement. The associated inference is that future export tenders may weigh software-update cadence more heavily than initial airframe specifications, bringing consumer electronics to refresh logic into defense procurement.

Cyber-hardening Challenges for Beyond-Line-of-Sight Missions

DARPA launched the Security and Privacy Assurance for Embedded Reasoning (SABER) program in March 2025 to expose data-poisoning and adversarial-input vulnerabilities in autonomous control loops, confirming that cyber validity is now a prerequisite for operational release (DARPA contracting notice). The initiative highlights a core tension: every additional sensor and communications channel widens the attack surface even as mission designers crave richer data. Consequently, primes are spending more on zero-trust architecture and real-time anomaly detection-investments that heighten non-recurring engineering costs but strengthen competitiveness when export customers demand verified cyber assurance.

Other drivers and restraints analyzed in the detailed report include:

- Global Rollout of High-Throughput SATCOM

- Miniaturization of Precision-Guided Munitions

- MTCR and Wassenaar Regime Export Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platforms cruising under 30,000 ft generated 64.39% revenue in 2024 because they fill ISR and close-air-support roles at sustainable fuel burn rates. Affordable airframes such as Bayraktar TB2 and MQ-9 variants offer 27-hour endurance yet remain agile enough for dynamic retasking. However, high-altitude designs above 30,000 ft post the fastest 11.45% CAGR as nations seek surveillance persistence over anti-access zones.

Stealth shaping and turbojet propulsion let these aircraft loiter above most surface-to-air coverage, adding resilience in peer conflicts. This dual-track demand keeps manufacturers investing in pressurized fuselages and high-aspect wings to elevate ceilings without sacrificing payload. The unmanned combat aerial vehicle market size for high-altitude craft could double by 2030, supported by satellite-enabled command loops.

UCAVs capable of 200-1,000 km dominate with a 53.64% share, supporting cross-border missions and maritime patrols at manageable logistics cost. Theater commanders value their flexibility to redeploy quickly among dispersed forward bases. Yet, requirements for stand-off strikes and Indo-Pacific reach spur the growth of the greater than 1,000 km class by 12.76% annually. Integrating multi-band SATCOM and efficient turbine-hybrid engines underpins this surge, as does doctrine prioritizing deep penetration against integrated air defenses. Consequently, the unmanned combat aerial vehicle market anticipates a portfolio tilt toward fuel-efficient designs that pair high transit speed with broadband connectivity.

The Unmanned Combat Aerial Vehicle (UCAV) Market Report is Segmented by Altitude of Operation (Below 30, 000 Ft, and More), Range (Short-Range (Less Than 200km), and More), Endurance (Up To 6 Hours, and More), Type (Fixed-Wing and Rotary-Wing (VTOL)), Engine Type (Turboprop, and More), End-User (Air Force, and More), & Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.51% revenue in 2024, propelled by a USD 61.2 billion US defense appropriation for aviation systems and an industrial base that couples platform manufacture with secure communications, propulsion, and AI software. Contract awards to General Atomics for the XQ-67A and Boeing for MQ-25A indicate sustained capital flow toward complementary crewed-uncrewed force packages. Long-lead component suppliers benefit from multiyear production lots that stabilize demand forecasts.

Asia-Pacific posts the quickest 12.36% CAGR as China, India, and South Korea channel modernization funds toward indigenous unmanned strike capabilities. China's aero-engine initiatives seek self-reliance, reducing reliance on foreign hot sections while powering FH-97 loyal-wingman demonstrators. Japan's tilt-rotor and VTOL explorations add lift-capable unmanned systems to maritime patrol arsenals. Regional procurement aims to counterbalance contested sea lanes and archipelagic chokepoints, enlarging the unmanned combat aerial vehicle market in quantity and technological sophistication.

Europe sustains steady adoption through multinational collaborations that share risk and integrate UCAVs into next-generation manned fighters. The Leonardo-Baykar accord to feed Kizilelma data into the Global Combat Air Programme underpins a wider drive to converge sensors, datalinks, and weapons across alliance fleets. Regulatory alignment on civilian air-traffic integration remains a hurdle, yet EU defense-preparedness recommendations urge acceleration of unmanned combat aerial vehicle market uptake to strengthen collective deterrence.

- General Atomics

- Northrop Grumman Corporation

- Israel Aerospace Industries Ltd.

- BAE Systems plc

- China Aerospace Science and Technology Corporation

- Lockheed Martin Corporation

- BAYKAR A.S.

- The Boeing Company

- Elbit Systems Ltd.

- Kratos Defense & Security Solutions, Inc.

- BlueBird Aero Systems Ltd.

- Aviation Industry Corporation of China (AVIC)

- Turkish Aerospace Industries, Inc.

- AeroVironment, Inc.

- Saab AB

- Griffon Aerospace, Inc.

- Teledyne Technologies Incorporated

- Korean Aerospace Industries (KAI)

- Airbus SE

- L3Harris Technologies, Inc.

- QinetiQ Group

- Rheinmetall AG

- Hindustan Aeronautics Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Institutionalization of manned-unmanned teaming (MUM-T) doctrines by Tier-1 air forces

- 4.2.2 Integration of Artificial Intelligence-enabled swarm and Loyal-Wingman capabilities

- 4.2.3 Global rollout of high-throughput Ka/Ku/LEO SATCOM for Beyond-Line-of-Sight (BLOS) control

- 4.2.4 Miniaturization of precision-guided munitions for Class-III UCAVs

- 4.2.5 Increasing defense budgets and military modernization programs globally

- 4.2.6 Rising geopolitical tensions and regional conflicts driving demand for autonomous systems

- 4.3 Market Restraints

- 4.3.1 Cyber-hardening challenges for Beyond-Line-of-Sight missions

- 4.3.2 MTCR and Wassenaar Regime export restrictions on Category-I UCAVs

- 4.3.3 Dependence on limited-volume aero-turbine supply chain for high-thrust small engines

- 4.3.4 Civilian air-traffic integration hurdles in Europe and the Caribbean FIRs

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Altitude of Operation

- 5.1.1 Below 30,000 ft

- 5.1.2 Above 30,000 ft

- 5.2 By Range

- 5.2.1 Short-Range (Less than 200 km)

- 5.2.2 Medium-Range (Between 200 and 1,000 km)

- 5.2.3 Long-Range (Greater than 1,000 km)

- 5.3 By Endurance

- 5.3.1 Up to 6 hours

- 5.3.2 6 to 24 hours

- 5.3.3 More than 24 hours

- 5.4 By Type

- 5.4.1 Fixed-Wing

- 5.4.2 Rotary-Wing (VTOL)

- 5.5 By Engine Type

- 5.5.1 Turboprop

- 5.5.2 Turbojet/Turbofan

- 5.5.3 Hybrid-Electric/Hydrogen

- 5.6 By End-User

- 5.6.1 Air Force

- 5.6.2 Army (Ground Forces)

- 5.6.3 Navy/Marine Corps

- 5.6.4 Joint Special Operations Commands

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 France

- 5.7.2.3 Germany

- 5.7.2.4 Russia

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Israel

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 General Atomics

- 6.4.2 Northrop Grumman Corporation

- 6.4.3 Israel Aerospace Industries Ltd.

- 6.4.4 BAE Systems plc

- 6.4.5 China Aerospace Science and Technology Corporation

- 6.4.6 Lockheed Martin Corporation

- 6.4.7 BAYKAR A.S.

- 6.4.8 The Boeing Company

- 6.4.9 Elbit Systems Ltd.

- 6.4.10 Kratos Defense & Security Solutions, Inc.

- 6.4.11 BlueBird Aero Systems Ltd.

- 6.4.12 Aviation Industry Corporation of China (AVIC)

- 6.4.13 Turkish Aerospace Industries, Inc.

- 6.4.14 AeroVironment, Inc.

- 6.4.15 Saab AB

- 6.4.16 Griffon Aerospace, Inc.

- 6.4.17 Teledyne Technologies Incorporated

- 6.4.18 Korean Aerospace Industries (KAI)

- 6.4.19 Airbus SE

- 6.4.20 L3Harris Technologies, Inc.

- 6.4.21 QinetiQ Group

- 6.4.22 Rheinmetall AG

- 6.4.23 Hindustan Aeronautics Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment