PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750309

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750309

Anti-pollution Nasal Spray Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

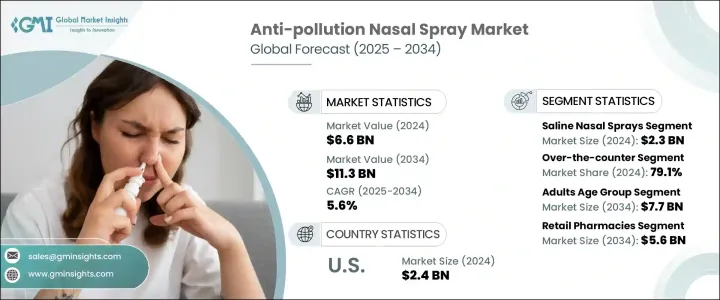

The Global Anti-Pollution Nasal Spray Market was valued at USD 6.6 billion in 2024 and is estimated to expand at a CAGR of 5.6% to reach USD 11.3 billion by 2034. This steady growth is largely attributed to the rising concern surrounding air pollution and its harmful impact on human health. Exposure to polluted air is linked to several life-threatening conditions, including cardiovascular diseases, respiratory complications, and other chronic illnesses. With pollution levels rising in urban environments and more people living in densely populated areas, the demand for preventive health solutions like nasal sprays has increased considerably. These products are increasingly viewed as a simple and effective defense mechanism against airborne contaminants that can aggravate respiratory health.

A growing body of evidence highlights the impact of fine particulate matter and environmental allergens on the nasal passages and respiratory system. As pollution continues to intensify, especially in industrial and metropolitan areas, consumers are turning toward daily-use products that can offer quick relief and long-term protection. Nasal sprays, especially those formulated to remove irritants and pollutants from the nasal passages, are becoming a widely accepted part of respiratory care routines. The rising incidence of air pollution-related respiratory disorders, including asthma, allergic rhinitis, and chronic obstructive pulmonary disease, is playing a key role in supporting market expansion. Increasing awareness about the preventive benefits of using nasal sprays regularly and the emphasis on early intervention are encouraging consumer adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $11.3 Billion |

| CAGR | 5.6% |

In terms of product type, the market is segmented into saline nasal sprays, homeopathic nasal sprays, barrier protection nasal sprays, and steroid nasal sprays. Saline nasal sprays led the market with a valuation of USD 2.3 billion in 2024. Their dominance is largely due to their proven effectiveness in flushing out airborne particles and maintaining moisture in nasal passages. These sprays are favored for their simplicity and minimal risk, making them suitable for everyday use and for a wide range of age groups. Their ability to relieve nasal irritation from dust, smoke, and other pollutants makes them a preferred choice among consumers.

Based on product classification, the market is categorized into prescription-based and over-the-counter (OTC) nasal sprays. The OTC segment emerged as the dominant category in 2024, accounting for 79.1% of the overall market share. As people become more proactive in managing their health, OTC products have gained immense popularity due to their accessibility and convenience. Consumers are increasingly inclined to choose nasal sprays that do not require a doctor's consultation, especially for addressing minor yet frequent symptoms like nasal congestion and irritation. The popularity of self-care and preventive health practices continues to support this trend.

Age-wise segmentation of the market includes pediatric and adult users. The adult segment held the largest market share in 2024, with a value of USD 4.6 billion, and is expected to grow to USD 7.7 billion by 2034, registering a CAGR of 5.5% during the forecast period. Adults are more frequently exposed to outdoor environments where pollution levels tend to be higher, driving the use of nasal sprays to combat pollution-induced respiratory symptoms. Better access to healthcare information, higher disposable incomes, and a growing interest in self-managed health routines have further fueled demand in this segment.

By application, the market is divided into allergy, sinus congestion, and asthma. The allergy segment held a prominent position in 2024, valued at USD 3.1 billion. The increasing occurrence of allergy symptoms caused by airborne allergens and pollutants is prompting consumers to seek fast-acting and effective relief options. Nasal sprays designed for allergy relief are being used more frequently as they offer a convenient way to manage symptoms and improve daily comfort. Public health campaigns promoting better allergy management also play a supporting role in driving product adoption.

Distribution channels for anti-pollution nasal sprays include hospital pharmacies, retail pharmacies, and online pharmacies. Retail pharmacies emerged as the leading segment in 2024 and are projected to reach USD 5.6 billion by 2034. The popularity of retail outlets stems from their widespread availability and ability to provide immediate access to a broad range of nasal spray options. Consumers looking for quick, non-prescription solutions often rely on retail pharmacies for convenience and accessibility. As self-care becomes more mainstream, retail pharmacies continue to serve as a critical touchpoint for consumers looking to manage everyday health concerns efficiently.

In the regional landscape, the U.S. accounted for a major share of the North American market in 2024, with a valuation of USD 2.4 billion. The rising occurrence of respiratory ailments linked to pollution, along with a well-informed consumer base, has strengthened the demand for nasal sprays in the country. High pollution levels in urban centers and growing health consciousness have led to an increased reliance on protective health products.

Leading companies in the market, which together control approximately 65%-75% of the total market share, continue to focus on product innovation, strategic collaborations, and business expansion to meet the growing consumer demand. The market remains concentrated, with key players adopting aggressive strategies to retain their competitive edge and respond to increasing global awareness about pollution-induced respiratory health issues.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing awareness for respiratory health

- 3.2.1.2 Increasing prevalence of allergies and respiratory disorders

- 3.2.1.3 Advancement in nasal drug delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and safety concerns

- 3.2.2.2 Availability of alternative dosage form

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Homeopathic nasal sprays

- 5.3 Saline nasal sprays

- 5.4 Barrier protection nasal spray

- 5.5 Steroid nasal sprays

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Prescription

- 6.3 Over the counter

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatric

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Allergy

- 8.3 Sinus congestion

- 8.4 Asthma

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Altamira Therapeutics

- 11.2 Arm & Harmer (Church & Dwight)

- 11.3 AstraZeneca

- 11.4 Beekeepers’ Naturals

- 11.5 B.F Ascher

- 11.6 GlaxoSmithKline

- 11.7 Himalaya Wellness

- 11.8 Merck

- 11.9 Nasaleze

- 11.10 NeilMed Pharmaceuticals

- 11.11 Sterimar

- 11.12 Trutek

- 11.13 Xlear