PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750311

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750311

Perovskite Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

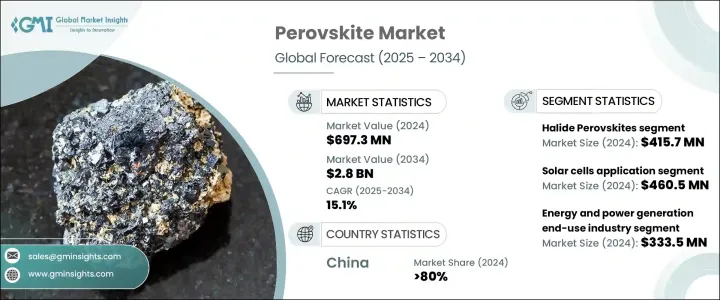

The Global Perovskite Market was valued at USD 697.3 million in 2024 and is estimated to grow at a CAGR of 15.1% to reach USD 2.8 billion by 2034, driven by the rising global attention toward sustainable energy and material innovation in the spotlight, especially in clean energy applications. As energy infrastructures adapt to support renewable integration, perovskites are gaining traction due to their versatility, lightweight properties, and compatibility with advanced energy systems. These materials are unlocking new possibilities in solar power, sensors, and consumer electronics thanks to their strong performance in flexible and efficient thin-film configurations.

Ongoing R&D is driven by public and private initiatives focused on accelerating energy transformation, particularly in the United States, where government-backed sustainability targets align with investments in photonics and semiconductor innovation. Interest is growing in combining silicon with perovskite for tandem solar cell use, offering potential to exceed the efficiency levels of traditional photovoltaics. Their adaptability also supports applications in portable and wearable solar devices, addressing demand from residential and commercial markets. Rapid innovation in thin-film electronics enables creative device designs, further increasing the relevance of perovskites in future-facing technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $697.3 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 15.1% |

In 2024, halide perovskites generated USD 415.7 million and are expected to grow at a CAGR of 16.7% through 2034. These materials are proving especially effective in solar and optoelectronic applications because of their exceptional light absorption capabilities. Their ability to perform well in tandem solar configurations continues to draw attention from researchers and commercial developers. A steady increase in funding for emerging solar materials indicates robust global confidence in these technologies. Innovations involving halide perovskites are expected to accelerate progress in high-efficiency solar and photonics solutions.

The solar cell segment dominated the market with USD 460.5 million in 2024, holding a 66.1% share and anticipated to grow at 18% CAGR through 2034. The improved energy conversion efficiency of perovskite solar cells, especially in tandem configurations, propels their use in the global solar industry. Technology is increasingly being integrated into solar panels used in both residential and utility-scale projects due to reduced manufacturing costs and scalable fabrication methods. This trend aligns with the global transition toward renewable energy, with solar projected to lead future clean energy investments.

China Perovskite Market held 80% share in 2024, driven by the world's manufacturing capacity for critical components, such as wafers, cells, and modules, concentrated within its borders. This extensive control not only strengthens its position as the primary exporter of solar technologies but also reinforces its strategic influence over the pricing, scalability, and innovation pace across emerging solar segments, including perovskites. China's aggressive investments in R&D, state-backed subsidies, and vertically integrated manufacturing ecosystems enable it to commercialize next-generation technologies.

Top companies in this market include Frontier Materials, Swift Solar, Oxford PV, Saule Technologies, and Microquanta Semiconductor. To secure their positions, leading companies focus on scaling production capabilities, enhancing efficiency through material innovation, and forming strategic partnerships with energy providers and research institutions. Many invest in pilot production lines to test large-scale deployment viability while protecting their IP through patents to maintain a competitive advantage. These strategies are designed to meet global demand and reinforce long-term market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising global energy demand driving next-generation photovoltaic adoption

- 3.7.1.2 Favorable government incentives for clean and decentralized energy systems

- 3.7.1.3 Superior efficiency and cost advantages of perovskite-based solar technologies

- 3.7.1.4 Increasing off-grid electrification projects in developing and remote regions

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Stability and durability concerns of perovskite materials in harsh environments

- 3.7.2.2 Lack of established large-scale manufacturing and commercialization infrastructure

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Competitive landscape

- 4.1.1 Company overview

- 4.1.2 Product portfolio and specifications

- 4.1.3 Swot analysis

- 4.2 Company market share analysis, 2024

- 4.2.1 Global market share by company

- 4.2.2 Regional market share analysis

- 4.2.3 Product portfolio share analysis

- 4.3 Strategic initiative

- 4.3.1 Mergers and acquisitions

- 4.3.2 Partnerships and collaborations

- 4.3.3 Product launches and innovations

- 4.3.4 Expansion plans and investments

- 4.4 Company benchmarking

- 4.4.1 Product innovation benchmarking

- 4.4.2 Pricing strategy comparison

- 4.4.3 Distribution network comparison

- 4.4.4 Customer service and support comparison

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Halide perovskites

- 5.2.1 Organic-inorganic hybrid halide perovskites

- 5.2.2 All-inorganic halide perovskites

- 5.2.3 Lead-based halide perovskites

- 5.2.4 Lead-free halide perovskites

- 5.3 Oxide perovskites

- 5.3.1 Titanate-based oxide perovskites

- 5.3.2 Ferroelectric oxide perovskites

- 5.3.3 Other oxide perovskites

- 5.4 Other perovskite materials

- 5.4.1 Double perovskites

- 5.4.2 Layered perovskites

- 5.4.3 Perovskite-inspired materials

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solar cells

- 6.2.1 Single-junction perovskite solar cells

- 6.2.2 Tandem perovskite-silicon solar cells

- 6.2.3 Flexible perovskite solar cells

- 6.2.4 Building-integrated photovoltaics (bipv)

- 6.2.5 Space applications

- 6.3 Light-emitting diodes (leds)

- 6.3.1 Display technologies

- 6.3.2 Lighting applications

- 6.4 Photodetectors and sensors

- 6.4.1 X-ray detectors

- 6.4.2 Photodetectors

- 6.4.3 Gas sensors

- 6.4.4 Pressure sensors

- 6.5 Lasers and optical applications

- 6.6 Energy storage devices

- 6.7 Quantum computing applications

- 6.8 Other applications

- 6.8.1 Catalysis

- 6.8.2 Thermoelectric devices

- 6.8.3 Neuromorphic computing

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Energy and power generation

- 7.3 Electronics and optoelectronics

- 7.4 Construction and building materials

- 7.5 Automotive and transportation

- 7.6 Aerospace and defense

- 7.7 Healthcare and medical devices

- 7.8 Telecommunications

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Oxford PV

- 9.2 Saule Technologies

- 9.3 Microquanta Semiconductor

- 9.4 Swift Solar

- 9.5 Frontier Materials

- 9.6 Toshiba

- 9.7 Panasonic

- 9.8 Sekisui Chemical

- 9.9 Hanwha Vision

- 9.10 GCL Suzhou Nanotechnology

- 9.11 EneCoat Technologies

- 9.12 Kaneka Corporation

- 9.13 Aisin Corporation

- 9.14 UtmoLight

- 9.15 Wonder Solar

- 9.16 Other Notable Players