PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750324

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750324

Europe Battery Electric Vehicle (BEV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

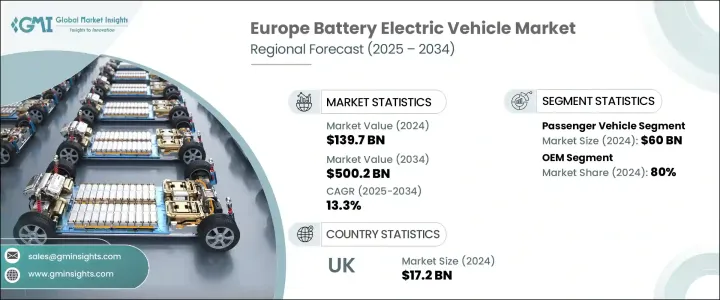

Europe Battery Electric Vehicle Market was valued at USD 139.7 billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 500.2 billion by 2034, driven by the rise in BEV adoption by the region's expanding electric vehicle infrastructure, making it easier for consumers to embrace e-mobility. This infrastructure includes an increasing number of fast-charging stations along highways, in urban areas, and even in residential zones, which alleviates concerns about range anxiety, a major barrier for potential electric vehicle buyers.

The rapid expansion of both public and private charging infrastructure is playing a crucial role in accelerating the adoption of battery electric vehicles (BEVs) in Europe. In urban areas, where home charging solutions may be limited due to space constraints or lack of parking, the increase in accessible charging points ensures that potential BEV owners feel confident in making the switch to electric mobility. By enhancing the convenience of recharging, these developments significantly reduce range anxiety, one of the major barriers to BEV adoption. Moreover, the growing number of fast-charging stations along highways and in busy city centers is making long-distance travel and daily commutes more viable for BEV drivers. As charging networks expand, drivers can recharge their vehicles more quickly and easily, minimizing downtime and making electric vehicles more practical for a broader range of consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $139.7 Billion |

| Forecast Value | $500.2 Billion |

| CAGR | 13.3% |

The market is divided into several segments, including passenger vehicles, commercial vehicles, two and three-wheelers, and off-highway vehicles. In 2024, the passenger vehicle segment was valued at USD 60 billion, capturing a 40% share. Increasingly, European consumers are opting for BEVs, either as primary or secondary vehicles, driven by incentives, government policies promoting low-emission zones, and the variety of models now available in the market. These range from compact city cars to larger family SUVs, providing consumers with more options and enhancing adoption.

In terms of sales channels, the OEM (Original Equipment Manufacturer) segment dominates, accounting for 80% share in 2024. OEMs offer BEVs through their official dealerships, ensuring full control over pricing, inventory, and customer service. This structure allows manufacturers to provide financing options, warranties, and post-purchase services, which build trust among consumers. Consumers often prefer buying from well-known brands due to the reliability and services these established companies offer, compared to aftermarket or independent resellers.

Northern Europe Battery Electric Vehicle (BEV) Market held 35% share in 2024, with the UK leading the way. The UK has become a significant hub for BEV adoption, owing to the rapid growth of public charging stations, including fast chargers on highways. This infrastructure makes BEVs more practical for both urban and rural drivers, accelerating their popularity. Car manufacturers are also investing in local production, ensuring a steady supply of vehicles and keeping prices competitive in the region.

The key strategies adopted by companies in the Europe BEV market include expanding electric vehicle offerings, enhancing charging infrastructure, and investing in local production. Companies like Mercedes, Hyundai, Volkswagen, Stellantis, BMW, Tesla, and Renault are all focused on offering a broad range of BEVs to meet diverse consumer needs, from city cars to larger family vehicles. Furthermore, they are accelerating investments in EV and battery assembly plants to strengthen their supply chains. By improving access to charging stations and offering financing solutions, these companies are also making it easier for consumers to switch to electric mobility. Their emphasis on sustainability and performance is shaping the future of the Europe BEV market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Battery manufacturers

- 3.2.3 Component and technology providers

- 3.2.4 Manufacturers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price trend

- 3.7.1 Vehicle

- 3.7.2 Region

- 3.8 Cost breakdown analysis

- 3.9 Import and export

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 Impact forces

- 3.12.1 Growth drivers

- 3.12.1.1 Stringent emissions regulations

- 3.12.1.2 Expanding charging infrastructure

- 3.12.1.3 Corporate and fleet electrification

- 3.12.1.4 Technological improvements in battery and other related components

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 High upfront costs

- 3.12.2.2 Long charging times

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lithium-ion batteries

- 5.3 Lithium iron phosphate (LFP)

- 5.4 Solid-state batteries

- 5.5 Nickel-metal hydride (NiMH)

Chapter 6 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Short range (<150 miles / 240 km)

- 6.3 Medium range (150–300 miles / 240–480 km)

- 6.4 Long range (>300 miles / 480 km)

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two and three wheelers

- 7.5 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Western Europe

- 9.2.1 Germany

- 9.2.2 Austria

- 9.2.3 France

- 9.2.4 Switzerland

- 9.2.5 Belgium

- 9.2.6 Luxembourg

- 9.2.7 Netherlands

- 9.2.8 Portugal

- 9.3 Eastern Europe

- 9.3.1 Poland

- 9.3.2 Romania

- 9.3.3 Czechia

- 9.3.4 Slovenia

- 9.3.5 Hungary

- 9.3.6 Bulgaria

- 9.3.7 Slovakia

- 9.3.8 Croatia

- 9.4 Northern Europe

- 9.4.1 UK

- 9.4.2 Denmark

- 9.4.3 Sweden

- 9.4.4 Finland

- 9.4.5 Norway

- 9.5 Southern Europe

- 9.5.1 Italy

- 9.5.2 Spain

- 9.5.3 Greece

- 9.5.4 Bosnia and Herzegovina

- 9.5.5 Albania

Chapter 10 Company Profiles

- 10.1 BMW Group

- 10.2 BYD

- 10.3 Ford

- 10.4 Geely

- 10.5 Honda

- 10.6 Hyundai

- 10.7 Kia

- 10.8 Mercedes-Benz Group

- 10.9 MG Motor

- 10.10 Microlino

- 10.11 Nissan

- 10.12 Polestar

- 10.13 Renault

- 10.14 Rimac Automobili

- 10.15 Skoda Auto

- 10.16 Stellantis

- 10.17 Tesla

- 10.18 Toyota

- 10.19 Volkswagen Group

- 10.20 Volvo Cars