PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750427

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750427

North America Battery Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

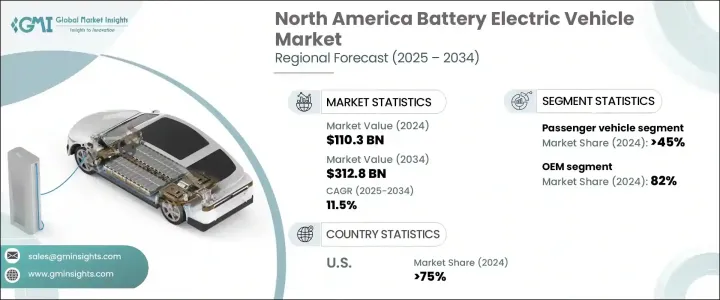

North America Battery Electric Vehicle Market was valued at USD 110.3 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 312.8 billion by 2034, driven by consumer awareness about clean mobility, coupled with advancements in vehicle range and battery technology. A major contributing factor to the expansion of BEVs in North America is the rapid development of public and private charging infrastructure. This has not only made long-distance travel more accessible but has also reduced range-related concerns, encouraging more consumers and commercial operators to transition away from internal combustion engines. With more charging points available in remote and urban areas, BEVs are quickly becoming a preferred mode of transport for individuals and fleets.

As fleet electrification gains momentum, businesses across North America are moving towards electric delivery vehicles to reduce operational costs and comply with emission norms. Government incentives and regulatory pressure are also pushing corporations to upgrade their existing fleets with battery-powered vehicles. The move towards sustainable transportation solutions has increased demand for electric trucks and vans, particularly in last-mile delivery operations. This shift in commercial logistics encourages the development of advanced electric models with extended driving ranges and higher load capacities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $110.3 Billion |

| Forecast Value | $312.8 Billion |

| CAGR | 11.5% |

The passenger vehicle category accounted for a 45% share and was valued at USD 50 billion in 2024. Personal transportation continues to dominate the region's vehicle demand, as most households own at least one private vehicle. Growing access to affordable and efficient BEVs, especially compact SUVs and sedans, accelerates the transition to electric vehicles in everyday travel. People opt for these cleaner alternatives due to lower fuel costs, reduced maintenance needs, and improved resale values.

Original equipment manufacturers (OEMs) segment held 82% share in 2024. Their extensive supply chains, robust dealership networks, and trusted after-sales services allow them to command significant market presence. Buyers are more inclined to purchase from these well-established brands due to the comprehensive support and warranty options they offer. OEMs are better equipped to meet rising demand through large-scale production and market reach, unlike smaller aftermarket players that lack similar operational infrastructure.

United States Battery Electric Vehicle Market held a 75% share in 2024, with an estimated valuation of USD 86 billion. This dominant share is supported by several structural and economic advantages, including a robust industrial ecosystem, widespread vehicle ownership, and a mature consumer base receptive to new technologies. The country's strong emphasis on innovation, coupled with the growing availability of EV infrastructure, is driving rapid adoption of battery electric vehicles across various segments. Federal and state-level policy incentives-ranging from tax credits and rebates to infrastructure grants-have significantly enhanced the affordability and accessibility of BEVs.

In North America Battery Electric Vehicle Market, companies deploy strategic collaborations, local production expansions, and R&D investments to strengthen their positions. Firms like Hyundai, Volkswagen Group, Karma Automotive, and Nissan focus on increasing local manufacturing capacity to benefit from regional policy incentives and reduce supply chain dependencies. Tesla and BMW are expanding their charging networks and battery innovation efforts to enhance product competitiveness and customer satisfaction. General Motors and Ford Motor Company are aggressively ramping their electric portfolios with dedicated BEV platforms. Blue Bird Corporation targets niche electric bus markets, while Honda is working on long-term electrification goals through global partnerships. These moves support faster market penetration and align with North America's broader zero-emission transportation goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Battery manufacturers

- 3.2.3 Component and technology providers

- 3.2.4 Manufacturers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price trend

- 3.7.1 Vehicle

- 3.7.2 Region

- 3.8 Cost breakdown analysis

- 3.9 Import and export data

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 Impact forces

- 3.12.1 Growth drivers

- 3.12.1.1 Expanding charging infrastructure

- 3.12.1.2 Corporate fleet electrification

- 3.12.1.3 High gasoline prices & volatility

- 3.12.1.4 Government incentives & regulations

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 High purchase prices

- 3.12.2.2 Limited aftermarket & maintenance support

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Battery Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lithium-ion batteries

- 5.3 Lithium iron phosphate (LFP)

- 5.4 Solid-state batteries

- 5.5 Nickel-metal hydride (NiMH)

Chapter 6 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Short Range (<150 miles / 240 km)

- 6.3 Medium Range (150–300 miles / 240–480 km)

- 6.4 Long Range (>300 miles / 480 km)

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two and three wheelers

- 7.5 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 U.S.

- 9.2.1 Alabama

- 9.2.2 Alaska

- 9.2.3 Arizona

- 9.2.4 Arkansas

- 9.2.5 California

- 9.2.6 Colorado

- 9.2.7 Connecticut

- 9.2.8 Delaware

- 9.2.9 Florida

- 9.2.10 Georgia

- 9.2.11 Hawaii

- 9.2.12 Idaho

- 9.2.13 Illinois

- 9.2.14 Indiana

- 9.2.15 Iowa

- 9.2.16 Kansas

- 9.2.17 Kentucky

- 9.2.18 Louisiana

- 9.2.19 Maine

- 9.2.20 Maryland

- 9.2.21 Massachusetts

- 9.2.22 Michigan

- 9.2.23 Minnesota

- 9.2.24 Mississippi

- 9.2.25 Missouri

- 9.2.26 Montana

- 9.2.27 Nebraska

- 9.2.28 Nevada

- 9.2.29 New Hampshire

- 9.2.30 New Jersey

- 9.2.31 New Mexico

- 9.2.32 New York

- 9.2.33 North Carolina

- 9.2.34 North Dakota

- 9.2.35 Ohio

- 9.2.36 Oklahoma

- 9.2.37 Oregon

- 9.2.38 Pennsylvania

- 9.2.39 Rhode Island

- 9.2.40 South Carolina

- 9.2.41 South Dakota

- 9.2.42 Tennessee

- 9.2.43 Texas

- 9.2.44 Utah

- 9.2.45 Vermont

- 9.2.46 Virginia

- 9.2.47 Washington

- 9.2.48 West Virginia

- 9.2.49 Wisconsin

- 9.2.50 Wyoming

- 9.3 Canada

- 9.3.1 Alberta

- 9.3.2 British Columbia

- 9.3.3 Manitoba

- 9.3.4 New Brunswick

- 9.3.5 Newfoundland and Labrador

- 9.3.6 Nova Scotia

- 9.3.7 Ontario

- 9.3.8 Prince Edward Island

- 9.3.9 Quebec

- 9.3.10 Saskatchewan

- 9.3.11 Northwest Territories

- 9.3.12 Nunavut

- 9.3.13 Yukon

Chapter 10 Company Profiles

- 10.1 Blue Bird Corporation

- 10.2 BMW

- 10.3 BYD North America

- 10.4 Ford Motor Company

- 10.5 General Motors

- 10.6 Honda

- 10.7 Hyundai

- 10.8 Karma Automotive

- 10.9 Kia

- 10.10 Lion Electric

- 10.11 Lucid Motors

- 10.12 Mercedes-Benz

- 10.13 Nissan

- 10.14 Rivian

- 10.15 Stellantis

- 10.16 Tesla

- 10.17 Toyota

- 10.18 Vinfast

- 10.19 Volkswagen Group

- 10.20 Volvo