PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750339

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750339

SGLT2 Inhibitors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

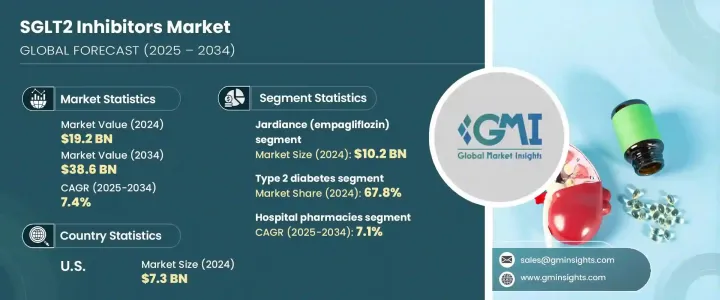

The Global SGLT2 Inhibitors Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 38.6 billion by 2034, driven by the increasing global prevalence of type 2 diabetes, a condition affecting millions due to lifestyle factors such as physical inactivity, aging populations, and rising obesity rates. These medications stand out in the therapeutic landscape because they offer multiple benefits beyond lowering blood sugar, particularly for patients with cardiovascular and renal complications. Their expanding role in managing chronic health conditions has significantly broadened their patient base.

Unlike traditional diabetes medications, SGLT2 inhibitors reduce glucose levels by promoting glucose excretion through the kidneys, which not only supports glycemic control but also contributes to cardiovascular and kidney protection. This makes them a preferred option among both patients and healthcare providers. With mounting evidence from clinical studies showing reduced hospitalization rates and mortality in heart failure and kidney disease patients, these drugs are increasingly used as part of combination therapies to improve treatment efficacy and patient compliance. Additionally, ongoing advancements in pharmaceutical research are further accelerating innovation and enhancing product effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $38.6 Billion |

| CAGR | 7.4% |

In 2024, the segment for managing type 2 diabetes held a 67.8% share. The dominance of this segment reflects the urgent need for effective solutions amid the growing diabetes burden. Notably, many physicians now favor prescribing these inhibitors alongside other oral antidiabetic agents to amplify therapeutic outcomes. Their ability to address multiple disease factors simultaneously has made them a cornerstone of modern diabetes management.

By distribution channel, the global SGLT2 inhibitors market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. As of 2024, the hospital pharmacies segment will grow at a CAGR of 7.1% from 2025-2034, driven by its central role in delivering specialized treatment solutions across inpatient and outpatient settings. The dominant position of hospital pharmacies stems from their integration of advanced pharmacy services that support coordinated care pathways and improve clinical outcomes. These pharmacies play a crucial role in medication management for hospitalized patients, ensuring the timely administration of prescribed therapies, especially in acute care settings.

United States SGLT2 Inhibitors Market held 41.1% share in 2024 and will grow at a 7.2% CAGR through 2034. United States generated USD 7.3 billion in 2034. The country's growth trajectory is supported by a robust healthcare infrastructure, widespread patient access to treatments, and strong reimbursement policies encouraging prescription adoption. Meanwhile, Europe and the Asia-Pacific markets are showing significant traction due to improved diagnosis rates, rising healthcare investments, and broader access to innovative therapies.

Prominent players in the Global SGLT2 Inhibitors Industry include Merck, Lupin Limited, Glenmark Pharmaceuticals, Astellas, Boehringer Ingelheim International, Lexicon Pharmaceuticals, AstraZeneca, Johnson & Johnson (Janssen Pharmaceuticals), Sanofi, Eli Lilly and Company, TheracosBio, and Bristol-Myers Squibb Company. To strengthen their position in the Global SGLT2 Inhibitors Market, companies are actively investing in strategic partnerships, co-marketing agreements, and expanding clinical indications. Major players in North America and Europe are leveraging R&D pipelines to develop advanced formulations targeting not just diabetes, but also heart failure and kidney disease. Firms in Asia-Pacific are expanding manufacturing capacities and forming distribution alliances to meet rising demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes

- 3.2.1.2 Expanding therapeutic indications

- 3.2.1.3 Increased patient preference for oral therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with drugs

- 3.2.2.2 Competition from alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Jardiance (Empagliflozin)

- 5.3 Farxiga (Dapagliflozin)

- 5.4 Invokana (Canagliflozin)

- 5.5 Inpefa (Sotagliflozin)

- 5.6 Qtern (Dapagliflozin/Saxagliptin)

- 5.7 Other SGLT2 inhibitors

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 2 diabetes

- 6.3 Cardiovascular diseases

- 6.4 Chronic kidney disease (CKD)

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Astellas

- 9.2 AstraZeneca

- 9.3 Boehringer Ingelheim International

- 9.4 Bristol-Myers Squibb Company

- 9.5 Eli Lilly and Company

- 9.6 Glenmark Pharmaceuticals

- 9.7 Johnson & Johnson (Janssen Pharmaceuticals)

- 9.8 Lexicon Pharmaceuticals

- 9.9 Lupin Limited

- 9.10 Merck

- 9.11 Sanofi

- 9.12 TheracosBio