PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750346

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750346

Probiotic Drinks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

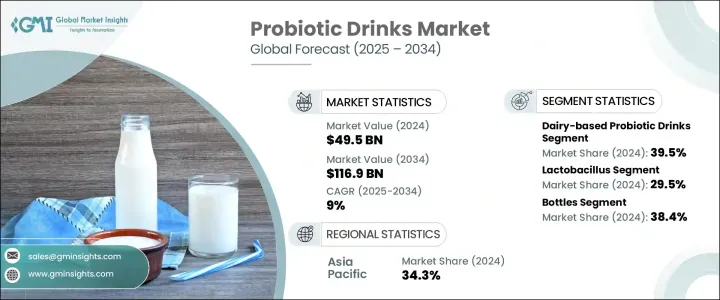

The Global Probiotic Drinks Market was valued at USD 49.5 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 116.9 billion by 2034, driven by a surge in consumer interest in gut health, immunity, and overall wellness. Initially limited to yogurt and supplements, probiotic products have since evolved to include functional beverages, infant formulas, and even animal feed. The market's growth is supported by scientific research confirming the health benefits of probiotics, as well as increasing consumer awareness.

Demand for probiotic drinks is rising across both developed and emerging markets, with particularly high growth in North America, Europe, and the Asia-Pacific region. The Asia-Pacific market is expected to experience the highest growth rates due to its large population, increasing disposable income, and changing dietary preferences. Additionally, an aging population and a rise in metabolic and gastrointestinal disorders are driving the demand for probiotic-based products. Research has shown that incorporating probiotics into food and beverages, especially in dairy products, has significantly increased consumer acceptance and product stability, expanding the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $49.5 Billion |

| Forecast Value | $116.9 Billion |

| CAGR | 9% |

Dairy-based probiotic drinks segment held a 39.5% share in 2024. These drinks remain popular for their nutritional value, with yogurt drinks and kefir continuing to dominate in certain regions. However, the market is witnessing a shift toward plant-based probiotic drinks. This change is largely driven by growing demand for vegan, lactose-free, and allergen-free alternatives. Drinks made from ingredients like soy, almond, coconut, and oat are gaining popularity for their taste and health benefits.

The probiotic drinks market is categorized by probiotic strains, with Lactobacillus taking the lead, representing a 29.5% share in 2024. Lactobacillus strains such as L. rhamnosus and L. acidophilus are well-known for promoting digestive health and boosting immunity. Other strains like B. bifidum and B. longum help maintain a healthy gut balance, especially in the elderly and children. As consumer awareness of the benefits of probiotics grows, these strains are expected to drive market expansion.

Asia-Pacific Probiotic Drinks Market held a 34.3% share in 2024. The region is experiencing rapid growth, with countries like Japan focusing on science-backed probiotic products, while China and India are increasingly embracing health-conscious beverages like yogurt and kombucha. North America is also seeing a rise in wellness trends, with a growing demand for functional beverages such as drinkable yogurts and kombucha.

In the Global Probiotic Drinks Market, companies like Yakult Honsha Co. Ltd., Groupe Danone SA, The Fonterra Co-op Group Ltd., Kerry Group PLC, and Groupe Lactalis are adopting key strategies to strengthen their market presence. These strategies include expanding product portfolios to include a wider range of functional and plant-based drinks, leveraging advanced production technologies to enhance product quality, and aligning with sustainability trends through eco-friendly packaging and sourcing practices. Additionally, these companies are investing in research and development to create innovative products that meet changing consumer preferences, focusing on improving product stability and enhancing health benefits.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.1.6 Impact on trade

- 3.1.7 Trade volume disruptions

- 3.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Demand-side impact (selling price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 North America

- 3.12.1 FDA regulations (United States)

- 3.12.2 Health Canada regulations

- 3.13 Europe

- 3.13.1 European Food Safety Authority (EFSA) Guidelines

- 3.13.2 EU health claims regulation

- 3.14 Asia Pacific

- 3.14.1 FOSHU regulations (Japan)

- 3.14.2 CFDA regulations (China)

- 3.14.3 FSSAI regulations (India)

- 3.15 Rest of the world

- 3.16 Impact forces

- 3.16.1 Growth drivers

- 3.16.1.1 Personalized health and wellness needs

- 3.16.1.2 Sustainability and ethical sourcing

- 3.16.1.3 Shift toward plant-based and non-dairy alternatives

- 3.16.2 Industry pitfalls & challenges

- 3.16.2.1 High production costs

- 3.16.2.2 Challenges in maintaining probiotic viability

- 3.16.3 Market Opportunities

- 3.16.3.1 Expansion in emerging markets

- 3.16.3.2 Innovation in product formulations

- 3.16.3.3 Growth of E-commerce and direct-to-consumer channels

- 3.16.3.4 Rising demand for plant-based alternatives

- 3.16.1 Growth drivers

- 3.17 Growth potential analysis

- 3.18 Porter's analysis

- 3.19 PESTEL analysis

- 3.20 Manufacturing process and technology

- 3.20.1 Manufacturing process overview

- 3.20.1.1 Raw material procurement and preparation

- 3.20.1.2 Probiotic culture preparation

- 3.20.1.3 Fermentation and processing

- 3.20.1.4 Formulation and blending

- 3.20.1.5 Packaging and storage strategies

- 3.20.2 Production cost analysis

- 3.20.2.1 Raw material costs

- 3.20.2.2 Processing costs

- 3.20.2.3 Labor costs

- 3.20.2.4 Packaging costs

- 3.20.2.5 Manufacturing overheads

- 3.20.2.6 Cost optimization strategies

- 3.20.3 Manufacturing facilities analysis

- 3.20.3.1 Facility expansion plans

- 3.20.4 Supply chain challenges and solutions

- 3.20.4.1 Raw material sourcing

- 3.20.4.2 Quality control throughout supply chain

- 3.20.4.3 Cold chain management

- 3.20.4.4 Inventory management

- 3.20.5 Quality assurance and control

- 3.20.5.1 Microbial testing

- 3.20.5.2 Stability and shelf-life testing

- 3.20.5.3 Sensory evaluation

- 3.20.1 Manufacturing process overview

- 3.21 Consumer behavior and market trends analysis

- 3.21.1 Consumer preferences and purchasing patterns

- 3.21.2 Demographic analysis of consumers

- 3.21.3 Consumer awareness and education

- 3.21.4 Emerging consumer trends

- 3.21.5 Impact of digital transformation on consumer engagement

- 3.21.6 Consumer feedback analysis and implications

- 3.22 Pricing trends analysis

- 3.22.1 Factors affecting pricing

- 3.22.1.1 Raw material costs

- 3.22.1.2 Production and processing costs

- 3.22.2 Pricing strategies across product segments

- 3.22.2.1 Premium vs. mass market positionings

- 3.22.2.2 Value-based pricing approaches

- 3.22.1 Factors affecting pricing

- 3.23 Regional price variations and factors

- 3.24 Price-value relationship analysis

- 3.25 Economic indicators impacting the market

- 3.26 Current technological trends in probiotic drinks

- 3.26.1 Emerging technologies and their potential impact

- 3.26.1.1 Microencapsulation technologies

- 3.26.1.2 Synbiotic formulations

- 3.26.2 Product innovation trends

- 3.26.2.1 Functional ingredient combinations

- 3.26.2.2 Shelf-stable probiotic solutions

- 3.26.3 Packaging innovations

- 3.26.3.1 Sustainable packaging materials

- 3.26.3.2 Active and intelligent packaging

- 3.26.4 Digital technologies in production and distribution

- 3.26.4.1 IoT and smart manufacturing

- 3.26.4.2 Blockchain for traceability

- 3.26.5 R&D activities and innovation hubs

- 3.26.6 Technology adoption trends across regions

- 3.26.6.1 Asia-pacific leading in functional drink tech adoption

- 3.26.6.2 Europe emphasizing sustainability in production tech

- 3.26.7 Future technology roadmap 2025-2033

- 3.26.7.1 Development of personalized probiotic solutions

- 3.26.7.2 Automation and ai in quality control systems

- 3.26.1 Emerging technologies and their potential impact

- 3.27 Marketing strategies and brand analysis

- 3.27.1 Current marketing landscape

- 3.27.2 Digital marketing strategies

- 3.27.3 Traditional marketing approaches

- 3.27.4 Health communication strategies

- 3.27.5 Brand analysis of key players

- 3.27.6 Packaging as a marketing tool

- 3.27.7 Future marketing trends and strategies

- 3.28 Market opportunities and strategic recommendations

- 3.28.1 Untapped market opportunities

- 3.28.2 Strategic recommendations for market participants

- 3.28.3 Product development strategies

- 3.28.4 Market entry and expansion strategies

- 3.28.5 Competitive advantage building strategies

- 3.28.6 Future growth pathways

- 3.29 Risk assessment and mitigation strategies

- 3.29.1 Market risks

- 3.29.1.1 Demand fluctuations

- 3.29.1.2 Competitive pressures

- 3.29.2 Operational risks

- 3.29.2.1 Supply chain disruptions

- 3.29.2.2 Production challenges

- 3.29.3 Regulatory and compliance risks

- 3.29.3.1 Changing food safety regulations

- 3.29.3.2 Labeling and claims regulations

- 3.29.4 Reputational risks

- 3.29.5 Environmental and sustainability risks

- 3.29.6 Risk mitigation strategies and frameworks

- 3.29.1 Market risks

- 3.30 Future outlook and market evolution

- 3.30.1 Long-term market forecast 2025-2035

- 3.30.2 Future market scenarios

- 3.30.2.1 Optimistic scenario

- 3.30.2.2 Realistic scenario

- 3.30.2.3 Pessimistic scenario

- 3.30.3 Emerging product categories and innovations

- 3.30.4 Evolving consumer preferences and behaviors

- 3.30.5 Technological evolution and its impact

- 3.30.6 Sustainability and circular economy developments

- 3.30.7 Future competitive landscape

- 3.30.8 Strategic imperatives for long-term success

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Liters)

- 5.1 Key trends

- 5.2 Dairy-based probiotic drinks

- 5.2.1 Probiotic yogurt drinks

- 5.2.2 Kefir

- 5.2.3 Probiotic milk drinks

- 5.2.4 Others

- 5.3 Plant-based probiotic drinks

- 5.3.1 Soy-based drinks

- 5.3.2 Almond-based drinks

- 5.3.3 Coconut-based drinks

- 5.3.4 Others

- 5.4 Fruit and vegetable-based probiotic drinks

- 5.4.1 Probiotic fruit juices

- 5.4.2 Probiotic vegetable juices

- 5.4.3 Mixed fruit and vegetable drinks

- 5.5 Water-based probiotic drinks

- 5.5.1 Probiotic water

- 5.5.2 Probiotic sparkling beverages

- 5.6 Fermented probiotic beverages

- 5.6.1 Kombucha

- 5.6.2 Kvass

- 5.6.3 Others

- 5.7 Probiotic functional beverages

- 5.7.1 Probiotic energy drinks

- 5.7.2 Probiotic sports drinks

- 5.7.3 Probiotic wellness shots

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Billion) (Kilo Liters)

- 6.1 Key trends

- 6.2 Lactobacillus

- 6.3 Bifidobacterium

- 6.4 Streptococcus

- 6.5 Bacillus

- 6.6 Saccharomyces

- 6.7 Multi-strain formulations

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Kilo Liters)

- 7.1 Key trends

- 7.2 Bottles

- 7.3 Cartons

- 7.4 Cans

- 7.5 Pouches

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Target Consumer Group, 2021 - 2034 (USD Billion) (Kilo Liters)

- 8.1 Key trends

- 8.2 General adult population

- 8.3 Children and Adolescents

- 8.4 Elderly population

- 8.5 Athletes and fitness enthusiasts

- 8.6 Health-conscious consumers

Chapter 9 Market Estimates and Forecast, By Consumption Occasion, 2021 - 2034 (USD Billion) (Kilo Liters)

- 9.1 Key trends

- 9.2 Daily consumption

- 9.3 Meal replacement

- 9.4 On-the-Go consumption

- 9.5 Post-exercise recovery

Chapter 10 Market Estimates and Forecast, By Price Segment, 2021 - 2034 (USD Billion) (Kilo Liters)

- 10.1 Key trends

- 10.2 Economy / mass market

- 10.3 Mid-range

- 10.4 Premium / luxury

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Liters)

- 11.1 Key trends

- 11.2 Supermarkets and hypermarkets

- 11.3 Convenience stores

- 11.4 Specialty health food stores

- 11.5 Pharmacy and drug stores

- 11.6 Online retail

- 11.7 Foodservice sector

Chapter 12 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 (USD Billion) (Kilo Liters)

- 12.1 Key trends

- 12.2 B2B

- 12.3 B2C

Chapter 13 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Liters)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Spain

- 13.3.5 Italy

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 Middle East and Africa

- 13.6.1 Saudi Arabia

- 13.6.2 South Africa

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Yakult Honsha Co., Ltd.

- 14.2 Danone S.A.

- 14.3 Nestle S.A.

- 14.4 PepsiCo, Inc.

- 14.5 Coca-Cola Company

- 14.6 Lifeway Foods, Inc.

- 14.7 Harmless Harvest

- 14.8 KeVita (PepsiCo)

- 14.9 GoodBelly (NextFoods)

- 14.10 Chobani, LLC

- 14.11 Groupe Lactalis

- 14.12 Bio-K Plus International Inc.

- 14.13 Fonterra Co-operative Group Juicery