PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750351

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750351

Lipid Nanoparticles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

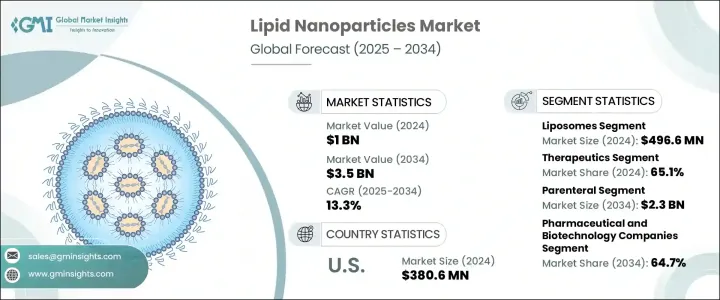

The Global Lipid Nanoparticles Market was valued at USD 1 billion in 2024, and it is estimated to grow at a CAGR of 13.3% to reach USD 3.5 billion by 2034, driven by the increasing demand for mRNA-based therapeutics, particularly in vaccines and genetic medicines. The use of lipid nanoparticles in the delivery of mRNA has gained significant attention due to their ability to protect fragile mRNA molecules, facilitating their safe and efficient transport into cells. This success in the mRNA vaccine space has sparked greater investment and research in LNP technologies, pushing their applications beyond infectious diseases into areas like cancer immunotherapy, protein replacement therapies, and treatments for rare genetic disorders.

The demand for optimized delivery systems like LNPs is expected to surge as biotech and pharmaceutical companies develop new generations of mRNA-based treatments. Advances in lipid composition, scalability, and manufacturing processes have enhanced the availability of LNPs for clinical applications, further fueling market expansion. LNPs are a key component in drug delivery, encapsulating therapeutic agents such as nucleic acids, proteins, and small molecules, making them critical for a wide range of medical applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 13.3% |

The liposomes segment led the market in 2024, with a value of USD 496.6 million. Liposomes, composed of lipid bilayers, are highly efficient in drug delivery systems, offering advantages in drug stability and bioavailability. Their versatility, especially in oncology treatments, has grown their popularity. In addition, advancements in nanotechnology are improving liposomal formulations, increasing their drug loading efficiency and controlled release profiles, further boosting their market share.

The therapeutics segment dominated the market with a 65.1% share in 2024, growing at a steady rate of 13%. LNPs help deliver nucleic acid-based drugs such as mRNA, siRNA, and DNA to treat various diseases. Their ability to enhance drug stability and precision delivery, particularly in cancer, infectious diseases, and genetic disorders, has made them a preferred platform in next-generation drug development. With more global approvals and clinical trials underway, the therapeutics segment is expected to maintain its dominance.

United States Lipid Nanoparticles Market reached USD 380.6 million in 2024, growing from USD 334.2 million in 2023, and is expected to grow at a CAGR of 12.7% through 2034. The U.S. maintains a strong leadership position in the market, supported by its robust biotechnology and pharmaceutical industries, substantial R&D investments, and favorable regulatory environment. As innovations continue and collaborations expand, the U.S. will likely continue to lead the market.

Prominent players in the Global Lipid Nanoparticles Industry include Cayman Chemicals, Arcturus Therapeutics, Alnylam Pharmaceuticals, Moderna, BioNTech SE, Sigma-Tau Pharmaceuticals, Evonik, Merck, Ascendia Pharmaceuticals, ABP Biosciences, Creative Biostructure, Diant Pharma, Bayer, ThermoFischer Scientific, and Acuitas Therapeutics. Key strategies adopted by companies in the Global Lipid Nanoparticles Market to strengthen their position include increasing R&D investments to enhance LNP delivery systems, exploring new applications in gene therapies and cancer immunotherapies, and forming strategic partnerships to expand their product offerings. Additionally, companies are focused on improving manufacturing processes to ensure scalability and cost-effectiveness, enabling them to meet the growing demand for LNP-based therapeutics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic disease

- 3.2.1.2 Growing demand for improved stability and bioavailability drug formulations

- 3.2.1.3 Expanding research fundings and activities

- 3.2.1.4 Growing expansion in mRNA therapeutics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory requirements

- 3.2.2.2 High cost of raw materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Liposomes

- 5.3 Solid lipid nanoparticles

- 5.4 Nanostructured lipid carriers

- 5.5 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Therapeutics

- 6.2.1 Cancer

- 6.2.2 Fungal disease

- 6.2.3 Analgesics

- 6.2.4 Vaccines

- 6.2.5 Other applications

- 6.3 Research

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Topical

- 7.5 Other routes of administration

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Research Institutes

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABP Biosciences

- 10.2 Acuitas Therapeutics

- 10.3 Alnylam Pharmaceuticals

- 10.4 Arcturus Therapeutics

- 10.5 Ascendia Pharmaceuticals

- 10.6 Bayer

- 10.7 BioNTech SE

- 10.8 Cayman Chemicals

- 10.9 Creative Biostructure

- 10.10 Diant Pharma

- 10.11 Evonik

- 10.12 Merck

- 10.13 Moderna

- 10.14 Sigma-Tau Pharmaceuticals

- 10.15 ThermoFischer Scientific