PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750353

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750353

Polyketone (PK) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

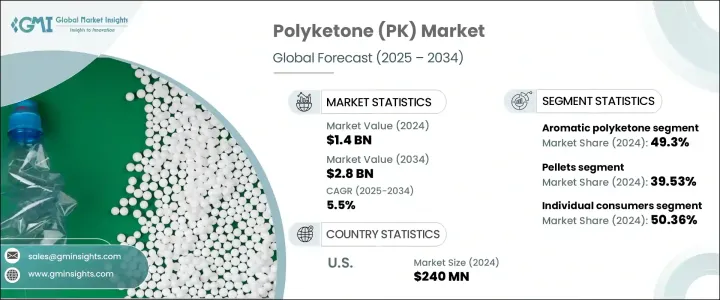

The Global Polyketone Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 2.8 billion by 2034 due to increasing demand for high-performance polymers across several industries. This growth is largely fueled by the search for advanced material alternatives that offer superior chemical resistance, low moisture absorption, and improved wear properties. These characteristics position polyketones as a competitive substitute for traditional materials like polyamides and polyoxymethylene. Their applications continue to expand, especially in sectors requiring materials that meet stringent performance and regulatory standards. Rising environmental consciousness and the push for lightweight, fuel-efficient solutions drive adoption.

Polyketone's market performance has been strong, particularly in segments that demand durability and chemical resistance. Lightweight polymers like PK are increasingly used in high-stress environments, such as fuel systems and structural automotive components. They help manufacturers meet strict emissions standards while improving product performance and reducing overall vehicle weight. Polyketone's ability to maintain mechanical strength under extreme conditions makes it a valuable alternative to conventional engineering plastics, especially where exposure to fuels, lubricants, and high temperatures is common. The material's adaptability in various forms-like pellets, fibers, sheets, and films-has further widened its appeal across industries, including electronics, consumer goods, and transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.5% |

The pellets segment accounted for 39.53% share in 2024 due to their ease of processing and compatibility with standard manufacturing techniques such as extrusion and injection molding. Their uniformity, low moisture absorption, and excellent dimensional stability allow precision in manufacturing complex parts. Additionally, their strong resistance to harsh chemicals and hydrocarbons makes them a preferred choice for components exposed to aggressive environments. These advantages make pellets the go-to form in demanding sectors like automotive, where performance, safety, and compliance with regulations are non-negotiable.

Meanwhile, consumer awareness of eco-friendly alternatives has pushed demand within the individual consumer segment, representing a 50.36% share in 2024. People lean toward sustainable materials in everyday products, a trend that aligns well with polyketone's recyclable and environmentally conscious profile. The shift in consumer mindset is not only driving sales of green products but also encouraging companies to reformulate existing goods using high-performance sustainable polymers. This shift has opened new opportunities for polyketone in the production of items such as sporting goods, wearable tech, kitchenware, and personal accessories-areas where users are now expecting eco-conscious design without compromising on durability or function.

United States Polyketone (PK) Market was valued at USD 240 million in 2024 and continues to grow rapidly, backed by a robust industrial framework, innovation-focused development, and a high demand for advanced materials. North America remains a major hub for PK applications due to strong activity in the electronics, aerospace, and automotive sectors. Local emphasis on sustainable technologies and advanced polymer science plays a significant role in reinforcing polyketone's presence in the region.

The Polyketone (PK) industry players include Nexeo Plastics, Ensinger, HYOSUNG, MITSUI PLASTICS, and Avient. To secure a stronger position in the market, companies are heavily investing in research and development, focusing on product innovations and expanding application areas. Strategic partnerships with manufacturers across the automotive and electronics sectors help boost commercial adoption. Businesses are also improving supply chain efficiency and introducing sustainable manufacturing processes. By developing custom grades and diversifying product portfolios, they're addressing evolving end-user needs and reinforcing long-term competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.4 Demand-side impact (selling price)

- 3.2.4.1 Price transmission to end markets

- 3.2.4.2 Market share dynamics

- 3.2.4.3 Consumer response patterns

- 3.2.5 Key companies impacted

- 3.2.6 Strategic industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Growing demand in the automotive industry

- 3.5.1.2 Rise of electric vehicles (EVs) and sustainable mobility

- 3.5.1.3 Increasing demand for high-performance materials

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High production costs

- 3.5.2.2 Regulatory & environmental concerns

- 3.5.1 Growth drivers

- 3.6 Policy engagement

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Aromatic polyketone

- 5.3 Aliphatic polyketone

- 5.4 Copolymer polyketone

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pellets

- 6.3 Fibers

- 6.4 Films

- 6.5 Sheets

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive components

- 7.3 Electrical & electronics

- 7.4 Industrial machinery

- 7.5 Consumer goods

- 7.6 Coatings & adhesives

- 7.7 Medical devices

- 7.8 Packaging

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AKRO-PLASTIC

- 9.2 Avient

- 9.3 Distrupol

- 9.4 Ensinger

- 9.5 HYOSUNG

- 9.6 K.D. Feddersen

- 9.7 LEHVOSS

- 9.8 MITSUI PLASTICS

- 9.9 Nexeo Plastics

- 9.10 POLYOLS & POLYMERS

- 9.11 Rochling

- 9.12 Specialist Engineering Plastics

- 9.13 Technoform