PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750415

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750415

Off-highway EV Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

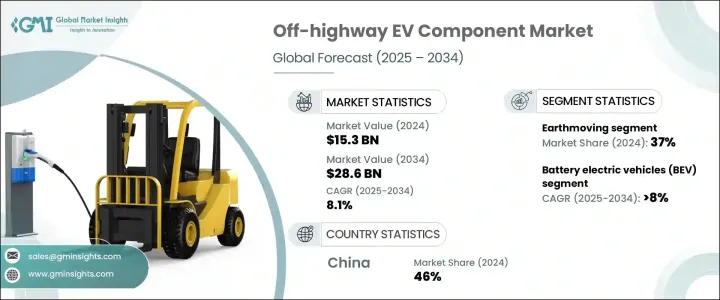

The Global Off-highway EV Component Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 28.6 billion by 2034, fueled by the accelerating transition toward electrified construction, mining, and agricultural machinery. As industries prioritize cleaner alternatives to traditional combustion engines, electric-powered equipment is gaining traction for reduced emissions, lower fuel consumption, and minimized maintenance costs. Regulatory mandates, emission control laws, and rising environmental awareness are pressuring original equipment manufacturers to invest in electric solutions. Additionally, governments and private sectors are investing heavily in smart infrastructure and green development, further increasing the demand for off-highway EV components.

The adoption of electric equipment such as loaders, dozers, and cranes is essential in reducing the environmental footprint of major urban development and infrastructure projects. Beyond electrification, the integration of digital technologies-such as predictive diagnostics, fleet connectivity, and smart telematics-is redefining operational efficiency in off-highway segments. These advancements fuel demand for highly specialized electronic components tailored for rugged, high-duty environments. Equipment with remote monitoring and real-time data capabilities supports better uptime and lifecycle cost control, helping fleet operators optimize performance in field operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $28.6 Billion |

| CAGR | 8.1% |

Among application categories, the earthmoving segment captured the largest share in 2024, accounting for 37% share, driven by the high usage of electric excavators, loaders, and similar equipment across diverse project sites. Earthmoving machinery is well-suited for electrification, given its consistent usage patterns and the increasing need to operate in emission-regulated zones. OEMs and system suppliers are responding with next-gen battery packs, electric drivetrains, and cooling systems to meet growing demand in both public and private projects.

In 2024, battery electric vehicles (BEVs) captured the largest portion in the off-highway EV component market, making up 66% share, driven by their ability to operate without tailpipe emissions, a major advantage in today's push for greener construction and mining operations. BEVs also offer operational efficiency and long-term cost benefits, thanks to lower fuel consumption, reduced mechanical complexity, and minimal maintenance requirements. Their compatibility with closed or restricted environments, such as tunnels, dense urban job sites, and indoor agriculture facilities, further enhances their utility. The quiet operation of BEVs also makes them increasingly favored in noise-regulated environments, supporting broader adoption across multiple off-highway sectors.

China Off-highway EV Component Market held 46% share and generated USD 3.25 billion in 2024, underpinned by consistent support from national policies aimed at reducing industrial emissions and improving equipment efficiency. With advanced manufacturing capabilities, especially in battery production and electric powertrain technologies, China supplies high-performance EV components at scale. The nation's comprehensive EV infrastructure, combined with widespread deployment across agriculture, mining, and construction sectors, continues to reinforce its leadership and accelerate the region's overall market expansion.

To reinforce their market positions, companies such as Tata Elxsi, Volvo AB, Komatsu, Liebherr, and Deere & Company are focusing on vertical integration and long-term collaborations. Strategic investments in next-gen battery systems, power electronics, and digital platforms enable these firms to lead electrification trends. Partnerships with tech providers and co-development of customized solutions allow these players to cater to sector-specific needs while maintaining cost competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Tier 1 automotive suppliers

- 3.2.3 Specialized off-highway system integrators

- 3.2.4 Off-highway vehicle OEM

- 3.2.5 Technology providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.6.2 Component

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Governments worldwide are implementing increasingly strict regulations to curb greenhouse gas emissions

- 3.11.1.2 Electrification of construction, mining & agriculture equipment

- 3.11.1.3 Advancements in battery & motor technologies

- 3.11.1.4 Increased investments in smart cities, mining automation, and mechanized agriculture

- 3.11.1.5 OEM & tier-1 supplier collaborations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial purchase cost

- 3.11.2.2 Battery technology limitations

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery packs

- 5.3 Electric motors

- 5.4 Controllers

- 5.5 Inverters

- 5.6 Power electronics

- 5.7 Thermal management systems

- 5.8 Onboard chargers

- 5.9 Electric power steering systems

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Plug-in hybrid electric vehicles (PHEV)

- 6.4 Hybrid electric vehicles (HEV)

- 6.5 Fuel cell electric vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Material handling

- 7.3 Earthmoving

- 7.4 Harvesting

- 7.5 Transport & hauling

- 7.6 Drilling & blasting

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Electric construction vehicles

- 8.2.1 Excavators

- 8.2.2 Bulldozers

- 8.2.3 Loaders

- 8.3 Electric agricultural vehicles

- 8.3.1 Tractors

- 8.3.2 Harvesters

- 8.3.3 Sprayers

- 8.4 Electric mining vehicles

- 8.4.1 Haul trucks

- 8.4.2 Drills

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Original Equipment Manufacturers (OEM)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bell Equipment

- 11.2 Caterpillar

- 11.3 CNH Industrial

- 11.4 Dana

- 11.5 Deere & Company

- 11.6 Doosan

- 11.7 Epiroc

- 11.8 Hitachi Construction Machinery

- 11.9 JCB

- 11.10 Komatsu

- 11.11 Kubota

- 11.12 Liebherr

- 11.13 Manitou Group

- 11.14 Sandvik

- 11.15 Sona Comstar

- 11.16 Sumitomo Heavy Industries

- 11.17 Tata AutoComp

- 11.18 Tata Elxsi

- 11.19 Terex

- 11.20 Volvo AB