PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750419

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750419

Sternal Closure Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

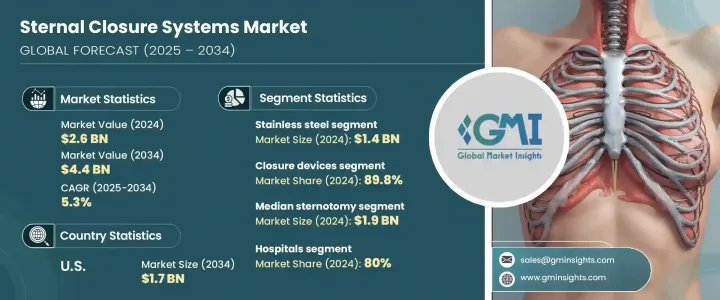

The Global Sternal Closure Systems Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 4.4 billion by 2034, driven by the increasing prevalence of cardiovascular diseases, such as coronary artery disease, which has made open-heart surgeries, especially median sternotomies, more common. As the number of cardiac surgeries rises, the demand for effective sternal closure devices has surged. Advanced sternal closure systems have enhanced patient outcomes by reducing infection risks, improving healing, and minimizing hospital stay times. The success of these systems has led to lower post-surgical complications, boosting their use and the overall market growth.

Sternal closure systems are medical devices designed to stabilize and close the sternum after surgeries like heart surgery. These devices prevent complications such as wound dehiscence and infection by holding the two halves of the sternum together. Common devices used in these systems include wires, plates, screws, clips, and bone cement, which are essential for ensuring proper healing and preventing mechanical issues after surgery. The development of new, more efficient sternal closure devices, such as those using antimicrobial coatings or resorbable technology, continues to push the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 5.3% |

The devices segment held the largest market share of 89.8% in 2024. The increasing number of open-heart surgeries, particularly coronary artery bypass grafting and heart valve replacement, continues to drive the demand for sternal closure devices. As cardiovascular diseases remain a leading cause of death worldwide, the need for reliable and efficient systems to fixate the sternum post-surgery is growing. Furthermore, advanced techniques and fixation methods, especially for high-risk or complicated cases, are becoming more prevalent, further propelling market growth.

In 2024, the stainless steel sternal closure systems segment generated the largest revenue, valued at USD 1.4 billion. Stainless steel is favored due to its cost-effectiveness and durability, making it ideal for hospitals operating under tight budget constraints. Its ability to withstand sterilization while maintaining mechanical integrity is crucial in high-volume surgical environments, particularly in public hospitals and low-to-middle-income regions. This combination of affordability and reliability makes stainless steel a popular choice.

U.S. Sternal Closure Systems Market was valued at USD 1.1 billion in 2024 and is anticipated to reach USD 1.7 billion by 2034. The aging population and the high incidence of heart conditions in the U.S. are the main drivers behind this growth. Furthermore, healthcare institutions are increasingly adopting advanced sternal closure systems to reduce complications like wound infections and improve recovery outcomes. These systems help hospitals meet the cost-effectiveness and quality care standards of organizations like the Centers for Medicare & Medicaid Services.

Some key players in the Global Sternal Closure Systems Market include Jeil Medical, Zimmer Biomet, Acumed, Stryker, KLS Martin, Orthofix, Johnson & Johnson, and Praesidia. Key strategies in the sternal closure systems market include investing in research and development to enhance product offerings with innovative features, such as antimicrobial coatings and resorbable technologies. They also strengthen their market presence through strategic partnerships, acquisitions, and collaborations. Companies are increasingly expanding their product portfolios to offer more versatile and effective solutions for various patient needs. Additionally, enhancing their sales and distribution networks, particularly in emerging markets, helps these companies strengthen their foothold and reach a broader customer base. By continuously improving the functionality and performance of their products, these players ensure long-term growth in the competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in sternotomy techniques

- 3.2.1.2 Increasing number of cardiothoracic surgical procedures

- 3.2.1.3 Growing availability of medical reimbursement across major markets

- 3.2.1.4 Rising preference for minimally invasive procedures and faster recovery solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with sternal closure

- 3.2.2.2 High cost of advanced closure systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on the Industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook and future considerationsTrump administration tariffs

- 3.4.1 Impact on trade

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Closure devices

- 5.2.1 Wires

- 5.2.2 Plates and screws

- 5.2.3 Clips and straps

- 5.3 Bone cement

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Titanium

- 6.4 Polyether ether ketone (PEEK)

Chapter 7 Market Estimates and Forecast, By Procedure, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Median sternotomy

- 7.3 Hemistemotomy

- 7.4 Bilateral thoracotomy

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Specialty clinics

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Mexico

- 9.5.2 Brazil

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Able Medical

- 10.2 Abyrx

- 10.3 Acumed

- 10.4 B. Braun

- 10.5 IDEAR

- 10.6 Jace Medical

- 10.7 Jeil Medical

- 10.8 Johnson & Johnson

- 10.9 Kinamed

- 10.10 KLS Martin

- 10.11 Orthofix

- 10.12 Praesidia

- 10.13 Stryker

- 10.14 Waston Medical

- 10.15 Zimmer Biomet