PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750493

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750493

PVT Collectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

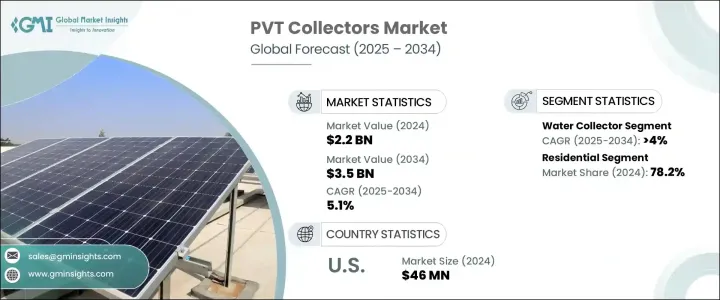

The Global Photovoltaic Thermal Collectors Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 3.5 billion by 2034. Increasing demand for hybrid solar energy systems in remote and off-grid locations is accelerating the adoption of PVT collectors worldwide. These systems combine photovoltaic and thermal technologies into a single panel, offering both electricity and heat. By efficiently utilizing solar energy, PVT collectors help reduce reliance on conventional fuel sources, offering cost-effective and sustainable energy solutions. Growing electrification initiatives in underserved areas are expected to further drive this demand, particularly in regions with limited energy infrastructure.

In addition to rural electrification, growing interest in hybrid renewable systems in building energy management is encouraging the broader use of PVT collectors. These systems allow for space-efficient installations that deliver dual energy outputs while minimizing land use and installation costs. As urban areas become more congested, there is an increasing focus on technologies that enable maximum energy generation from minimal surface area. PVT collectors fit this requirement well, offering a practical solution for densely populated areas. With stricter regulations encouraging energy-efficient and low-emission building practices, governments are also playing a key role in driving the shift toward integrated renewable technologies like PVT systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 5.1% |

Market growth is being further stimulated by the increasing integration of PVT collectors with other green technologies, such as heat pumps. The combination enables greater energy efficiency in both domestic hot water systems and space heating solutions. The synergy between PVT panels and heat pumps contributes to notable energy savings, making it a viable option for both residential and commercial energy consumers seeking performance optimization and cost reduction. As more companies and institutions develop these integrated solutions, market penetration is expected to accelerate.

Another important trend shaping market dynamics is the rising need for efficient low-temperature heat in residential and commercial buildings. PVT systems can meet this demand while offering the added benefit of electricity generation, all from a single rooftop unit. As decentralized energy systems gain traction globally, dual-generation units like PVT collectors are increasingly preferred for their high return on investment. These systems enhance overall building energy performance, especially in urban residential spaces where rooftop space is limited. This efficiency is contributing to the growing popularity of building-integrated solar solutions, especially as property owners and developers seek ways to meet sustainability targets without compromising on energy output.

Despite the positive outlook, some regulatory and policy-related challenges are impacting the industry. High import duties on PVT components such as solar cells and thermal units have increased system prices and slowed adoption, especially in markets heavily dependent on imported technology. This cost barrier limits access to advanced, high-efficiency systems and extends the deployment timeline for larger projects, potentially slowing growth in some regions.

In terms of product segmentation, the PVT collectors market is categorized into water collectors, air collectors, and concentrator systems. Among these, the water collectors segment is projected to expand at a CAGR exceeding 4% through 2034. These systems are gaining popularity for their ability to deliver reliable thermal output in a wide range of climatic conditions, supporting broader adoption in both developed and developing markets. Their compatibility with energy-saving initiatives makes them a preferred option for institutions and enterprises targeting long-term decarbonization.

By application, the market is split between residential and commercial sectors. The residential segment accounted for a dominant 78.2% share of global revenue in 2024. This strong presence is due to the increasing burden of utility bills and a rising preference among homeowners for energy self-sufficiency. The compact design and dual-energy output make PVT systems ideal for residential buildings, especially in urban areas where space is limited. Government-backed incentives and rebate programs for solar technology adoption further encourage household-level installations, reinforcing the growth of this segment.

In the United States, the PVT collectors market has shown steady growth, reaching USD 46 million in 2024, up from USD 43 million in 2023 and USD 41 million in 2022. North America currently holds a 2.3% share of the global market, a figure expected to rise steadily through 2034. High electricity prices in several US states are driving consumers to explore alternative energy sources like PVT systems to cut down on utility costs and reduce grid dependency.

Leading players in the industry collectively account for around 39.5% of the global market share. These companies maintain competitive advantages through vertical integration, managing everything from R&D and manufacturing to installation and service. Their partnerships with construction and HVAC firms further enhance their market position, ensuring seamless system compatibility and optimized performance. Heavy investment in R&D has led to the rollout of new-generation PVT panels that offer superior energy output and are equipped with advanced monitoring technologies. These developments not only improve system efficiency but also align with growing global commitments to sustainable, net-zero energy buildings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million, m2 & MW)

- 5.1 Key trends

- 5.2 Water collectors

- 5.2.1 Covered

- 5.2.2 Uncovered

- 5.2.3 Evacuated tube

- 5.3 Air collectors

- 5.4 Concentrators

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, m2 & MW)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, m2 & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Greece

- 7.3.4 Poland

- 7.3.5 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.5 Middle East & North Africa

- 7.5.1 Israel

- 7.5.2 Jordan

- 7.5.3 Lebanon

- 7.5.4 Morocco

- 7.6 Rest of World

Chapter 8 Company Profiles

- 8.1 Abora Solar

- 8.2 Balkansolar

- 8.3 Dualsun

- 8.4 Naked Energy

- 8.5 NIBE Energy

- 8.6 PowerPanel

- 8.7 SolarPower

- 8.8 Solimpeks

- 8.9 SunEarth

- 8.10 Sunmaxx