PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750494

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750494

Cloud Telecommunications AI Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

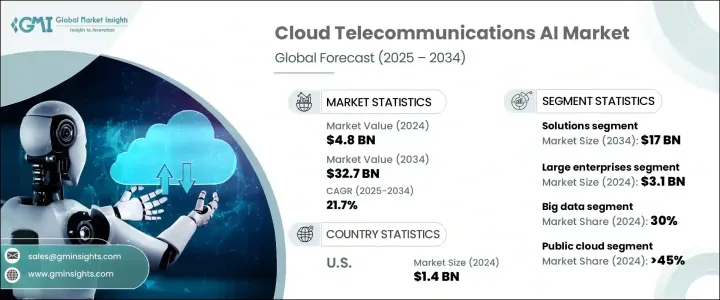

The Global Cloud Telecommunications AI Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 21.7% to reach USD 32.7 billion by 2034, fueled by the convergence of artificial intelligence and cloud technologies within the telecom industry. As networks become more complex, telecom providers shift to AI cloud solutions to manage systems more efficiently, deliver seamless connectivity, and optimize customer experiences. The ongoing rollout of 5G, coupled with the widespread use of smart devices, is accelerating demand for intelligent, scalable networks. AI-powered cloud platforms are used to automate critical network functions, improve resource allocation, and reduce latency across dynamic network environments.

Global investments in cloud-based AI for telecom have intensified as operators seek flexible infrastructure capable of adapting to shifting demands. The push for digital transformation-amplified by recent global disruptions-has highlighted the need for highly resilient communication systems. AI integration helps manage data-heavy operations, predict maintenance needs, and cut operational costs through automation. Additionally, the growing reliance on real-time analytics and machine learning models makes AI a cornerstone in transforming telecom infrastructure to support future innovations. The synergy between cloud architecture and AI redefines how telecommunications providers design, operate, and scale their services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $32.7 Billion |

| CAGR | 21.7% |

In 2024, the solutions segment represented a 59% share and is projected to generate USD 17 billion by 2034. This segment is gaining traction due to rising demand for integrated AI tools that enhance network reliability and streamline internal workflows. AI-powered platforms are deployed to automate fault detection, manage network congestion, and optimize bandwidth in real time. As data volumes increase, telecoms need systems capable of interpreting complex traffic patterns and proactively addressing potential disruptions.

The large enterprises segment led the market in 2024, generating USD 3.1 billion. Enterprises rely heavily on AI technologies to manage expansive networks and support large user bases. These businesses require advanced automation and predictive capabilities to deliver consistent performance while minimizing downtime. AI enables resource optimization and better infrastructure planning, especially in environments where operational scale is vast and complexity is high.

United States Cloud Telecommunications AI Market held the largest share in 2024, accounting for 23%. This strong market position results in large-scale investments in advanced telecommunications infrastructure, particularly in AI integration and 5G deployment. The country's leadership is further solidified by robust support from federal agencies promoting digital transformation and smart network development. Public and private sector collaboration has accelerated the adoption of cloud-based AI technologies, focusing on enhancing network efficiency, real-time analytics, and service automation.

Companies like SAP SE, Salesforce, Tencent, IBM, Microsoft, Nvidia, Oracle, ATOS, Alphabet, and Amazon Web Services are advancing AI adoption in telecom. Companies in this space are implementing a range of strategic initiatives. Many are expanding their global cloud infrastructure and offering AI-as-a-service tailored for telecom applications. Collaborations with telecom providers are helping deliver customized solutions that address specific network challenges. Firms are also enhancing AI capabilities through acquisitions, joint ventures, and internal innovation to strengthen their offerings. Additionally, investment in edge computing, real-time analytics, and cross-platform integration helps these players stay ahead in a rapidly evolving landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model.

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Core AI component provider.

- 3.1.1.2 Software & platform vendors

- 3.1.1.3 Application provider

- 3.1.1.4 End users

- 3.1.2 Profit margin analysis.

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring.

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets.

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration.

- 3.2.1 Impact on trade

- 3.3 Pricing and product strategies

- 3.4 Technology & innovation landscape

- 3.4.1 Current technological trends

- 3.4.1.1 AI-powered network optimization

- 3.4.1.2 Cloud-Based Unified Communications (UCaaS)

- 3.4.1.3 5G-enabled edge computing

- 3.4.1.4 Telecom cloud orchestration and automation

- 3.4.2 Emerging Technologies

- 3.4.2.1 Quantum computing for telecom networks

- 3.4.2.2 6G networks with ai integration

- 3.4.2.3 Blockchain-driven network security

- 3.4.2.4 Intelligent virtual network functions

- 3.4.3 Advanced material sciences

- 3.4.1 Current technological trends

- 3.5 Pricing strategies

- 3.6 Patent analysis

- 3.7 Use cases

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 5G network expansion and ai integration

- 3.10.1.2 Advancements in edge computing

- 3.10.1.3 Improved AI-powered predictive maintenance

- 3.10.1.4 Progress in cloud-native network functions

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Data quality, governance, and security concerns

- 3.10.2.2 Complexity and talent gap in AI development and deployment

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Network optimization

- 5.2.2 Network security

- 5.2.3 Customer analytics

- 5.2.4 Virtual assistants

- 5.2.5 Fraud detection

- 5.2.6 Predictive maintenance

- 5.2.7 Others

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

- 5.3.3 Consulting & training

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Machine learning

- 6.3 Natural Language Processing (NLP)

- 6.4 Big data

- 6.5 Deep learning

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Small & Medium-sized Enterprises (SME)

- 7.3 Large Enterprises

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Public cloud

- 8.3 Private cloud

- 8.4 Hybrid cloud

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Telecom Operators<

- 9.2.1 Mobile Network Operators (MNOs)

- 9.2.2 Fixed line operators

- 9.2.3 Satellite operators

- 9.3 Internet Service Providers (ISPs)

- 9.3.1 Broadband ISPs

- 9.3.2 Wireless ISPs

- 9.4 Managed Service Providers (MSPs)

- 9.4.1 Cloud service providers

- 9.4.2 Network management providers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Sweden

- 10.2.8 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Alibaba Cloud

- 11.2 Altair Engineering

- 11.3 Amazon Web Services (AWS)

- 11.4 ATOS SE

- 11.5 Avaamo

- 11.6 Baidu

- 11.7 Alphabet Inc

- 11.8 Hewlett Packard Enterprise Development

- 11.9 Huawei Cloud Computing Technologies

- 11.10 IBM

- 11.11 Intel

- 11.12 Microsoft

- 11.13 NICE Ltd.

- 11.14 Nvidia

- 11.15 Oracle

- 11.16 Qualcomm Technologies

- 11.17 SalesForce

- 11.18 SAP SE

- 11.19 Snowflake

- 11.20 Tencent