PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750503

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750503

Marine Vessels Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

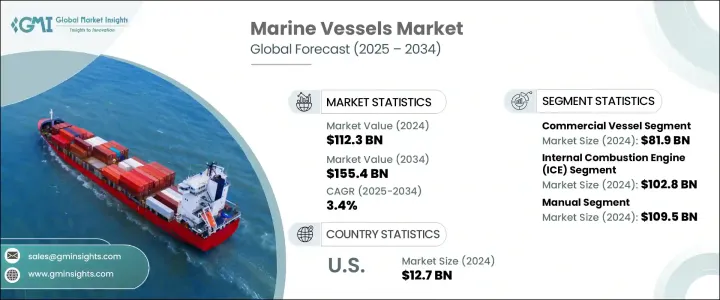

The Global Marine Vessels Market was valued at USD 112.3 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 155.4 billion by 2034, driven by the rising scale of global maritime trade and increasing government investments in naval fleet modernization. As trade routes expand and geopolitical tensions persist, countries are strengthening naval capabilities and modernizing their fleets, creating a stable demand for both commercial and military vessels. The need for logistical efficiency in seaborne trade, coupled with evolving maritime security requirements, continues to shape the global demand for advanced marine vessels.

The imposition of tariffs on key imported materials such as steel and aluminum in recent years created significant ripple effects across the marine vessels industry. These policies raised manufacturing costs for domestic shipbuilders, making U.S.-built vessels less competitive in pricing and lead times than their international counterparts. The increase in raw material expenses led to slower progress on vessel construction and strained budgets for commercial and defense contracts. Furthermore, retaliatory trade measures imposed by other nations restricted the export potential of American-built vessels, compounding the operational and financial challenges for domestic yards. The uncertainty introduced by such policies disrupted supply chains, delayed projects, and prompted some shipbuilders to reevaluate sourcing and production strategies to remain viable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $112.3 Billion |

| Forecast Value | $155.4 Billion |

| CAGR | 3.4% |

The commercial vessels segment was valued at USD 81.9 billion in 2024. Expanding global shipping activities and infrastructure upgrades across ports fuel the need for more tankers, container ships, and bulk carriers. Additionally, the resurgence of cruise travel and the introduction of high-capacity ferry systems are helping drive segment growth. Several nations have stepped up investments in port and maritime logistics networks, which further amplifies the demand for specialized and feeder vessels across coastal and inland waterways.

On the basis of propulsion, the internal combustion engines (ICE) segment was valued at USD 102.8 billion in 2024. These engines are well-established in the industry, offering cost efficiency, power reliability, and extended range, especially crucial for long-haul cargo transport and deep-sea operations. For many shipping companies and offshore operations, ICE-powered ships remain the most practical solution, particularly where fueling infrastructure is limited. This propulsion type is also widely adopted for its ability to support heavy-duty vessels in offshore drilling and logistics missions.

United States Marine Vessels Market reached USD 12.7 billion in 2024, supported by several robust demand drivers. The expanding need for specialized service and crew transfer vessels, particularly for large-scale offshore energy projects, is fueling new vessel procurement. These vessels play a critical role in enabling the construction and maintenance of offshore wind farms and energy platforms. Additionally, investments aimed at revitalizing inland waterway transportation, especially across river systems, encourage the modernization of older fleets, improving efficiency and sustainability across regional logistics.

Key players in the Global Marine Vessels Industry include General Dynamics NASSCO, Vard, HII, Sumitomo Heavy Industries Marine and Engineering, Damen Shipyards Group, Meyer Werft, Mitsubishi Heavy Industries, Babcock International Group, Austal, SHI-MCI, Fincantieri, Meyer Turku, Navantia, Lurssen, Japan Marine United Corporation, Hyundai Heavy Industries, Tsuneishi Shipbuilding, Cochin Shipyard, Garden Reach Shipbuilders and Engineers, and China Shipbuilding Industry Corporation.

To maintain market relevance and expand globally, leading marine vessel manufacturers focus on next-generation ship designs, integration of hybrid propulsion systems, and advanced automation technologies. Companies align their strategies with decarbonization goals by investing in green shipbuilding, LNG propulsion, and AI-driven maintenance solutions. Strategic partnerships with port authorities, naval forces, and logistics providers enhance operational reach, while aggressive R&D and digital transformation continue to differentiate market leaders from competitors.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rapid expansion of global trade

- 3.3.1.2 Military navy expansion and modernization

- 3.3.1.3 Surge in passenger and tourism activities

- 3.3.1.4 Indigenous manufacturing and government initiatives

- 3.3.1.5 Increasing demand for larger and more efficient vessels

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Geopolitical tensions and security risks

- 3.3.2.2 Economic uncertainty and inflation

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Vessel Type, 2021 - 2034 (USD Billion and Units)

- 5.1 Key trends

- 5.2 Commercial vessels

- 5.2.1 Containerships

- 5.2.2 Tankers

- 5.2.3 Bulk carriers

- 5.2.4 Cruise ships

- 5.2.5 Others

- 5.3 Naval & defense vessels

- 5.3.1 Destroyers

- 5.3.2 Submarines

- 5.3.3 Aircraft carriers

- 5.3.4 Patrol ships

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Propulsion Type, 2021 - 2034 (USD Billion and Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric

- 6.4 Hybrid (Electric + ICE)

Chapter 7 Market Estimates and Forecast, By Control Mechanism, 2021 - 2034 (USD Billion and Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Autonomous

- 7.4 Semi-autonomous

- 7.5 Fully autonomous

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Austal

- 9.2 Babcock International Group

- 9.3 China Shipbuilding Industry Corporation

- 9.4 Cochin Shipyard

- 9.5 Damen Shipyards Group

- 9.6 Fincantieri

- 9.7 Garden Reach Shipbuilders and Engineers

- 9.8 General Dynamics NASSCO

- 9.9 HII

- 9.10 Hyundai Heavy Industries

- 9.11 Japan Marine United Corporation

- 9.12 Lurssen

- 9.13 Meyer Turku

- 9.14 Meyer Werft

- 9.15 Mitsubishi Heavy Industries

- 9.16 Navantia

- 9.17 SHI-MCI

- 9.18 Sumitomo Heavy Industries Marine and Engineering

- 9.19 Tsuneishi Shipbuilding

- 9.20 Vard