PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750548

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750548

Automotive Portable Lithium Iron Phosphate (LFP) Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

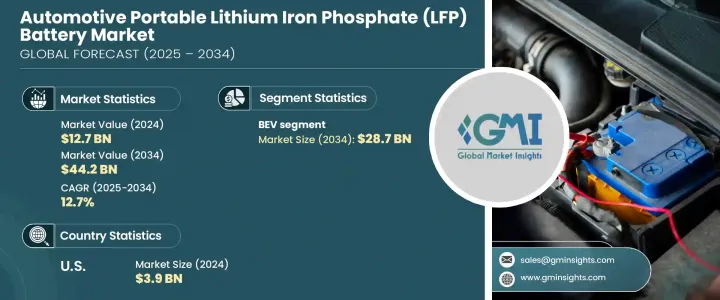

The Global Automotive Portable Lithium Iron Phosphate (LFP) Battery Market was valued at USD 12.7 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 44.2 billion by 2034. LFP batteries are gaining widespread attention due to their safety profile, superior thermal stability, and resistance to overheating-qualities that make them an ideal choice for electric vehicles. As the demand for cost-efficient and reliable battery technologies grows, especially in the entry-level and mid-range EV segment, LFP batteries are becoming an essential solution. Their lower risk of thermal runaway compared to other chemistries significantly enhances passenger safety, a key factor influencing consumer decisions and OEM strategies alike.

The automotive industry is experiencing a noticeable shift toward lithium iron phosphate technology as it offers several advantages over traditional battery types. Extended cycle life, competitive pricing, and enhanced safety make LFP batteries particularly attractive to electric vehicle users. As a result, more automotive manufacturers are adopting these batteries across their product lines, especially in models designed for broader accessibility and affordability. The increasing reliance on LFP technology supports the industry's goals of sustainability and performance without inflating production costs. Furthermore, regulatory pressure to minimize carbon emissions is driving automakers to focus on battery chemistries that not only meet safety standards but also align with green energy initiatives. The growing popularity of LFP batteries is also pushing manufacturers to explore advancements in energy density and fast-charging technologies to boost overall vehicle performance and user satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.7 Billion |

| Forecast Value | $44.2 Billion |

| CAGR | 12.7% |

In terms of application, the automotive portable LFP battery market is segmented into hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs). In 2024, the HEV segment accounted for 58.9% of the market share. HEVs are playing a vital role in the global transition toward electrified mobility, offering a balance between traditional combustion engines and fully electric systems. Their increasing acceptance stems from the ability to improve fuel efficiency and lower emissions without the need for widespread charging infrastructure. LFP batteries, known for their stable performance and longevity, are well-suited to hybrid systems where frequent cycling and durability are essential.

Despite the current dominance of HEVs, the BEV segment is poised for significant growth and is projected to surpass USD 28.7 billion in revenue by 2034. The expanding availability of charging infrastructure and declining battery costs are making BEVs more accessible to a wider customer base. As range anxiety continues to decline and supportive policies encourage full electrification, BEVs are expected to take a larger share of the automotive market, with LFP batteries serving as the preferred power source due to their affordability and reliable performance. The market momentum is also being fueled by consumer preference for low-maintenance solutions and increasing confidence in the safety of LFP technology.

In the United States, the automotive portable LFP battery market has shown consistent growth. The industry was valued at USD 2.8 billion in 2022, increased to USD 3.3 billion in 2023, and reached USD 3.9 billion in 2024. Several government-led initiatives are accelerating this upward trend by providing incentives aimed at boosting domestic battery production. Policies promoting the development of local EV supply chains and reducing dependency on international sources are encouraging the use of LFP batteries in American-made vehicles. Such financial support helps make EVs more affordable and accessible, indirectly promoting the widespread use of lithium iron phosphate battery technology in the region.

Globally, five key players dominate the automotive portable LFP battery space, collectively holding over 55% of the market share. These companies benefit from strong supply chain integration and scale, enabling them to adapt quickly to shifting regulatory environments and secure contracts that offer government backing. Their leadership also allows for increased investments in research and development, particularly in areas like energy density optimization, improved charging speeds, and end-of-life battery recycling. Innovations introduced by these dominant firms often influence the broader market, either through licensing deals or competitive advancements, helping elevate overall industry standards and encouraging sustainable battery use throughout the product lifecycle.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trade administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 HEV

- 5.3 BEV

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 Russia

- 6.3.4 UK

- 6.3.5 Spain

- 6.3.6 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 South Korea

- 6.4.4 Australia

- 6.4.5 India

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 A123 Systems

- 7.2 Clarios

- 7.3 Contemporary Amperex Technology

- 7.4 Ding Tai Battery Company

- 7.5 Duracell

- 7.6 ENERGON

- 7.7 Exide Technologies

- 7.8 General Electric

- 7.9 Hitachi Energy

- 7.10 Koninklijke Philips

- 7.11 LG Energy Solution

- 7.12 LITHIUMWERKS

- 7.13 ProLogium Technology

- 7.14 Saft

- 7.15 Tesla