PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750550

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750550

Oil and Gas Wastewater Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

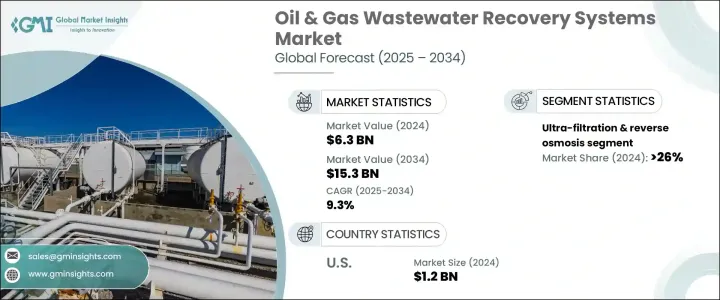

The Global Oil and Gas Wastewater Recovery Systems Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 15.3 billion by 2034, fueled by mounting water scarcity challenges, particularly in water-stressed regions such as the Middle East, parts of North America, and South Asia. As freshwater becomes increasingly limited, the need to recycle and recover wastewater in industrial sectors like oil and gas has become critical. Regulatory pressure is another key growth driver. Governments worldwide are enforcing strict environmental policies that demand effective wastewater treatment before disposal. These measures are pushing companies to adopt advanced recovery technologies, aligning with the rising emphasis on water stewardship and regulatory compliance.

Beyond regulation, sustainability is becoming central to operational strategies. Oil & gas producers are actively investing in recovery systems to minimize environmental impact and reinforce ESG performance. Integrating CSR and green initiatives into business models has become vital for long-term value and reputation. Additionally, the focus on automation and smart filtration technologies is helping firms boost efficiency in wastewater treatment across upstream and downstream processes. By leveraging IoT-enabled sensors, AI-powered monitoring systems, and automated control platforms, companies can now optimize treatment cycles in real-time, reduce manual intervention, and detect anomalies before they escalate into larger issues. These intelligent solutions allow for dynamic adjustment of filtration parameters based on water quality fluctuations, which enhances system responsiveness and energy efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $15.3 Billion |

| CAGR | 9.3% |

The ultra-filtration & reverse osmosis segment accounted for a 26% share in 2024 due to their superior ability to eliminate fine particulates and dissolved contaminants. Activated carbon filtration continues to be widely adopted for its effectiveness in absorbing hydrocarbons, color, odor, and residual oils from treated water. These systems are essential during the polishing phase to ensure water quality standards are met for reuse or discharge. Ultra-filtration & reverse osmosis membrane-based techniques are useful for treating produced and flowback water from hydraulic fracturing.

U.S. Oil & Gas Wastewater Recovery Systems Market generated USD 1.2 billion in 2024. Strict federal regulations, water infrastructure challenges, and heightened awareness of water scarcity have driven adoption in North America. Shifts in production strategies and aging oilfield assets contribute to increased demand for wastewater recovery technologies across the U.S. market.

Key players in the oil & gas wastewater recovery systems market are aggressively expanding their portfolios through technological innovation, mergers, and partnerships. Companies like Veolia, Evoqua Water Technologies, Pall Corporation, and CLEARAS Water Recovery are channeling investments into membrane-based filtration, modular recovery units, and AI-driven monitoring solutions. Strategic collaborations with oilfield service providers allow for on-site deployment of treatment systems, reducing transport costs and environmental impact. Firms like Calgon Carbon and Kovalus Separation Solutions strengthen their R&D capabilities to enhance process efficiency and customize treatment methods for different water chemistries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Activated carbon

- 5.3 Ultra-filtration & reverse osmosis

- 5.4 Membrane filtration

- 5.5 Ion exchange resin systems

- 5.6 Media filtration

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Poland

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Malaysia

- 6.4.6 Indonesia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Mexico

- 6.6.3 Argentina

Chapter 7 Company Profiles

- 7.1 BioChem Technology

- 7.2 Calgon Carbon

- 7.3 CLEARAS Water Recovery

- 7.4 ClearBlu Environmental

- 7.5 Dynatec Systems

- 7.6 Encon Evaporators

- 7.7 Evoqua Water Technologies

- 7.8 Kemco Systems

- 7.9 Kovalus Separation Solutions

- 7.10 Kontek Ecology Systems

- 7.11 Korte Environmental Technology

- 7.12 Mech-Chem Associates

- 7.13 Pall Corporation

- 7.14 Veolia

- 7.15 Westlake Vinnolit