PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750577

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750577

Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

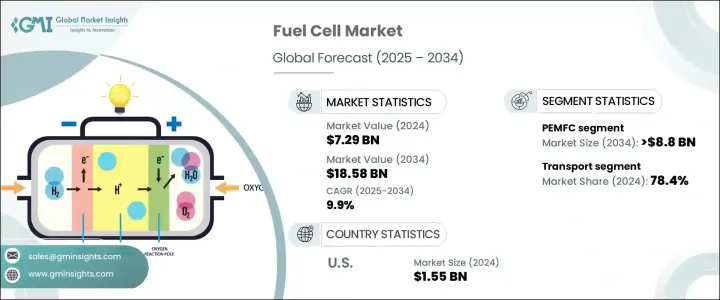

The Global Fuel Cell Market was valued at USD 7.29 billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 18.58 billion by 2034 as the need for clean, reliable, and efficient power sources continues to grow. This growth is being driven by an increasing demand for power in remote and off-grid locations, as well as by tightening environmental regulations aimed at reducing emissions. As industries shift their focus toward sustainability and cost-effective power solutions, fuel cells are emerging as a promising alternative. These systems are particularly attractive due to their high operational efficiency, lower environmental impact, and competitive pricing compared to conventional technologies.

Fuel cells are being widely adopted in the manufacturing sector, where uninterrupted power supply and low-emission solutions are critical. Their capability to produce electricity with minimal pollution has drawn the attention of governments and private players alike. With a growing number of countries rolling out policies focused on reducing carbon footprints and improving energy efficiency, the use of fuel cells across a range of applications is expanding steadily. Financial institutions and government bodies are pouring significant investments into research and development to drive technological advancements in this space. As innovation progresses, fuel cells are expected to become increasingly viable for both commercial and residential energy systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.29 Billion |

| Forecast Value | $18.58 Billion |

| CAGR | 9.9% |

Investments from both public and private sectors are also contributing to the growth of the market. Organizations across the globe are stepping up efforts to develop advanced technologies that improve the performance, efficiency, and affordability of fuel cells. These initiatives are encouraging companies across multiple industries to adopt fuel cell systems as part of their energy transition strategies. In response to these developments, the demand for next-generation fuel cell systems is growing rapidly.

Among the various types of fuel cells, the Proton Exchange Membrane Fuel Cell (PEMFC) segment is expected to surpass USD 8.8 billion by 2034. These fuel cells are known for their low operating temperature and quick startup times, making them ideal for a variety of applications, from backup power solutions to portable energy systems and automotive uses. As these technologies evolve and become more reliable, their use in sectors such as data centers, residential buildings, and mobile infrastructure is anticipated to increase significantly.

In terms of application, the market is categorized into stationary, portable, and transport sectors. The transport segment dominated the market in 2024, accounting for more than 78.4% of the total share. This segment is witnessing accelerated adoption of fuel cell systems in electric bikes, unmanned aerial vehicles, and commercial fleets. The transportation sector's increasing focus on reducing emissions and transitioning to greener technologies is propelling the integration of hydrogen fuel cell systems. As infrastructure for hydrogen production and distribution improves, the deployment of these systems across various transport applications, including maritime logistics and commercial shipping, is expected to expand.

The North American fuel cell market, led by the United States, is also witnessing steady progress. The US market alone recorded a value of over USD 1.52 billion in 2022, USD 1.53 billion in 2023, and reached USD 1.55 billion in 2024. Across the continent, the market is forecasted to grow at a CAGR of over 6% through 2034. The development of on-site hydrogen generation stations using integrated methane reforming technologies has provided cost-effective solutions for fueling infrastructure, thus boosting regional adoption. These advancements are creating a more favorable environment for the widespread deployment of fuel cells in both public and private sectors.

The global fuel cell market is currently shaped by the presence of several key players who are continuously working to strengthen their market position through innovation and collaboration. The top five companies-Cummins, Ballard Power Systems, Fuji Electric, Toshiba Corporation, and Plug Power-collectively account for around 40% of the global market share. Their strategies include forming alliances with energy companies, automotive manufacturers, and research institutions to enhance product offerings and accelerate technology development. These collaborative efforts are expanding the reach of fuel cell technology and opening new avenues for commercialization.

Strategic partnerships, joint ventures, and increased funding from both government and private entities are accelerating the pace of research and development. These efforts are not only driving innovation but also improving the scalability and market readiness of fuel cell solutions. As a result, the industry is moving closer to achieving large-scale deployment, with significant implications for the global energy landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiatives

- 4.4 Strategic dashboard

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Fuel Cell Market, By Product, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 PEMFC

- 5.3 DMFC

- 5.4 SOFC

- 5.5 PAFC & AFC

- 5.6 MCFC

Chapter 6 Fuel Cell Market, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Stationary

- 6.2.1 < 200 kW

- 6.2.2 200 kW - 1 MW

- 6.2.3 ≥ 1 MW

- 6.3 Portable

- 6.4 Transport

- 6.4.1 Marine

- 6.4.2 Railways

- 6.4.3 FCEVs

- 6.4.4 Others

Chapter 7 Fuel Cell Market, By Fuel, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Hydrogen

- 7.3 Ammonia

- 7.4 Methanol

- 7.5 Hydrocarbons

Chapter 8 Fuel Cell Market, By Size, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Small scale

- 8.3 Large scale

Chapter 9 Fuel Cell Market, By End Use, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial & industrial

- 9.4 Data centers

- 9.5 Military and defense

- 9.6 Utilities & government

- 9.7 Transportation

Chapter 10 Fuel Cell Market, By Region, 2021 - 2034 (USD Million & MW)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Austria

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 South Korea

- 10.4.3 China

- 10.4.4 India

- 10.4.5 Philippines

- 10.4.6 Vietnam

- 10.5 Middle East & Africa

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Peru

- 10.6.3 Mexico

Chapter 11 Company Profiles

- 11.1 Cummins

- 11.2 Ballard Power Systems

- 11.3 Plug Power

- 11.4 Nuvera Fuel Cells

- 11.5 Nedstack Fuel Cell Technology

- 11.6 Bloom Energy

- 11.7 Panasonic Corporation

- 11.8 Doosan Fuel Cell

- 11.9 Aisin Corporation

- 11.10 Ceres

- 11.11 SFC Energy

- 11.12 Toshiba Corporation

- 11.13 Robert Bosch

- 11.14 TW Horizon Fuel Cell Technologies

- 11.15 AFC Energy

- 11.16 FuelCell Energy

- 11.17 Fuji Electric

- 11.18 Hyundai Motor Company