PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750595

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750595

Industrial Connector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

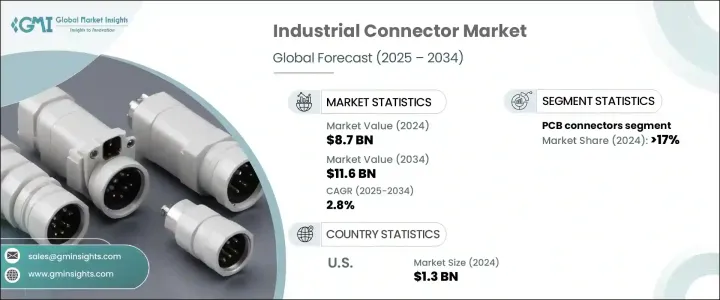

The Global Industrial Connector Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 11.6 billion by 2034, driven by the growth of industrial automation, technological advancements, and the widespread integration of smart factory concepts under Industry 4.0. These connectors are essential for ensuring reliable communication and functionality across many automation systems, connecting critical components such as sensors, actuators, and control units. As factories and manufacturing environments become smarter, the need for high-performance connectors that support fast data exchange, high-speed transmission, and precise automation is increasing. Industrial connectors are not only pivotal in ensuring robust system performance but also contribute to the efficient operation of machines, which increasingly rely on continuous data flow.

Technology advancements in the connector space have broadened the scope of industrial connectors, introducing miniature and lightweight designs with enhanced functionality. Features like high-speed data transfer, anti-vibration capabilities, and resistance to extreme temperatures have increased the demand for these connectors across multiple industries. A significant trend in the sector is the inclusion of built-in sensors in connectors, which measure parameters like temperature, pressure, and connectivity, improving the overall system performance and reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 2.8% |

The PCB (Printed Circuit Board) connector segment held a significant share of 17% in 2024, attributed to the growing demand for PCB connectors across multiple industrial sectors, including manufacturing, energy, telecommunications, and automotive industries. These connectors are essential for providing reliable electrical connections on printed circuit boards integral in operating electronic devices and systems. In the manufacturing sector, PCB connectors establish connections between different circuit board components, ensuring seamless data transmission and power distribution.

U.S. Industrial Connector Market was valued at USD 1.3 billion in 2024, driven by its strong focus on automation, advanced manufacturing technologies, and the Industrial Internet of Things (IIoT), which is fueling demand for high-performance connectors. The shift toward smart factories and connected manufacturing systems impacts the need for reliable and robust connectors. Increased investment in automation and digital systems continues to expand opportunities in the region, with more industries requiring sophisticated connectors to ensure efficient and seamless operations.

Leading players in the Global Industrial Connector Market include TE Connectivity, Amphenol Corporation, 3M, Molex, Inc., Phoenix Contact, and Aptiv PLC. These industry giants leverage their technological expertise to drive innovation in connector designs, enhancing performance and reliability. To strengthen their market position, companies in the industrial connector industry are focusing on strategic partnerships and collaborations to innovate and improve their product offerings. Many companies are investing heavily in R&D to develop connectors with improved functionalities, such as high-speed data transfer and resistance to environmental stress factors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (Million Units & USD Billion)

- 5.1 Key trends

- 5.2 PCB connectors

- 5.3 IO connectors

- 5.4 Circular connectors

- 5.5 Fiber optic connectors

- 5.6 RF coaxial connectors

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (Million Units & USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 UK

- 6.3.4 Italy

- 6.3.5 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 3M

- 7.2 AMETEK Inc.

- 7.3 Amphenol Corporation

- 7.4 Aptiv PLC

- 7.5 AVX Corporation

- 7.6 Fischer Connectors

- 7.7 Foxconn Technology Group

- 7.8 GTK UK Ltd.

- 7.9 Hirose Electric Co., Ltd.

- 7.10 Japan Aviation Electronics Industry, Ltd.

- 7.11 Lapp Group

- 7.12 Luxshare Precision Industry Co., Ltd.

- 7.13 Mencom Corporation

- 7.14 Molex, Inc.

- 7.15 Phoenix Contact

- 7.16 Rosenberger Group

- 7.17 TE Connectivity

- 7.18 YAZAKI Corporation