PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750601

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750601

Diesel Prime Power Generators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

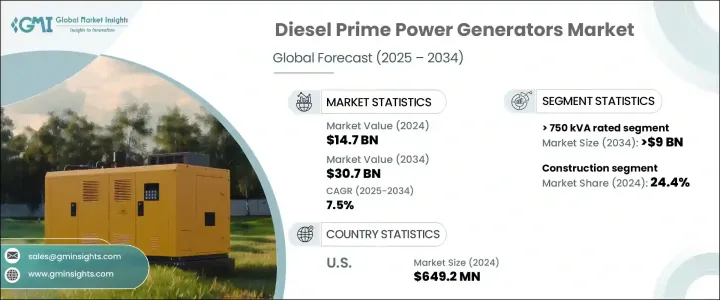

The Global Diesel Prime Power Generators Market was valued at USD 14.7 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 30.7 billion by 2034, driven by the increasing need for a stable and efficient power supply across various sectors. This surge is primarily attributed to rapid infrastructure expansion and the growing demand for reliable grid systems in developing economies. Industries around the world are facing frequent power outages and unstable electrical infrastructure, making it essential to adopt dependable power sources to maintain operational continuity. Diesel prime power generators have emerged as a critical solution for industries, commercial establishments, and off-grid locations that require consistent power without interruption.

The market is seeing considerable momentum from the widespread growth of infrastructure projects and the increasing pace of industrialization. As nations invest in large-scale developments, the demand for reliable energy systems becomes even more crucial. The need for backup and continuous power has become more pronounced, especially in areas facing regular blackouts and grid instability. Technological advancements aimed at lowering emissions are also playing a pivotal role in shaping the market landscape. As governments and organizations emphasize sustainable practices, manufacturers are innovating diesel generator technologies that align with emission regulations while delivering high performance. Furthermore, the expansion of high-power operations such as industrial facilities and sensitive commercial applications continues to boost the market. Power reliability, flexibility, and durability remain top priorities for end-users, creating a strong business case for diesel-based prime power systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.7 Billion |

| Forecast Value | $30.7 billion |

| CAGR | 7.5% |

The market is also benefiting from increased investments in sectors that require high-load handling equipment. With growing awareness around environmental sustainability, there is a stronger push to integrate renewable energy sources into hybrid generator models. Manufacturers are actively developing fuel-efficient engines and hybrid configurations that address both power demands and environmental concerns. This evolution in product offerings is in line with the diverse needs of end-users across various regions, allowing for better customization and wider adoption. The transition toward sustainable solutions is enhancing product development, leading to more advanced, cost-effective, and efficient generator sets.

Based on power rating, the diesel prime power generators market is segmented into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA. Among these, the > 750 kVA category holds a dominant position and is anticipated to exceed USD 9 billion by 2034. These high-capacity generators are specifically designed for demanding environments where the grid is either unavailable or unreliable. Their ability to consistently deliver large volumes of power under strenuous conditions makes them ideal for mission-critical applications. Their robust design and high efficiency make them indispensable in scenarios requiring continuous and stable electricity, especially in industries with high operational demands.

In terms of application, the industry is categorized into hospitality, telecom, mining, construction, oil and gas, agriculture, industrial, and others. The construction segment alone held a 24.4% share in 2024. This is due to the increased demand for uninterrupted power on job sites where grid access is often limited or unreliable. The integration of intelligent power management systems and renewable components further enhances operational efficiency in the construction domain. Industrial construction activities continue to rely heavily on diesel generators, reinforcing the segment's role in overall market growth.

Regionally, the United States has shown steady market expansion, with values reaching USD 570.6 million in 2022, USD 610.8 million in 2023, and USD 649.2 million in 2024. The country's increasing susceptibility to extreme weather events has amplified the demand for reliable backup power systems. The broader North American market is projected to grow significantly and is expected to cross USD 1 billion by 2034. This growth is driven by aging grid infrastructure and a rising need for consistent energy in both urban and remote locations. Innovations in emission control, digital monitoring, and smart generator technologies are enhancing product performance and adoption across the region.

The diesel prime power generators industry is moderately consolidated, with the top five players accounting for approximately 40% of the global market. These companies are known for their strong technological expertise and expansive supply networks. Their broad product portfolios cater to diverse needs across sectors including energy, healthcare, manufacturing, and commercial operations. Their focus on innovation and adaptability ensures that they remain competitive in a rapidly changing energy landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Hospitality

- 6.4 Oil & gas

- 6.5 Mining

- 6.6 Construction

- 6.7 Agriculture

- 6.8 Industries

- 6.9 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Myanmar

- 7.4.12 Bangladesh

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Ashok Leyland

- 8.2 Atlas Copco

- 8.3 Briggs & Stratton

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 Deere & Company

- 8.7 Generac Power Systems

- 8.8 HIMOINSA

- 8.9 Kirloskar

- 8.10 Mahindra POWEROL

- 8.11 Mitsubishi Heavy Industries

- 8.12 Rapid Power Generation

- 8.13 Rehlko

- 8.14 Rolls-Royce

- 8.15 Siemens

- 8.16 Volvo Penta

- 8.17 Wartsilä

- 8.18 Yanmar Holdings