PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750614

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750614

Surgical Snares Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

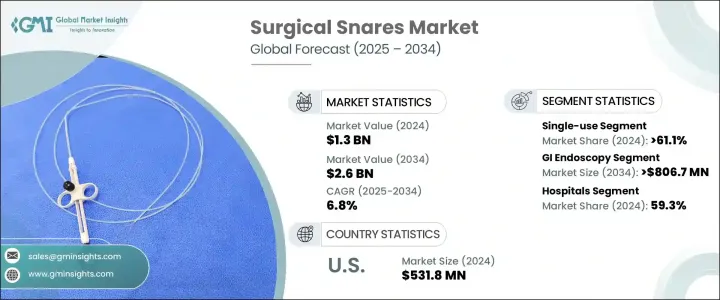

The Global Surgical Snares Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 2.6 billion by 2034 due to an increase in gastrointestinal disorders, growing preference for minimally invasive procedures, advancements in endoscopic technologies, and rising global healthcare spending. A rapidly aging population and improved access to modern healthcare tools further contribute to the rising demand for surgical snares. With healthcare systems focusing on more efficient, lower-risk surgical solutions, these instruments are becoming increasingly vital in endoscopic applications across medical facilities worldwide.

Surgical snares, designed as flexible wire loops, are critical tools used during various endoscopic interventions to remove abnormal tissue or foreign bodies. These devices are widely utilized in procedures such as colonoscopy and bronchoscopy, supporting both diagnostic and therapeutic functions by enabling the safe removal of polyps, abnormal tissues, and foreign objects. Their ability to perform precise excisions without invasive surgery reduces recovery time and minimizes patient discomfort, making them highly valuable in outpatient and minimally invasive settings. Surgical snares are designed to seamlessly integrate with modern endoscopic platforms, allowing for improved visibility, control, and accuracy during procedures. This compatibility not only enhances procedural efficiency but also reduces complications and improves patient outcomes. As healthcare providers increasingly adopt advanced endoscopic tools, surgical snares have become indispensable in managing gastrointestinal and pulmonary conditions across various clinical environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 6.8% |

In 2024, the single-use segment led the market with a share of 61.1%. Disposable snares are gaining strong market traction due to benefits such as reduced contamination risk, improved surgical efficiency, and cost-effectiveness. These ready-to-use, pre-sterilized tools reduce reliance on sterilization infrastructure and eliminate risks associated with reusing medical instruments. Additionally, regulatory agencies and safety bodies emphasize disposable medical tools to minimize hospital-acquired infections. This shift in preference is especially significant in high-volume and high-risk surgical environments.

The hospital segment held a 59.3% share in 2024, driven by the growing need for advanced surgical capabilities to manage complex gastrointestinal cases. Hospitals typically offer better infrastructure and access to cutting-edge technologies, making them primary consumers of surgical snares. Their usage is particularly high in procedures involving polypectomy and tissue resection. Moreover, insurance coverage for hospital-based endoscopic procedures supports broader adoption of these devices.

United States Surgical Snares Market reached USD 531.8 million in 2024, driven by the widespread adoption of minimally invasive technologies and growing demand for efficient, high-precision surgical tools. The healthcare sector in the country emphasizes recovery time, surgical accuracy, and patient comfort, making surgical snares essential in endoscopy and laparoscopy. Availability of advanced surgical centers and increased patient awareness continue to push demand for these instruments.

Leading companies in the Global Surgical Snares Market include Olympus, Cook, ConMed, Teleflex, Merit Medical Systems, Hill-Rom Holdings, Avalign Technologies, Medtronic, STERIS, EndoMed Systems, Boston Scientific Corporation, Aspen Surgical, GPC Medical, Medline, and Sklar Surgical Instruments. To reinforce market position, companies are investing in product innovation, focusing on ergonomic designs and enhanced cutting precision. Strategic collaborations with healthcare institutions help manufacturers develop customized solutions tailored to specific surgical needs. Many are expanding their portfolios through acquisitions and investing in advanced materials to enhance device safety and performance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic conditions

- 3.2.1.2 Surging number of endoscopies

- 3.2.1.3 Increasing awareness of colorectal cancer screening

- 3.2.1.4 Rising preference for minimally invasive surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Clinical complications involved in the usage of snares

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Pricing analysis, 2024

- 3.8 Reimbursement scenario

- 3.9 Application potential

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Future market trends

- 3.14 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Single-use

- 5.3 Reusable

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 GI endoscopy

- 6.3 Laparoscopy

- 6.4 Cystoscopy

- 6.5 Arthroscopy

- 6.6 Bronchoscopy

- 6.7 Gynecology endoscopy

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 aspen surgical

- 9.2 Avalign Technologies

- 9.3 Boston Scientific Corporation

- 9.4 ConMed

- 9.5 Cook

- 9.6 EndoMed Systems

- 9.7 GPC Medical

- 9.8 Hill-Rom Holdings

- 9.9 Medline

- 9.10 Medtronic

- 9.11 Merit Medical Systems

- 9.12 Olympus

- 9.13 Sklar Surgical Instruments

- 9.14 STERIS

- 9.15 Teleflex