PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842639

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842639

Surgical Snare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

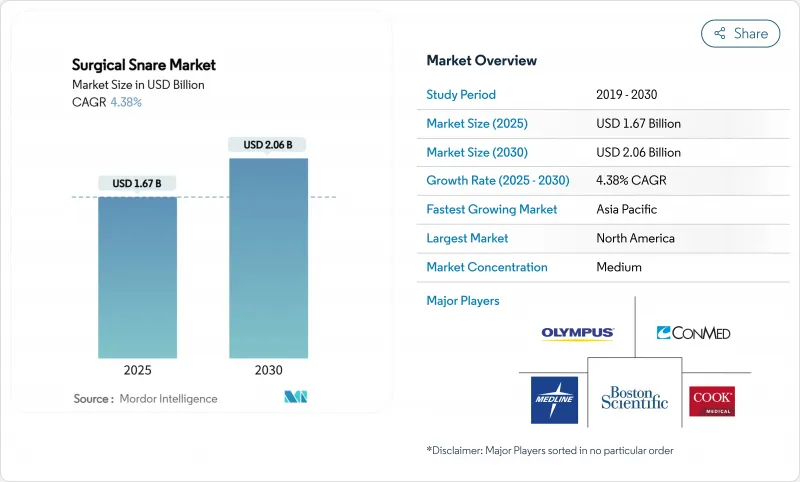

The surgical snare market stands at USD 1.67 billion in 2025 and is projected to reach USD 2.06 billion by 2030, reflecting a steady 4.38% CAGR.

Growth aligns with rising colorectal-cancer screening volumes, broader adoption of AI-assisted detection systems, and the transition toward cold-snare polypectomy that improves safety profiles. Ambulatory surgery centers (ASCs) now perform 72% of United States procedures at 45-60% lower costs than hospital settings, sharply increasing demand for single-use snares. Demographic tailwinds from aging populations further sustain procedure volumes, while technology leaders differentiate through shape optimization and artificial intelligence rather than price competition. Quality-assurance challenges, including recent recalls of single-use guide sheath kits, underscore the need for robust clinical evidence and post-market surveillance to protect adoption trajectories.

Global Surgical Snare Market Trends and Insights

Rising Preference for Minimally-Invasive Surgeries

Patient demand for faster recovery and lower complication rates is shifting procedural volumes toward endoscopic techniques. Device requirements now emphasize precise tissue capture through small lumens, favoring cold-snare designs compatible with robotic-assisted platforms. Seventeen robotic endoscopy systems remain under development, while nine hold regulatory approval. ASCs leverage this trend to attract cases, forecasting 25% volume growth over the next decade. The preference boosts the surgical snares market as clinicians standardize on single-use snares to secure sterility. Vendors that bundle AI-enabled visualization with snares gain additional traction in value-focused health systems.

Expansion of Endoscopic Ambulatory Surgery Centers

Thirty new gastrointestinal ASCs opened in 2023, illustrating a structural shift away from inpatient settings. CMS supports site-neutral reimbursement and plans a 2.6% ASC rate update for 2025, raising total payments to USD 7.4 billion. Private-equity funding accelerates network build-out in metropolitan areas, increasing standardized purchasing of disposable snares. Since ASCs emphasize quick turnover and infection control, the single-use segment of the surgical snares market expands faster than the reusable segment. Manufacturers that design procedure-specific kits gain purchasing preference as administrators seek inventory simplification.

Post-Polypectomy Bleeding and Perforation Risks

Cold snare techniques record 10.8% immediate bleeding compared with 3.2% for hot snare use, though delayed bleeding rates favor cold techniques. Liability exposure therefore influences device selection and training requirements. Regulators intensify clinical-evidence demands, particularly under the European Medical Device Regulation that mandates enhanced safety data. Manufacturers with established surveillance systems and rigorous post-market follow-up capitalize despite the hurdle. Emerging markets feel the risk more acutely due to limited emergency capacity, which moderates short-term uptake in high-volume centers.

Other drivers and restraints analyzed in the detailed report include:

- Hospital Investments in Advanced Endoscopy Suites

- Intensifying Colorectal-Cancer Screening Programs

- Reimbursement Cuts for GI Endoscopy Procedures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-use devices captured 68.36% of the surgical snares market share in 2024. The segment should advance at 4.89% CAGR to 2030 as infection-control mandates override per-procedure cost concerns. Recent contamination incidents involving reusable endoscopes push purchasers toward disposable options. However, rising waste management costs and new European packaging rules effective August 2026 create sustainability pressures on single-use models. Cardinal Health collected 18.3 million single-use items for recycling in 2024, showcasing emerging circular-economy responses.

Reusable snares remain relevant in high-volume centers that operate validated sterilization workflows. These facilities highlight lower lifetime costs compared with the USD 797-USD 4,400 per procedure expense for single-use duodenoscopes. Yet EU Medical Device Regulation compliance raises ongoing testing costs for reusables, narrowing the savings gap. Given the current adoption curve, the surgical snares market size for single-use devices will surpass USD 1.3 billion by 2030, representing a majority of incremental revenue. Providers increasingly demand eco-friendly materials to mitigate landfill impact, prompting vendors to explore biodegradable polymers.

Oval designs held 41.28% market share in 2024, underscoring physician familiarity and broad lesion applicability. Crescent designs, however, post the fastest 4.73% CAGR to 2030 due to superior capture efficiency in flat lesions and favorable ergonomics in the right colon. Early clinical evidence shows crescent snares improving complete resection rates for lateral spreading tumors. Vendors respond by integrating micro-serrated wire edges to enhance tissue grip.

Specialized shield and hexagonal shapes address niche anatomical scenarios but account for a smaller slice of the surgical snares market. The Exacto Cold Snare's shield shape yielded 91% complete resection versus 79% for traditional ovals, highlighting the performance boost that shape optimization can deliver. Demand for AI-guided navigation systems could accelerate adoption of shape-specific snares because algorithms prefer devices with predictable curvature profiles. As these innovations mature, the surgical snares market size for crescent designs could reach USD 590 million by 2030.

The Surgical Snare Market is Segmented by Usability (Reusable Surgical Snares, Single-Use Surgical Snares), by Shape (Oval, Crescent, and More), by Application (Gastrointestinal Endoscopy, Laparoscopy, and More), by End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America led with 43.26% of 2024 revenue, underpinned by mature screening programs, robust ASC infrastructure, and early adoption of AI decision support. Growth through 2030 sits at 4.2% as value-based care rewards high resection completeness and low complication rates. FDA scrutiny following safety recalls prompts providers to favor manufacturers with transparent real-world evidence. The surgical snare market size in North America is expected to exceed USD 830 million by 2030, with single-use penetration topping 75%.

Europe presents a sophisticated regulatory environment anchored by the EU Medical Device Regulation. Higher approval costs create competitive moats for compliant suppliers, while environmental policy drives recyclable packaging mandates starting 2026. Germany, France, and the Nordic region continue to invest in AI CADe systems, positioning the surgical snare market for steady 4.1% CAGR despite reimbursement headwinds. Hospitals increasingly sign multiyear strategic agreements to secure evidence-backed snare designs and training services.

Asia-Pacific posts the fastest 5.76% CAGR through 2030 due to infrastructure expansion and screening guideline adoption. China continues to pilot community screening programs, and Japan's decision to reimburse AI colonoscopy tools in 2024 boosts technology demand. Cost sensitivity persists in Thailand and Indonesia, steering buyers toward value-engineered devices. Local manufacturing partnerships reduce import duties and strengthen regional competitiveness. By 2030, Asia-Pacific could contribute 30% of global surgical snare market revenue, narrowing the gap with North America.

- Olympus

- Boston Scientific

- Cook Group

- Conmed

- Medline Industries

- Medtronic

- STERIS

- Merit Medical Systems

- HOYA Group - Pentax Medical

- Karl Storz

- Micro-tech

- Endo-Flex

- Taewoong Medical

- Medico's Hirata Inc.

- EMED Endoscopy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising preference for minimally-invasive surgeries

- 4.2.2 Expansion of endoscopic ambulatory surgery centers

- 4.2.3 Hospital investments in advanced endoscopy suites

- 4.2.4 Intensifying colorectal-cancer screening programs

- 4.2.5 Increasing adoption of cold-snare polypectomy techniques

- 4.2.6 AI-enabled snare devices enhancing detection & resection efficiency

- 4.3 Market Restraints

- 4.3.1 Post-polypectomy bleeding & perforation risks

- 4.3.2 Reimbursement cuts for GI endoscopy procedures

- 4.3.3 Stringent approval pathway for single-use devices

- 4.3.4 Shift toward endoscopic submucosal dissection tools

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Usability

- 5.1.1 Reusable Surgical Snares

- 5.1.2 Single-Use Surgical Snares

- 5.2 By Shape

- 5.2.1 Oval

- 5.2.2 Crescent

- 5.2.3 Hexagonal

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Gastrointestinal Endoscopy

- 5.3.2 Laparoscopy

- 5.3.3 Urology Endoscopy

- 5.3.4 Gynecology / Obstetrics Endoscopy

- 5.3.5 Others

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Olympus Corporation

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Cook Medical (Cook Group)

- 6.3.4 CONMED Corporation

- 6.3.5 Medline Industries

- 6.3.6 Medtronic plc

- 6.3.7 STERIS plc

- 6.3.8 Merit Medical Systems

- 6.3.9 HOYA Group - Pentax Medical

- 6.3.10 Karl Storz SE & Co. KG

- 6.3.11 Micro-Tech Endoscopy

- 6.3.12 Endo-Flex GmbH

- 6.3.13 Taewoong Medical Co. Ltd

- 6.3.14 Medico's Hirata Inc.

- 6.3.15 EMED Endoscopy