PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750620

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750620

Ambulance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

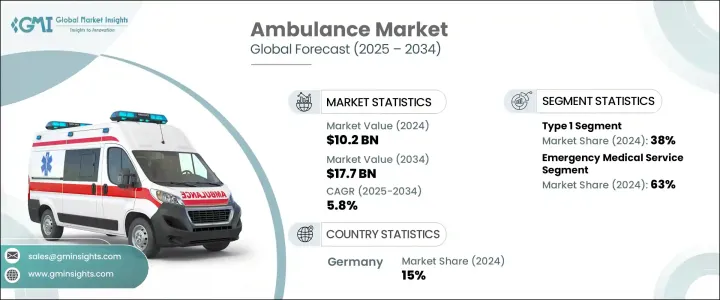

The Global Ambulance Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 17.7 billion by 2034, driven by the increased healthcare spending and the rising importance of emergency medical services (EMS). Government and private sectors are investing significantly in expanding ambulance fleets, improving response times, and upgrading medical technology. These investments help ensure that ambulances are better equipped to handle emergencies, improving patient care during transport. As a result, ambulances are increasingly equipped with advanced medical equipment, such as ventilators, automated CPR devices, and advanced defibrillators, to manage critical conditions during transit.

The growing emphasis on airway management and ventilators further supports the ambulance market's growth. Ventilators are crucial in stabilizing patients with respiratory distress, ensuring oxygen is delivered effectively during emergencies such as cardiac arrest or severe trauma. With advanced features like adjustable pressure and volume control, these devices help paramedics provide critical care while en route to medical facilities. As more healthcare systems recognize the value of high-quality EMS, demand for better-equipped and specialized ambulances continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 5.8% |

In 2024, Type 1 ambulances led the market, accounting for 38% share. These vehicles, typically built on a truck chassis, provide a durable platform and additional space for medical equipment and personnel. The growing preference for Type 1 ambulances is driven by their ability to handle emergencies, including large-scale accidents or natural disasters, and their capacity to transport multiple patients or larger equipment.

The EMS segment held a 63% share in 2024, driven by healthcare providers prioritizing rapid, reliable transport of critically ill patients. Advances in telemedicine and mobile health solutions have further improved EMS capabilities, enabling paramedics to consult with doctors remotely and optimize care before patients arrive at the hospital. These innovations are expected to increase the demand for more advanced ambulances capable of longer-distance, high-level care during transport.

Germany Ambulance Market held a 15% share in 2024, fueled by strong regulatory support for environmental sustainability and the growing adoption of electric ambulances. The country is taking proactive steps to reduce its carbon footprint, making electric ambulances an increasingly popular choice. As environmental regulations tighten across Europe, Germany has embraced electric vehicles, including ambulances, to meet stringent emission standards and contribute to cleaner air. This move aligns with the nation's broader commitment to sustainability and has positioned it as a leader in the transition toward eco-friendly emergency medical services (EMS).

Key players in the Global Ambulance Market include Braun Industries, NAFFCO, Toyota, Demers Ambulances, and Crestline Ambulance. To expand their market footprint, companies are investing in electric ambulances to meet sustainability goals and reduce operational costs. They integrate cutting-edge technologies like real-time telemedicine and advanced monitoring systems into their vehicles. Collaborations with healthcare providers and government agencies to improve service delivery and fleet management are helping companies enhance their competitive advantage. Additionally, expanding into emerging markets where healthcare infrastructure is rapidly developing has allowed companies to tap into new revenue streams.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Technology providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rise in chronic diseases and trauma cases

- 3.9.1.2 Rising healthcare expenditure

- 3.9.1.3 Advancements in ambulance technology

- 3.9.1.4 Growing investments in the healthcare sector across the globe

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High operational and maintenance cost

- 3.9.2.2 Traffic congestion and delayed response times

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Type 1

- 5.3 Type 2

- 5.4 Type 3

- 5.5 Medium-duty

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Emergency medical service

- 6.3 Fire ambulances

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Diesel

- 8.3 Gasoline

- 8.4 Electric vehicles

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Auto Ribeiro

- 10.2 BAUS AT

- 10.3 Bollanti

- 10.4 Braun Industries

- 10.5 Crestline Ambulance

- 10.6 Demers Ambulances

- 10.7 Excellence

- 10.8 Frazer Ltd

- 10.9 JCBL Group

- 10.10 Life Line Emergency Vehicles

- 10.11 Medicop

- 10.12 Medix Specialty Vehicles

- 10.13 Miller Coach Company

- 10.14 NAFFCO

- 10.15 O&H Vehicle Technology

- 10.16 Osage Ambulances

- 10.17 Profile Vehicles Oy

- 10.18 REV Group

- 10.19 Toyota

- 10.20 WAS