PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846302

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846302

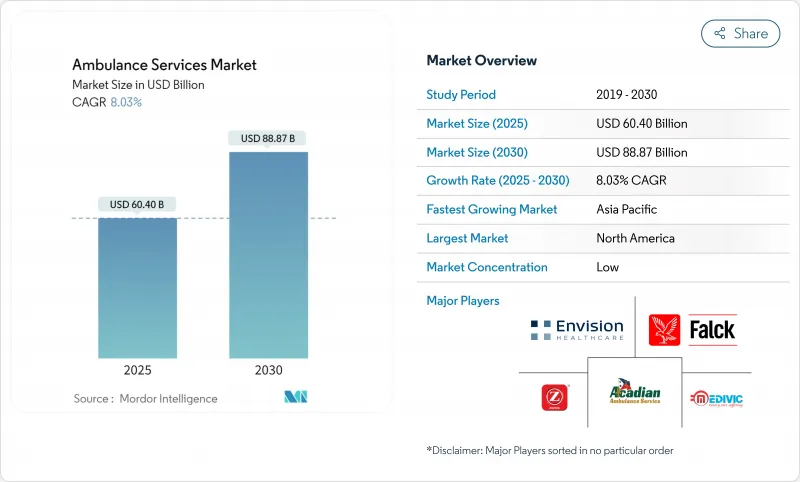

Ambulance Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ambulance services market is valued at USD 60.4 billion in 2025 and is projected to reach USD 88.87 billion by 2030, advancing at an 8.03% CAGR.

Expansion reflects rising demand for rapid pre-hospital care, stronger health-insurance coverage, and widespread uptake of connected-care technology. Asia-Pacific delivers the fastest growth at 9.4% as governments upgrade emergency medical services (EMS) and insurers scale coverage in emerging economies. Ground ambulances remain the revenue anchor, but air ambulances post the quickest gains at 9.2% CAGR, spurred by longer-range, fuel-efficient aircraft and growing appetite for critical-care retrieval. Real-time data-sharing tools now link field paramedics with remote specialists, widening clinical scope and sharpening competitive differentiation. At the same time, staffing shortfalls and fragmented regulatory frameworks weigh on margins, pushing operators toward consolidation and cross-border partnerships.

Global Ambulance Services Market Trends and Insights

Rising Global Incidence of Trauma, Cardiovascular Emergencies, and Other Time-Critical Medical Conditions

The upward trend in out-of-hospital cardiac arrest (OHCA) and road-traffic trauma continues to reshape deployment tactics. U.S. data point to roughly 350,000 OHCA episodes annually, prompting EMS agencies to field drone-delivered automated external defibrillators (AEDs) that can cut arrival times to under five minutes and uplift survival odds by 34%. Urban congestion reinforces the need for such hybrid response models, guiding investment towards complementary airborne assets that augment traditional ground fleets. Operators expect the ambulance services market to derive incremental revenue from licensing rapid-response platforms to city authorities.

Aging Population and Increasing Prevalence of Chronic Diseases

Adults aged 65+ already account for one-third of emergency transports and two-thirds of non-urgent journeys, despite making up 12% of the population . Utilisation rates climb even higher in rural belts, accelerating the need for geriatric-specific protocols, bariatric stretchers, and home-to-hospital shuttle networks. Market participants anticipate that demand from octogenarians will embed predictable baseline call volumes into the ambulance services market size, cushioning cyclical swings linked to acute outbreaks.

High Capital and Operating Expenditures

A new Type I diesel ambulance costs upward of USD 280,000, while battery-electric variants breach the USD 350,000 threshold, straining municipal budgets. Medicare payments for ambulance rides consumed USD 3.9 billion in 2022-just 1% of fee-for-service spending-underscoring a revenue-expense mismatch. Tight margins are nudging smaller fleets toward asset sales, thereby fuelling consolidation that may ultimately narrow supplier choice.

Other drivers and restraints analyzed in the detailed report include:

- Government-Led Public-Private Partnerships and Funding Programs Aimed at Strengthening EMS Networks

- Expansion of Healthcare Infrastructure and Health-Insurance Coverage

- Integration of Telemedicine, Real-Time Monitoring, and Advanced Life-Support Equipment

- Increasing Incidences of Road Accidents

- Shortage of Trained Paramedics, Pilots, and Critical-Care Staff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The air segment, though holding a smaller revenue slice, is projected to grow at a 9.2% CAGR. Fleet refresh favours fixed-wing airplanes fitted with pressurised cabins that extend retrieval range for neonatal and cardiac cases. At the same time, ground ambulances continue to anchor approximately 74.1% of 2024 revenue, preserving the largest ambulance services market share. The federal grant that supplied the Paterson Fire Department with two electric ambulances at USD 908,686 highlights municipalities' pivot toward low-emission fleets. Such capex drives a sustainable replacement cycle and protects total ambulance services market size.

Ground crews increasingly deploy battery-integrated life-support units that power equipment without engine idling, cutting diesel burn by 30%. Air operators, meanwhile, negotiate bulk fuel hedges and explore sustainable aviation fuel trials to mitigate cost volatility. Analysts predict that dual-modality providers will capture complex inter-facility transfers, unlocking synergies in dispatch software and maintenance facilities.

Advanced life support vehicles captured smaller volume but are scaling faster with an 8.8% CAGR. Each ALS ambulance houses ventilators, infusion pumps, and point-of-care ultrasound, enabling complex interventions in transit. Paramedics can push rapid-sequence induction drugs under physician oversight through video links. This capability improves patient stabilization during rural transfers and secures favorable case-mix payments.

In contrast, the basic life support segment retained 59.6% share in 2024 and anchors routine inter-facility and dialysis shuttles. Operating cost for BLS crews is lower, and recent studies found 13.1% hospital discharge survival among BLS patients versus 9.2% for ALS in select conditions . The findings spark debate on resource allocation, with some systems redeploying ALS units from low-acuity transport to high-risk calls. The ambulance services market size for BLS nonetheless remains large and stable as payers favor its cost efficiency.

The Ambulance Services Market Report Segments the Industry Into by Mode of Transport (Air Ambulance, and More), by Equipment (Basic Life Support Ambulance Services, and More), by Type of Service (Emergency Services, and More), by Ownership (Government/Municipal, and More), Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America ranks first by revenue with a 34.4% global share. Federal rulemaking to outlaw balance billing for emergency rides should heighten cost transparency and improve collections. Private insurers, anticipating regulatory enforcement, are moving toward bundled EMS-hospital payment packages, potentially smoothing revenue volatility for fleet owners. Tele-medical pilots led by Mayo Clinic confirm the region's penchant for frontier tech, hinting at export opportunities for communication vendors.

Asia-Pacific emerges as the fastest-growing corridor at 9.4% CAGR through 2030. National governments finance fleet expansion, while insurers expand to first-time buyers of health cover, directly lifting ambulance utilisation. China's 14th Five-Year Plan designates emergency rescue modernisation as a priority, earmarking USD 3.1 billion for trauma-centre upgrades. Fragmented rural terrain still hampers equitable access, making aerial EMS an attractive adjunct in mountainous provinces.

Europe maintains a sizable slice of the ambulance services market and leads on sustainability mandates. Scotland's net-zero fleet blueprint funds hydrogen-fuel-cell trials for inter-city missions. Meanwhile, EU tenders increasingly require life-cycle carbon reporting, pressing manufacturers to adopt recyclable composite bodies. Against a backdrop of ageing demographics, Slovenian projections indicate a steady uptick in dispatch volume tied to population over-75.

- Acadian Ambulance Service

- Air Methods

- American Medical Response

- Envision Healthcare

- Falck A/S

- Dutch Health B.V.

- BVG India

- Ziqitza Health Care Ltd

- GVK Emergency Management & Research Institute

- Medivic Aviation

- Scandinavian AirAmbulance

- Air Medical Group Holdings

- Lifeline Ambulance Services (UK)

- London Ambulance Service NHS Trust

- National Ambulance LLC (UAE)

- Air Charter Services Ltd (Kenya)

- St John Ambulance Australia

- SA Ambulance Service

- EMS Group (Japan)

- Aero Asahi Corporation

- PHI Air Medical

- REVA Air Ambulance

- CareFlight International

- Express Ambulances India

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Incidence Of Trauma, Cardiovascular Emergencies, And Other Time-Critical Medical Conditions

- 4.2.2 Aging Population And Increasing Prevalence Of Chronic Diseases

- 4.2.3 Government-Led Public-Private Partnerships And Funding Programs Aimed At Strengthening National And Regional EMS Networks.

- 4.2.4 Expansion Of Healthcare Infrastructure And Health-Insurance Coverage

- 4.2.5 Integration Of Telemedicine, Real-Time Monitoring, And Advanced Life-Support Equipment

- 4.2.6 Increasing Incidencs Of Raod Accidents

- 4.3 Market Restraints

- 4.3.1 High Capital And Operating Expenditures

- 4.3.2 Shortage Of Trained Paramedics, Pilots, And Critical-Care Staff

- 4.3.3 Competitive Pressure From Non-Emergency Medical Transport And Rideshare Health-Transport Services

- 4.3.4 Fragmented Regulatory Accreditation Raising Compliance Costs

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD million)

- 5.1 By Mode of Transport

- 5.1.1 Air Ambulance

- 5.1.1.1 Rotary-Wing

- 5.1.1.2 Fixed-Wing

- 5.1.2 Water Ambulance

- 5.1.3 Ground Ambulance

- 5.1.3.1 Type III Van

- 5.1.3.2 Type I/II Modular

- 5.1.3.3 Hybrid-Electric/EV Ambulance

- 5.1.1 Air Ambulance

- 5.2 By Equipment

- 5.2.1 Basic Life Support (BLS) Ambulance Services

- 5.2.2 Advanced Life Support (ALS) Ambulance Services

- 5.2.3 Specialty Care Transport (SCT)

- 5.3 By Type of Service

- 5.3.1 Emergency Services

- 5.3.2 Non-Emergency Services

- 5.4 By Ownership

- 5.4.1 Government/Municipal

- 5.4.2 Private Corporate

- 5.4.3 Hospital-Based

- 5.4.4 Volunteer/NGO

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Acadian Ambulance Service Inc.

- 6.3.2 Air Methods Corporation

- 6.3.3 American Medical Response

- 6.3.4 Envision Healthcare Corporation

- 6.3.5 Falck A/S

- 6.3.6 Dutch Health B.V.

- 6.3.7 BVG India Ltd

- 6.3.8 Ziqitza Health Care Ltd

- 6.3.9 GVK Emergency Management & Research Institute

- 6.3.10 Medivic Aviation

- 6.3.11 Scandinavian AirAmbulance

- 6.3.12 Air Medical Group Holdings

- 6.3.13 Lifeline Ambulance Services (UK)

- 6.3.14 London Ambulance Service NHS Trust

- 6.3.15 National Ambulance LLC (UAE)

- 6.3.16 Air Charter Services Ltd (Kenya)

- 6.3.17 St John Ambulance Australia

- 6.3.18 SA Ambulance Service

- 6.3.19 EMS Group (Japan)

- 6.3.20 Aero Asahi Corporation

- 6.3.21 PHI Air Medical

- 6.3.22 REVA Air Ambulance

- 6.3.23 CareFlight International

- 6.3.24 Express Ambulances India

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment