PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750623

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750623

Spider Lift Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

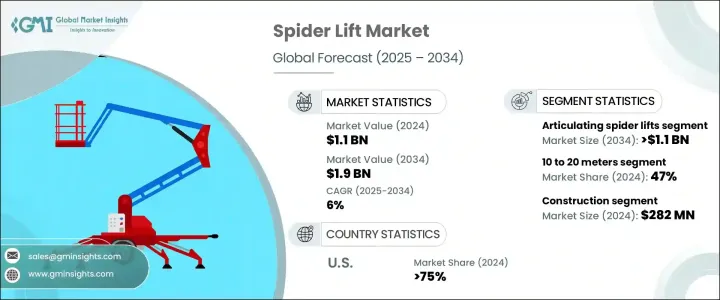

The Global Spider Lift Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 1.9 billion by 2034, driven by rapid technological advancements, including IoT integration, telematics, and automation. These innovations allow for better real-time tracking, predictive maintenance, and simplified operation, improving efficiency and safety. There is a growing momentum around hybrid and electric spider lift designs, influenced by increasingly stringent environmental regulations and the need for low-emission equipment in urban and indoor applications.

With construction projects requiring heights of greater access, longer-reach spider lifts are seeing a noticeable rise in demand as industries seek solutions that offer both elevation and stability in complex environments. These lifts are now a critical part of large-scale projects where conventional access equipment falls short, especially in high-rise maintenance, exterior building work, and utility installation. The ability of longer-reach spider lifts to operate in confined or difficult-to-reach areas makes them indispensable for today's modern job sites. In response to these needs, manufacturers focus on engineering robust and flexible lift models that offer greater reach without compromising safety or ease of operation. To meet the evolving regulatory landscape, companies are integrating intelligent safety and monitoring systems, including features like load-sensing technology, automated controls, and advanced telematics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 6% |

Articulating spider lifts segment held 51% share and is projected to generate USD 1.1 billion in value by 2034, favored by their compact design, lightweight build, and versatility across industries. Their ability to navigate narrow spaces and adapt to uneven terrain has increased their relevance in challenging environments. As manufacturers continue to refine models to meet unique application needs, demand has surged across maintenance, installation, and urban utility projects. Their flexible arms and precise maneuverability make them especially suitable for projects in areas with limited access, while their portability enables efficient deployment across sites.

Spider lifts with platform heights ranging from 10 to 20 meters held a 47% share in 2024, driven by the balanced need for reach and mobility. This height range offers ideal usability for tasks across landscaping, light construction, and public facility maintenance. Enhanced safety features such as anti-slip platforms, emergency descent systems, and automatic overload protection are becoming standard, helping operators work more confidently in dense or high-traffic environments. With stricter regulations around workplace safety, these features are becoming essential requirements.

United States Spider Lift Market generated USD 333.8 million, accounting for a 75% share in 2024, driven by rapid industrial development, a surge in commercial construction, and increased investments in infrastructure upgrades. The push for sustainability across federal and state levels accelerates the shift toward electric and hybrid spider lifts, which produce zero on-site emissions and operate more quietly in sensitive or indoor areas. In North America, contractors and rental companies turn to battery-powered or hybrid units as cities enforce stricter emissions standards and noise restrictions.

Key players shaping the industry include CTE SpA, Dinolift, Platform Basket, Cela, Shandong Toros Machinery Corporation, Oshkosh Corporation, Terex, Niftylift, Imer, and Hubei Goman Heavy Industry Technology. Leading companies are prioritizing strategic partnerships and product innovation. Many invest heavily in R&D to design lightweight, compact, eco-friendly models with advanced control systems. Global expansion through regional distribution networks and dealer partnerships is helping them tap into emerging markets. Companies are also enhancing after-sales services and offering flexible leasing and financing options to cater to rental businesses and large fleet operators.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material and component suppliers

- 3.1.1.2 Technology providers

- 3.1.1.3 Manufactures

- 3.1.1.4 Distributors

- 3.1.1.5 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.1 Impact on trade

- 3.3 Pricing and product strategies

- 3.4 Technology & innovation landscape

- 3.4.1 Automation and robotics

- 3.4.2 Eco-Friendly power systems

- 3.4.3 Integration of IoT and telematics

- 3.4.4 Advanced control systems and safety mechanisms

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Use cases

- 3.8 Key news & initiatives

- 3.9 Cost break-down analysis

- 3.9.1 Initial purchase

- 3.9.2 Maintenance & repairs

- 3.9.3 Operational costs

- 3.9.4 Transportation

- 3.9.5 Depreciation

- 3.10 Price trend analysis

- 3.10.1 Product

- 3.10.2 Region

- 3.11 Regulatory landscape

- 3.12 Impact on forces

- 3.12.1 Growth drivers

- 3.12.1.1 Rising demand for aerial work platforms in construction and infrastructure projects

- 3.12.1.2 Technological advancements and improved safety features

- 3.12.1.3 Growing awareness of worker safety regulations

- 3.12.1.4 Growing demand for rental equipment

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 High initial investment and maintenance costs

- 3.12.2.2 Regulatory compliance and safety standards

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Telescopic spider lifts

- 5.3 Articulating spider lifts

- 5.4 Crawler-based spider lifts

- 5.5 Electric or hybrid spider lifts

Chapter 6 Market Estimates & Forecast, By Platform Height, 2021 - 2034 ($Mn Units)

- 6.1 Key trends

- 6.2 Below 10 meters

- 6.3 10 to 20 meters

- 6.4 20 to 25 meters

- 6.5 Above 25 meters

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Government

- 7.3 Telecommunications & utility

- 7.4 Industrial and manufacturing firms

- 7.5 Facility management companies

- 7.6 Rental

- 7.7 Entertainment & media production

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.2 Europe

- 8.2.1 UK

- 8.2.2 Germany

- 8.2.3 France

- 8.2.4 Italy

- 8.2.5 Spain

- 8.2.6 Russia

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.2 India

- 8.3.3 Japan

- 8.3.4 Australia

- 8.3.5 South Korea

- 8.3.6 Southeast Asia

- 8.4 Latin America

- 8.4.1 Brazil

- 8.4.2 Mexico

- 8.4.3 Argentina

- 8.5 MEA

- 8.5.1 South Africa

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

Chapter 9 Company Profiles

- 9.1 Airo

- 9.2 Almac

- 9.3 Cela

- 9.4 CMC Lift

- 9.5 CTE

- 9.6 Dinolift

- 9.7 Easy Lift

- 9.8 Falcon Lift

- 9.9 HINOWA

- 9.10 Imer

- 9.11 JLG Industries

- 9.12 Niftylift

- 9.13 Omme Lift

- 9.14 Palazzani Industrie

- 9.15 Platform Basket

- 9.16 SHANDONG HIMOR MACHINERY

- 9.17 Socageworld

- 9.18 Teejan Equipment

- 9.19 Terex Corporation

- 9.20 Teupen