PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844258

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844258

North America Forklift Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

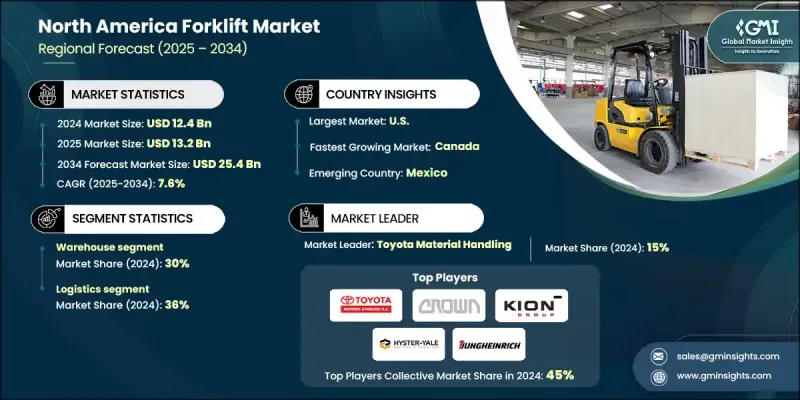

North America Forklift Market was valued at USD 12.4 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 25.4 billion by 2034.

The regional market operates under a highly structured ecosystem, with many manufacturers participating in collective organizations, creating a unified approach to industry development. This cohesion helps streamline innovation and compliance efforts across stakeholders. Technological advancements such as Simultaneous Localization and Mapping (SLAM) are reshaping forklift navigation by allowing operations without fixed surroundings, ideal for ever-changing warehouse environments. Modern sensor technologies are playing a pivotal role in improving safety standards and are anticipated to become baseline features in future forklift models. The demand for advanced safety systems is driven by increasingly stringent workplace safety mandates across the region. As material handling standards continue to evolve, manufacturers are adopting sensor-driven and autonomous solutions to support warehouse modernization and regulatory alignment. With rapid expansion in e-commerce and industrial automation, the forklift sector in North America is undergoing a significant transformation that prioritizes speed, safety, energy efficiency, and scalability in logistics and warehousing applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.4 billion |

| Forecast Value | $25.4 billion |

| CAGR | 7.6% |

In 2024, the warehouse applications segment held a 30% share and is forecasted to grow at a CAGR of 7.2% through 2034. Warehousing operations have surged across North America, influenced by rising demand for fast delivery and streamlined material handling across major fulfillment hubs. These trends have fueled forklift adoption, especially in multi-shift and automated warehouse environments.

The logistics segment held a 36% share in 2024 and is expected to grow at a CAGR of 8% from 2025 to 2034, driven by demand from e-commerce and third-party logistics operators. Electric forklifts in Class I through III see a spike in adoption as companies modernize operations with low-emission, high-efficiency machinery that supports rapid inventory turnover and safety improvements. Demand is especially strong in U.S. regions with high warehousing density and rising consumer fulfillment expectations, while Canada's growth is bolstered by the surge in cross-border logistics services.

U.S. Forklift Market generated USD 9.9 billion in 2024, securing its position as the largest forklift market in North America. Forklift use is widespread across the logistics, manufacturing, and retail sectors. Electric forklifts are gaining traction in warehouses as sustainability goals and environmental compliance become central to operational strategies. While internal combustion forklifts remain dominant in heavy-duty applications, the transition to cleaner alternatives continues to accelerate across the U.S. market.

Key companies operating in the North America Forklift Market include Hyster-Yale, Inc., Crown Equipment Corporation, Toyota Material Handling North America, Doosan Bobcat North America Inc., Jungheinrich AG, Mitsubishi Logisnext Co., Ltd., KION GROUP AG, Hyundai Material Handling Co., Ltd., Sellick Equipment Limited, Caterpillar Inc., UniCarriers Corporation, Hoist Liftruck Manufacturing, Inc., Manitou Group SA, Pettibone LLC, and Doosan Industrial Vehicle Co., Ltd. To enhance their position in the North America forklift market, manufacturers are emphasizing electric and hybrid product development aimed at improving energy efficiency and regulatory compliance. Brands such as Jungheinrich AG, Crown Equipment Corporation, and KION GROUP AG are scaling their portfolios with automation-ready forklifts and safety-enhancing sensor integrations. Companies are also forging strategic partnerships with warehouse operators to introduce fleet optimization solutions and connected vehicle systems. Expanding after-sales services and offering subscription-based maintenance plans have become key tactics for improving customer retention. Investments in smart warehouse solutions, telematics integration, and factory-direct distribution networks are enabling quicker deployment and improved end-user experience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product

- 2.2.3 Fuel

- 2.2.4 Class

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of E-commerce and Warehousing

- 3.2.1.2 Industrial and Manufacturing Expansion

- 3.2.1.3 Technological advancements in Forklift

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Reshoring and Infrastructure Investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1.3 Mexico

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Warehouse

- 5.3 Counterbalance

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Electric

- 6.4 Gasoline & LPG/CNG

Chapter 7 Market Estimates & Forecast, By Class, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Class I

- 7.3 Class II

- 7.4 Class III

- 7.5 Class IV

- 7.6 Class V

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Chemical

- 8.3 Food & beverages

- 8.4 Industrial

- 8.5 Logistics

- 8.6 Retail & e-commerce

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Country, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

- 10.4 Mexico

Chapter 11 Company Profiles

- 11.1 Caterpillar Inc.

- 11.2 Crown Equipment Corporation

- 11.3 Doosan Bobcat North America Inc.

- 11.4 Doosan Industrial Vehicle Co., Ltd.

- 11.5 Hoist Liftruck Manufacturing, Inc.

- 11.6 Hyster-Yale, Inc.

- 11.7 Hyundai Material Handling Co., Ltd.

- 11.8 Jungheinrich AG

- 11.9 KION GROUP AG

- 11.10 Manitou Group SA

- 11.11 Mitsubishi Logisnext Co., Ltd.

- 11.12 Pettibone LLC

- 11.13 Sellick Equipment Limited

- 11.14 Toyota Material Handling North America

- 11.15 UniCarriers Corporation