PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750624

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750624

North America Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

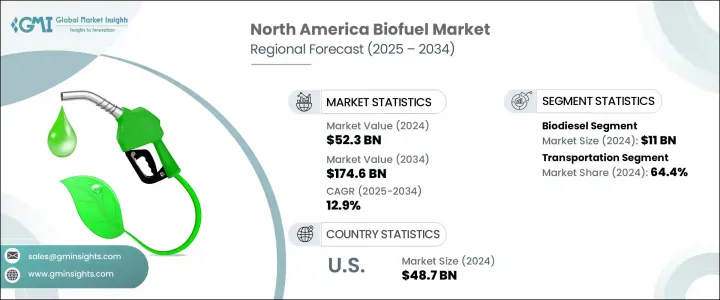

North America Biofuel Market was valued at USD 52.3 billion in 2024 and is estimated to grow at a CAGR of 12.9% to reach USD 174.6 billion by 2034 as demand for cleaner energy sources continues to rise. Supportive government policies, including renewable fuel mandates and financial incentives, are accelerating the shift toward biofuels. These renewable alternatives are increasingly favored for their ability to reduce greenhouse gas emissions and enhance energy independence across the region.

Growing environmental awareness and the urgency to meet climate targets are prompting both businesses and consumers to adopt sustainable energy options. Biofuels are emerging as a reliable substitute for petroleum-based fuels, especially as environmental regulations become more rigorous. Many organizations are turning to bio-based energy solutions to align with sustainability commitments while also responding to the rising pressure from investors and stakeholders demanding cleaner operations. With a clear push from federal and regional initiatives aimed at carbon reduction, biofuels have gained traction not only in road transport but also in sectors like aviation and maritime. This transition is driven by the necessity to decrease reliance on fossil fuels and to foster innovation in renewable fuel technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.3 Billion |

| Forecast Value | $174.6 Billion |

| CAGR | 12.9% |

The North America biofuel market is divided into biodiesel, ethanol, and other fuel types. Among these, the biodiesel segment stood at USD 11 billion in 2024. The production of biodiesel is becoming increasingly efficient due to continual technological upgrades, which help lower production costs and improve scalability. As producers refine manufacturing techniques and feedstock usage, biodiesel is being integrated more widely into the mainstream energy supply. It is primarily derived from renewable sources such as vegetable oils and animal fats, and it is being increasingly adopted in commercial and transportation sectors as a cleaner-burning fuel.

In terms of application, the market is segmented into transportation, aviation, and others. The transportation segment remains the leading contributor, accounting for 64.4% of the market revenue in 2024. Regulatory requirements around the blending of ethanol and the adoption of renewable diesel are pushing the use of biofuels in passenger vehicles, freight carriers, and shipping fleets. Biofuels are becoming standard in fuel mixes, replacing conventional petroleum products in many high-usage environments. This widespread incorporation is supported by efforts to lower emissions from road traffic, which remains one of the largest contributors to environmental pollution in North America.

The United States continues to dominate the regional landscape, with market values climbing from USD 35.4 billion in 2022 to USD 48.7 billion in 2024. This steady rise reflects the country's ongoing commitment to increasing the share of renewables in its energy mix. National initiatives are focused on accelerating the development of low-carbon fuel options across various transport modes. A wide range of programs, research investments, and updated fuel standards are contributing to market expansion, particularly as the government prioritizes the production of alternative fuels that are cleaner and more sustainable.

Key players shaping the competitive dynamics of the North American biofuel market include ADM, Cargill, Chevron Corporation, and POET, LLC. These four companies together hold more than 30% of the market share. Their market leadership is backed by strong production capabilities, robust supply chains, and continuous innovation in biofuel technologies. These organizations have successfully leveraged their expertise in agriculture, energy, and logistics to streamline the production and distribution of biofuels across the region. Additionally, they are expanding their renewable portfolios through collaborative efforts with growers, energy providers, and research institutes.

ADM plays a vital role in driving the biofuel sector forward. Its operations integrate advanced processing techniques to convert crops like corn and oilseeds into fuels for both transportation and industrial use. The company is committed to advancing the circular economy by focusing on sustainable feedstock sourcing and improving its energy efficiency. Investments in next-generation technologies, such as carbon management systems, further reinforce ADM's leadership position in the market. Its facilities across multiple states are strategically designed to support large-scale production, ensuring a reliable supply of biofuels to meet growing consumer and industrial demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Trump administration tariffs analysis

- 2.2.1 Impact on trade

- 2.2.1.1 Trade volume disruptions

- 2.2.1.2 Retaliatory measures

- 2.2.2 Impact on the industry

- 2.2.2.1 Supply-side impact (raw materials)

- 2.2.2.1.1 Price volatility in key materials

- 2.2.2.1.2 Supply chain restructuring

- 2.2.2.1.3 Production cost implications

- 2.2.2.2 Demand-side impact (selling price)

- 2.2.2.2.1 Price transmission to end markets

- 2.2.2.2.2 Market share dynamics

- 2.2.2.2.3 Consumer response patterns

- 2.2.2.1 Supply-side impact (raw materials)

- 2.2.3 Key companies impacted

- 2.2.4 Strategic industry responses

- 2.2.4.1 Supply chain reconfiguration

- 2.2.4.2 Pricing and product strategies

- 2.2.4.3 Policy engagement

- 2.2.1 Impact on trade

- 2.3 Outlook and future considerations

- 2.4 Industry impact forces

- 2.4.1 Growth drivers

- 2.4.2 Industry pitfalls & challenges

- 2.5 Growth potential analysis

- 2.6 Porter's analysis

- 2.6.1 Bargaining power of suppliers

- 2.6.2 Bargaining power of buyers

- 2.6.3 Threat of new entrants

- 2.6.4 Threat of substitutes

- 2.7 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Introduction

- 3.2 Company market share

- 3.3 Strategic dashboard

- 3.4 Strategic initiative

- 3.5 Competitive benchmarking

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By Fuel Type, 2021 - 2034 (Mtoe & USD Billion)

- 4.1 Key trends

- 4.2 Biodiesel

- 4.3 Ethanol

- 4.4 Others

Chapter 5 Market Size and Forecast, By Feedstock, 2021 - 2034 (Mtoe & USD Billion)

- 5.1 Key trends

- 5.2 Coarse grain

- 5.3 Sugar crop

- 5.4 Vegetable oil

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (Mtoe & USD Billion)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Aviation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (Mtoe & USD Billion)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 ADM

- 8.2 Andersons, Inc., The

- 8.3 Cargill

- 8.4 Chevron Corporation

- 8.5 Clean Energy

- 8.6 CLARIANT

- 8.7 COFCO

- 8.8 FutureFuel Corporation

- 8.9 Gevo, Inc.

- 8.10 Green Plains Inc.

- 8.11 My Eco Energy

- 8.12 Neste

- 8.13 POET, LLC

- 8.14 Renewable Energy Group

- 8.15 Rentech

- 8.16 TotalEnergies

- 8.17 UPM

- 8.18 VERBIO AG