PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750626

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750626

Battery Test Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

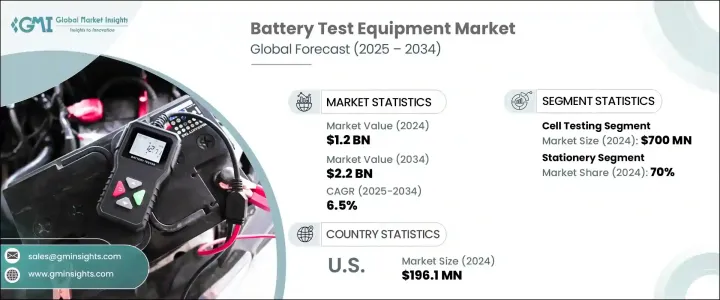

The Global Battery Test Equipment Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 2.2 billion by 2034, driven by the rising demand for electric mobility, advancements in renewable energy infrastructure, and growth in smart electronic devices. As battery systems become more complex and performance-intensive, manufacturers are placing higher emphasis on testing tools that ensure battery durability, accuracy, and compliance with international safety standards. This rising focus on battery health, lifecycle optimization, and predictive diagnostics has made test equipment essential across industries. The integration of automation, data analytics, and cloud platforms is also transforming traditional testing workflows.

These intelligent systems allow for real-time monitoring, advanced data logging, and error detection, providing manufacturers with faster, more precise insights. As new battery chemistries and architectures emerge, the need for flexible, scalable, and smart testing solutions becomes increasingly critical in maintaining product reliability across sectors such as transportation, storage, and electronics. These modern systems not only improve the accuracy of diagnostics but also reduce testing cycle times, enabling quicker time-to-market for innovative battery technologies. Their adaptability to a wide range of cell formats and configurations ensures they remain relevant in a rapidly evolving energy landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 6.5% |

Among functional segments, testing at the cell level dominated in 2024, generating USD 700 million due to the need for detailed analysis of individual cells to detect issues related to energy capacity, internal resistance, and voltage consistency before assembly into battery modules or packs. Such foundational evaluation plays a pivotal role in preventing system-wide failures and improving operational efficiency. With the rapid evolution of battery technology, cell testing has become more crucial than ever in guaranteeing product longevity and safe performance.

From a product type perspective, stationary test systems held the largest share of the market, accounting for 70% in 2024. Their superior precision, longer testing capabilities, and ability to manage complex performance evaluations have made them ideal for applications involving large-scale energy storage and heavy-duty battery units. The need for comprehensive analysis under controlled conditions continues to make stationary equipment the preferred choice for developers, researchers, and battery manufacturers focused on delivering high-performance energy solutions.

United States Battery Test Equipment Market generated USD 196.1 million in 2024 and is projected to grow at a CAGR of 6.8% through 2034, driven by continuous innovation, expansion in the clean energy sector, and increasing investments in battery production and testing infrastructure. Supportive government policies and the rapid adoption of electric mobility have also accelerated the demand for advanced battery testing technologies across the region.

To strengthen their market position, companies like Chroma ATE, Arbin, NH Research, Midtronics, and Neware Technology Limited are pursuing strategic initiatives focused on product innovation, global expansion, and collaboration. Many are investing in R&D to enhance test precision and support evolving battery chemistry. Firms such as Maccor and Bitrode are launching scalable, modular testing platforms that address diverse customer needs. Additionally, several players are integrating AI-driven analytics and cloud connectivity to offer intelligent diagnostic tools. Partnerships with research institutes and OEMs, along with customized service offerings, are also helping these companies gain competitive advantages in a dynamic, innovation-driven market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for rechargeable batteries

- 3.8.1.2 Growth in electric vehicle (EV) adoption

- 3.8.1.3 Expansion of energy storage systems

- 3.8.1.4 Technological advancements in battery testing

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Initial Investment Costs

- 3.8.2.2 Complexity of Battery Technologies

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Stationary

- 5.3 Portable

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Cell testing

- 6.3 Module testing

- 6.4 Pack testing

Chapter 7 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Capacity tester

- 7.3 Safety testing equipment

- 7.4 Temperature tester

- 7.5 Resistance tester

- 7.6 Voltage monitor

- 7.7 Fault tracker

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Energy and utility

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AMETEK

- 10.2 Amprobe

- 10.3 Arbin Instruments

- 10.4 BatteryDAQ

- 10.5 Bio-Logic Science

- 10.6 Bitrode

- 10.7 Cadex Electronics

- 10.8 Chroma ATE

- 10.9 Digatron Power Electronics

- 10.10 FLIR Systems

- 10.11 HIOKI E.E.

- 10.12 ITECH Electronic

- 10.13 Keysight Technologies

- 10.14 Maccor

- 10.15 Megger

- 10.16 Midtronics

- 10.17 Neware

- 10.18 NH Research

- 10.19 Pine Research

- 10.20 Tenmars