PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928891

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928891

Textile Waste Recycling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

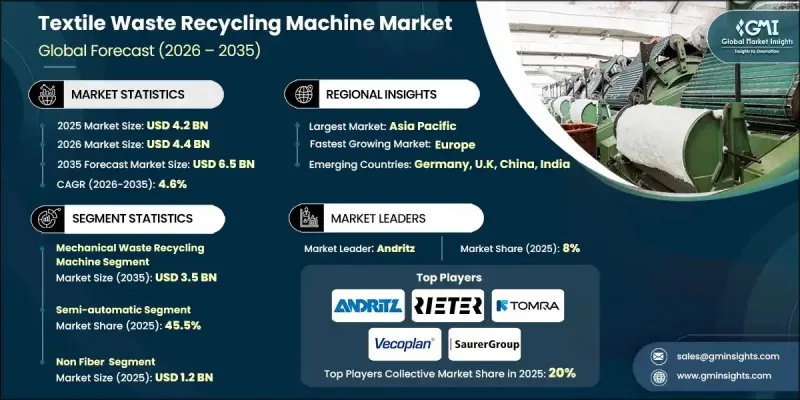

The Global Textile Waste Recycling Machine Market was valued at USD 4.2 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 6.5 billion by 2035.

Growth is driven by rising environmental awareness surrounding textile consumption and disposal, as well as stronger regulatory support for sustainable manufacturing practices. Industries are increasingly focused on minimizing waste and improving material recovery, which has accelerated demand for machinery capable of converting discarded textiles back into usable fiber forms. Public and private sector initiatives aimed at reducing landfill dependency and improving resource efficiency further support market expansion. Manufacturers are responding by advancing recycling technologies that improve throughput, reduce environmental impact, and align with circular economy goals. The industry also benefits from increasing pressure on textile producers to manage post-consumer and pre-consumer waste responsibly. As sustainability becomes a core operational requirement across apparel and industrial textile sectors, investment in advanced recycling machinery continues to rise, supporting long-term market stability and consistent adoption across developed and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.2 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 4.6% |

The mechanical recycling machines segment generated USD 2.3 billion in 2025 and is projected to reach USD 3.5 billion by 2035. This segment remains the backbone of the textile waste recycling machine market due to its cost efficiency and lower energy requirements. Mechanical systems can process a wide range of textile waste streams, making them a preferred choice for manufacturers seeking practical and scalable recycling solutions.

The semi-automatic machines segment accounted for 45.5% share in 2025. This segment leads the market due to its balance of affordability and operational control. Semi-automatic systems allow operators to manage key recycling stages while automating repetitive functions, reducing labor intensity without the high investment associated with fully automated equipment.

United States Textile Waste Recycling Machine Market represented 90.5% share in 2025. Regional growth is supported by increased government focus on textile waste reduction, the development of national recycling strategies, and new legislative measures that encourage improved recycling infrastructure. These efforts are driving higher investment in large-scale textile recycling machinery.

Key companies operating in the Global Textile Waste Recycling Machine Market include Rieter, Andritz, Starlinger, TOMRA Systems, Saurer Group, Vecoplan, Autefa Solutions, Masias Machinery, Loptex, Balkan Textile Machinery, Dell'Orco & Villani, Margasa Projects, Textile Engineering, Multipro, HSN Machinery, and SN Surgicare and Healthcare Science. Companies in the Global Textile Waste Recycling Machine Market focus on strengthening their market position through continuous technology upgrades and sustainability-driven innovation. Manufacturers invest heavily in research and development to enhance machine efficiency, energy performance, and material recovery rates. Strategic collaborations with textile producers and waste management firms help expand customer reach and ensure long-term equipment demand. Firms also prioritize modular machine designs that allow scalability and customization based on processing needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine Type

- 2.2.3 Fabric Type

- 2.2.4 Operation

- 2.2.5 Capacity

- 2.2.6 Application

- 2.2.7 Sourcing Type

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable and eco-friendly materials

- 3.2.1.2 Advancements in recycling technologies

- 3.2.1.3 Government regulations and policies on textile waste

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and machine cost

- 3.2.2.2 High maintenance and operational costs

- 3.2.3 Opportunities

- 3.2.3.1 Sustainability policies & circular economy push

- 3.2.3.2 Integration of IoT & predictive maintenance solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By machine type

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 8445)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter';s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Mechanical Recycling Machines

- 5.3 Chemical Recycling Machines

- 5.4 Thermal Recycling Machines

Chapter 6 Market Estimates & Forecast, By Fabric Type, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cotton

- 6.3 Polyester

- 6.4 Nylon

- 6.5 Wool

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Operation, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Automatic

Chapter 8 Market Estimates & Forecast, By Capacity, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Up to 1,000 kg/h

- 8.3 Up to 2,000 kg/h

- 8.4 Up to 3000 kg/h

- 8.5 Above 3000 kg/h

Chapter 9 Market Estimates & Forecast, By Application, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Fiber-to-fibre Recycling

- 9.3 Non-fibre Applications

- 9.4 Apparel Manufacturing

- 9.5 Home Textiles

- 9.6 Technical Textiles

Chapter 10 Market Estimates & Forecast, By Sourcing Type, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Pre-consumer Waste

- 10.3 Post-consumer Waste

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 France

- 12.3.3 UK

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Andritz

- 13.2 Autefa Solutions

- 13.3 Balkan Textile Machinery

- 13.4 Dell'Orco & Villani

- 13.5 HSN Machinery

- 13.6 Loptex

- 13.7 Margasa Projects and Textile Engineering

- 13.8 Masias Machinery

- 13.9 Multipro

- 13.10 Rieter

- 13.11 SN Surgicare and Healthcare Science

- 13.12 Starlinger

- 13.13 Saurer Group

- 13.14 TOMRA Systems

- 13.15 Vecoplan