PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755190

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755190

Solid-State Electrolytes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

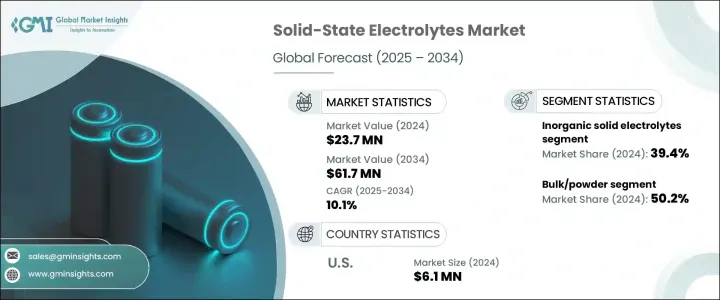

The Global Solid-State Electrolytes Market was valued at USD 23.7 million in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 61.7 million by 2034, driven by rising demand for advanced battery solutions that offer higher energy density, enhanced safety, and improved performance. Solid-state electrolytes replace the conventional liquid or gel-based electrolytes used in lithium-ion batteries, providing a safer and more efficient alternative. These materials address major concerns like flammability and leakage, reducing the risks of thermal runaway and fire incidents. Their ability to support faster charging and extend battery lifespan makes them a crucial innovation for electric vehicles, consumer electronics, and next-generation energy storage systems.

Continuous innovation in materials-particularly ceramic and polymer composite sulfide ion conductors-has pushed the market forward, improving ionic conductivity and material compatibility. As demand for safer, high-capacity batteries rises, especially with broader EV adoption and policy support for clean energy technologies, solid-state batteries are moving from concept to commercialization. Supportive regulations, combined with technological advancement, create a strong foundation for market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.7 Million |

| Forecast Value | $61.7 Million |

| CAGR | 10.1% |

The inorganic solid electrolytes segment accounted for a 39.4% share in 2024. These materials are preferred for their excellent ionic conductivity, thermal resilience, and structural integrity, essential in high-stress environments such as electric vehicle batteries and grid-scale energy storage systems. Their stability and compatibility with lithium metal anodes enhance energy density and extend battery life. Inorganic electrolytes-especially sulfide and oxide-based variants-are also non-combustible, eliminating the fire risks associated with traditional liquid systems. Their integration into current production workflows helps streamline manufacturing and accelerates deployment across energy storage applications.

The bulk or powder form segment in the solid-state electrolytes market held a 50.2% share in 2024. The widespread use of powdered electrolytes stems from their versatility and ease of integration with various electrode materials. This form allows for better structural compactness and active material incorporation, supporting efficient mass production for automotive and stationary applications. Powdered compounds such as lithium thiophosphate and garnet-based materials are increasingly used in pilot projects for next-generation battery systems, due to their outstanding ionic conductivity and mechanical strength, making them an optimal choice for commercial scaling.

U.S. Solid-State Electrolytes Market generated USD 6.1 million in 2024. Federal funding and policy initiatives aimed at domestic battery innovation play a key role in the country's market leadership. Major government programs are accelerating development through grants, tax credits, and research support under legislation such as the Inflation Reduction Act and Battery Manufacturing and Recycling Grant Program. These efforts boost innovation in the solid-state battery segment and encourage U.S.-based companies to scale up operations, reduce import dependence, and create robust local supply chains.

Prominent players in the Solid-State Electrolytes Market include Samsung SDI, Toyota Motor Corporation, LG Chem, QuantumScape, and ProLogium Technology. To expand their market presence, these companies invest in R&D to advance solid electrolyte chemistry and enhance battery performance. Collaborations with automotive OEMs and energy storage firms help secure long-term contracts and early adoption opportunities. Strategic partnerships with research institutions and government entities accelerate prototype development and scaling processes. Firms focus on streamlining manufacturing capabilities and deploying pilot production lines to ensure early-mover advantage in commercial solid-state battery deployment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Impact forces

- 3.4.1 Market drivers

- 3.4.1.1 Growing demand for high-energy density batteries

- 3.4.1.2 increasing focus on battery safety

- 3.4.1.3 Rising adoption of electric vehicles

- 3.4.1.4 Advancements in solid-state electrolyte materials

- 3.4.2 Market restraints

- 3.4.2.1 High manufacturing costs

- 3.4.2.2 technical challenges in scaling production

- 3.4.2.3 Interface stability issues

- 3.4.2.4 Competition from advanced liquid electrolytes

- 3.4.3 Market opportunities

- 3.4.3.1 Development of new solid electrolyte materials

- 3.4.3.2 Emerging applications in wearable devices

- 3.4.3.3 Integration with renewable energy storage

- 3.4.3.4 Government initiatives and funding

- 3.4.4 Market challenges

- 3.4.4.1 Achieving high ionic conductivity at room temperature

- 3.4.4.2 Addressing electrode-electrolyte interface issues

- 3.4.4.3 Lithium dendrite formation and growth

- 3.4.4.4 Mass production and cost reduction

- 3.4.1 Market drivers

- 3.5 Regulatory framework and government initiatives

- 3.5.1 Safety regulations for battery materials

- 3.5.2 Environmental regulations

- 3.5.3 Government funding and research initiatives

- 3.5.4 Regional regulatory variations

- 3.5.5 Future regulatory outlook

- 3.6 Growth potential analysis

- 3.7 Pricing analysis (USD/Tons) 2021-2034

- 3.8 Manufacturing and production processes

- 3.8.1 Solid-state synthesis

- 3.8.2 Sol-gel processing

- 3.8.3 Mechanochemical synthesis

- 3.8.4 Thin film deposition techniques

- 3.8.5 Polymer processing methods

- 3.8.6 Scalable manufacturing approaches

- 3.9 Material characterization techniques

- 3.9.1 X-ray diffraction analysis

- 3.9.2 Impedance spectroscopy

- 3.9.3 Scanning electron microscopy

- 3.9.4 Nuclear magnetic resonance

- 3.9.5 Thermal analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Patent analysis & innovation assessment

- 4.8 Market entry strategies for new players

- 4.9 Distribution network analysis

Chapter 5 Market Estimates and Forecast, By Material, 2021–2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Inorganic solid electrolytes

- 5.2.1 Oxide-based electrolytes

- 5.2.1.1 LISICON-type

- 5.2.1.2 NASICON- type

- 5.2.1.3 Perovskite- type

- 5.2.1.4 Garnet- type (LLZO)

- 5.2.1.5 Others

- 5.2.2 Sulfide- based electrolytes

- 5.2.2.1 Thio-LISICON

- 5.2.2.2 Argyrodite- type

- 5.2.2.3 Li2S-P2S5 glass-ceramics

- 5.2.2.4 Others

- 5.2.3 Halide- based electrolytes

- 5.2.4 Others

- 5.2.1 Oxide-based electrolytes

- 5.3 Polymer-based solid electrolytes

- 5.3.1 Polyethylene oxide (PEO)-based

- 5.3.2 Polyvinylidene fluoride (PVDF)- based

- 5.3.3 Polycarbonate- based

- 5.3.4 Others

- 5.4 Composite solid electrolytes

- 5.4.1 Polymer-ceramic composites

- 5.4.2 Polymer-inorganic salt composites

- 5.4.3 Ceramic-ceramic composites

- 5.4.4 Others

- 5.5 Hybrid solid electrolytes

Chapter 6 Market Estimates and Forecast, By Form, 2021–2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bulk/powder

- 6.3 Thin films

- 6.4 Sheets/membranes

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Electric vehicles

- 7.2.1 Passenger vehicles

- 7.2.2 Commercial vehicles

- 7.2.3 Two-wheelers

- 7.3 Consumer electronics

- 7.3.1 Smartphones and tablets

- 7.3.2 Laptops and computers

- 7.3.3 Wearable devices

- 7.3.4 Others

- 7.4 Energy storage systems

- 7.4.1 Residential

- 7.4.2 Commercial

- 7.4.3 Utility-Scale

- 7.5 Medical devices

- 7.5.1 Implantable devices

- 7.5.2 Portable medical equipment

- 7.5.3 Others

- 7.6 Aerospace and defense

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021–2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ampcera

- 9.2 Cymbet Corporation

- 9.3 Idemitsu Kosan

- 9.4 Ilika

- 9.5 ION Storage Systems

- 9.6 LG Energy

- 9.7 Murata Manufacturing

- 9.8 NEI Corporation

- 9.9 Ohara

- 9.10 ProLogium Technology

- 9.11 QuantumScape

- 9.12 Samsung SDI

- 9.13 Solid Power

- 9.14 TDK Corporation

- 9.15 Toyota Motor Corporation