PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755220

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755220

Non-alcoholic Steatohepatitis Biomarkers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

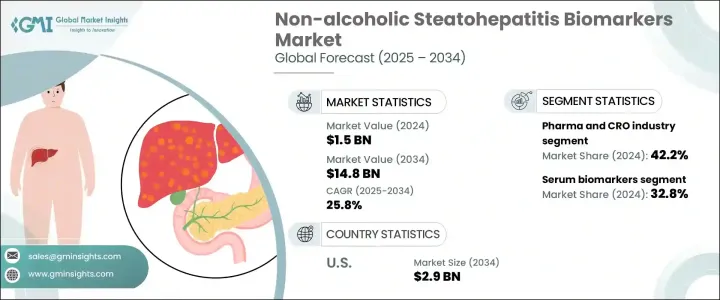

The Global Non-alcoholic Steatohepatitis Biomarkers Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 25.8% to reach USD 14.8 billion by 2034. NASH biomarkers are biological indicators that help evaluate the presence and progression of NASH, a severe liver condition that evolves from non-alcoholic fatty liver disease (NAFLD). As healthcare providers increasingly prioritize early detection and targeted interventions, the demand for such biomarkers has grown considerably. The push for proactive liver disease screening is further reinforced by evolving clinical recommendations targeting at-risk populations. This includes individuals with metabolic disorders such as obesity and type 2 diabetes, who are more likely to develop NASH.

As awareness of liver-related complications continues, healthcare systems are integrating biomarker-based diagnostic strategies to improve patient outcomes. These tools offer the potential to monitor disease progression, assess treatment efficacy, and identify patients most likely to benefit from emerging therapies. Their growing role in personalized medicine drives a significant shift in how liver diseases are diagnosed and managed. Increasing preference for minimally invasive methods and growing adoption of precision diagnostics in clinical research have further cemented the importance of NASH biomarkers in modern healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $14.8 Billion |

| CAGR | 25.8% |

The market is segmented by biomarker type into oxidative stress biomarkers, hepatic fibrosis biomarkers, serum biomarkers, apoptosis biomarkers, and others. Among these, serum biomarkers accounted for the largest share of revenue, contributing 32.8% in 2024. This segment's dominance is primarily due to the convenience of blood sampling, non-invasive procedures, and their frequent use in diagnosis, monitoring, and prognosis. Serum-based biomarkers are recognized for offering vital insights into liver health by detecting hepatocyte injury and other cellular responses linked to disease progression. Their application across both clinical settings and research environments adds to their widespread utility and market traction.

In terms of end use, the market is divided into the pharmaceutical and contract research organization (CRO) industry, hospitals, diagnostic laboratories, and academic research institutes. The pharmaceutical and CRO industry held the leading position in 2024, generating 42.2% of the overall revenue. This dominance reflects the industry's strong reliance on validated biomarkers for drug discovery, clinical trial stratification, and treatment monitoring. As drug developers seek to accelerate timelines and increase the precision of their therapeutic candidates, biomarkers have become essential in assessing efficacy and safety throughout the development cycle. CROs, on the other hand, support these efforts by offering technical and regulatory expertise for biomarker validation and testing. Their involvement has streamlined the transition from biomarker discovery to clinical application, bolstering the development of targeted treatments and contributing to faster market growth.

Geographically, the United States has emerged as a key growth engine within the NASH biomarkers space. The US market alone was valued at USD 308.8 million in 2024 and is anticipated to surge to approximately USD 2.9 billion by 2034. Several factors contribute to this significant trajectory, including a rising burden of liver-related conditions and a robust healthcare infrastructure capable of supporting advanced diagnostic technologies. The growing aging population is also a major driver, as older individuals face a higher risk of chronic liver diseases and require timely diagnostic interventions. Increasing healthcare investments in diagnostics, coupled with a focus on non-invasive solutions, are further driving demand for biomarker technologies. The need for accurate and early detection tools has never been greater, and the US is at the forefront of meeting this demand with rapid technological advancements and integration of next-generation testing protocols.

The competitive landscape of the NASH biomarkers market remains moderately fragmented. A mix of specialized biomarker firms and diagnostic solution providers is actively shaping the space, with leading players collectively capturing around 40% of the total market share. These companies are advancing the field by incorporating novel technologies and forming partnerships aimed at enhancing precision medicine capabilities. Innovations such as multiplexed platforms and AI-integrated analytics are transforming how biomarker data is collected, interpreted, and applied in both clinical and research settings. As the market continues to evolve, technological upgrades and cross-industry collaborations are expected to accelerate the adoption of more efficient, scalable, and patient-centered biomarker solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of non-alcoholic steatohepatitis (NASH)

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Increased awareness and screening initiatives for liver diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complexity of biomarker validation

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Serum biomarkers

- 5.3 Hepatic fibrosis biomarkers

- 5.4 Apoptosis biomarkers

- 5.5 Oxidative stress biomarkers

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pharma and CRO industry

- 6.3 Hospitals

- 6.4 Diagnostic labs

- 6.5 Academic research institutes

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BioPredictive

- 8.2 GENFIT

- 8.3 Glycotest

- 8.4 Labcorp

- 8.5 Nordic Bioscience

- 8.6 Prometheus Laboratories

- 8.7 Quest Diagnostics

- 8.8 Siemens Healthineers

- 8.9 SomaLogic

- 8.10 Zora Biosciences