PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755223

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755223

Vehicle Control Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

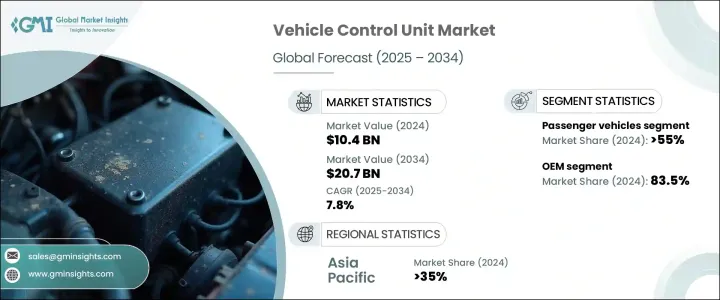

The Global Vehicle Control Unit Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 20.7 billion by 2034. The market growth is driven by the rising adoption of electric vehicles (EVs), which require VCUs to efficiently manage complex functions such as battery systems, electric motors, regenerative braking, and charging operations. Unlike traditional internal combustion vehicles, EVs rely on multiple interconnected systems that need real-time coordination. VCUs are central to this process, improving energy management, safety, and vehicle intelligence. As sustainability regulations tighten and incentives increase, automakers are accelerating EV production, which in turn is increasing the need for more advanced and scalable VCU solutions globally.

The market is also expanding due to the shift towards software-defined vehicle architectures. Automakers are integrating VCUs to enable over-the-air (OTA) updates, real-time diagnostics, and centralized vehicle monitoring. These systems allow for modular feature upgrades and adaptive performance management. Additionally, rising demand for ADAS and autonomous technologies in both commercial and passenger vehicles is further boosting the need for high-performance VCUs. By processing input from a wide range of sensors, VCUs facilitate intelligent driving functions such as lane assistance, emergency braking, and adaptive cruise control-making them vital in modern vehicle designs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $20.7 Billion |

| CAGR | 7.8% |

In 2024, the passenger vehicle segment generated USD 5 billion, claiming 55% share especially in leading markets such as the United States, China, and Europe. As newer vehicles roll off assembly lines with increasingly sophisticated digital features, the demand for integrated VCUs continues to surge. Passenger cars are leading the transition to electric and hybrid drivetrains, which require comprehensive coordination across multiple digital subsystems. VCUs make this integration seamless, ensuring optimal vehicle performance while supporting infotainment, safety, and driver-assist systems.

The OEM segment led the market in 2024, capturing 83.5% share. Vehicle control units are embedded into vehicle systems during the manufacturing process, making OEMs the primary integrators. These units must be customized to suit the architecture of different vehicle platforms and brands. Collaborations between OEMs and Tier 1 suppliers ensure that VCUs are developed with regulatory compliance and integration efficiency in mind. With a growing preference for centralized computing and software-first vehicle design, OEMs are deploying VCUs to support advanced functionalities like OTA capabilities, cloud-based services, and real-time system upgrades, which further expands their market footprint.

Asia Pacific Vehicle Control Unit Market held 35% share in 2024. As one of the top automotive manufacturing hubs globally, China benefits from strong domestic production capabilities, low-cost manufacturing, and proactive government support. Incentive programs for electric and intelligent vehicles, as well as advancements in homegrown VCU technologies, have positioned China at the forefront of VCU adoption. The country's push for smart mobility and energy-efficient vehicles is accelerating the rollout of VCUs across new vehicle platforms.

Key players in the Global Vehicle Control Unit Market include ASI Robots, Continental AG, Robert Bosch, Infineon, Denso, ZF Friedrichshafen AG, STMicroelectronics, NXP Semiconductors, Dorleco, and Delphi Technologies. These companies are leveraging a range of strategies to secure competitive positioning in the market. Core approaches include the development of modular VCU platforms that support vehicle electrification and ADAS, as well as partnerships with automakers for customized integration. Major players are investing in AI-driven VCU solutions, cloud connectivity, and OTA update frameworks. Additionally, many are expanding their manufacturing capabilities in Asia and Europe to meet rising global demand while complying with evolving automotive safety and software regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Propulsion

- 2.2.3 Vehicle

- 2.2.4 Functionality

- 2.2.5 Capacity

- 2.2.6 Component

- 2.2.7 Distribution Channel

- 2.2.8 Communication Type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of electric vehicles

- 3.2.1.2 Rise of advanced driver assistance systems and automation

- 3.2.1.3 Connectivity and infotainment demand

- 3.2.1.4 Stringent emission and safety regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High development and implementation costs

- 3.2.2.2 Growing cybersecurity risks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 ICE

- 5.3 Electric Vehicles (EVs)

- 5.4 Fuel Cell Electric Vehicles (FCEVs)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger Vehicles

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial Vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Off-highway Vehicles

Chapter 7 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Powertrain control

- 7.3 Battery management system (BMS) integration

- 7.4 Advanced driver assistance systems (ADAS)

- 7.5 Infotainment and connectivity

- 7.6 Autonomous driving systems

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 16-bit

- 8.3 32-bit

- 8.4 64-bit

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hardware

- 9.2.1 Microcontrollers/microprocessors

- 9.2.2 Memory units

- 9.2.3 Input/output interfaces

- 9.2.4 Power management components

- 9.2.5 Others

- 9.3 Software

- 9.3.1 Operating systems

- 9.3.2 Control algorithms

- 9.3.3 Diagnostic systems

- 9.3.4 User interfaces

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Communication Type, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 CAN (Controller Area Network)

- 11.3 LIN (Local Interconnect Network)

- 11.4 FlexRay (Flexible Data-Rate Network)

- 11.5 Ethernet

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Southeast Asia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 ASI Robots

- 13.2 Continental

- 13.3 Delphi Technologies

- 13.4 Denso

- 13.5 Dorleco

- 13.6 Embitel

- 13.7 Hitachi Astemo

- 13.8 Huawei Technologies

- 13.9 Infineon

- 13.10 Nidec Corporation

- 13.11 NXP Semiconductors

- 13.12 Pues Corporation

- 13.13 Renesas Electronics Corporation

- 13.14 Robert Bosch

- 13.15 Samino Inc

- 13.16 STMicroelectronics

- 13.17 Texas Instruments

- 13.18 Valeo

- 13.19 Vitesco Technologies

- 13.20 ZF Friedrichshafen