PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755266

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755266

Railway Sliding Bearing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

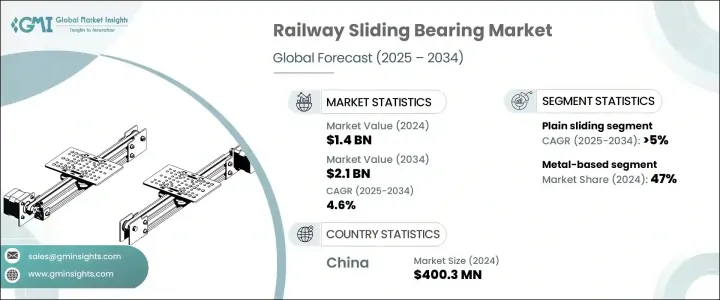

The Global Railway Sliding Bearing Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 2.1 billion by 2034. This growth is largely driven by expanding rail infrastructure projects worldwide and the increasing popularity of high-speed rail systems. As the transportation sector shifts toward faster, more efficient, and more sustainable solutions, sliding bearings are becoming essential components in modern rail networks. These bearings are no longer regarded as basic mechanical parts-they now play a critical role in ensuring performance, safety, and reliability.

With countries investing heavily in freight corridors, metro rail, and high-speed passenger lines, there is a growing reliance on high-grade sliding bearings designed to withstand intense operational conditions. These include heavy loads, extreme speeds, and fluctuating environmental stresses. Sliding bearings are evolving alongside the industry, incorporating new materials, digital diagnostics, and structural advancements that align with broader goals of improving transportation efficiency and infrastructure resilience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 4.6% |

The demand for high-performance bearing systems is rising due to the need for minimal maintenance, superior axle efficiency, and integration with advanced bogie platforms. Manufacturers are responding by developing innovative bearing solutions that utilize composite materials, incorporate smart monitoring features, and enhance long-term reliability. These changes are transforming the sliding bearing segment into a technology-forward market segment, supporting the evolution of intelligent and future-ready railway systems. As global rail strategies increasingly focus on speed, sustainability, and durability, bearing providers are adapting their offerings to meet these expectations, reinforcing their value in the modern rail ecosystem.

In 2024, the plain sliding bearings segment held a 27% share and is projected to grow at a CAGR of 5% throughout 2034. These bearings serve critical roles in freight and passenger rail operations, offering essential support for handling axial and radial loads, reducing mechanical friction, and facilitating smooth component movement. With their reliable structure, cost-effective manufacturing, and load-handling capability, plain sliding bearings remain a favored option for use in bogies, brake assemblies, and suspension mechanisms across various rail vehicle classes. Their efficiency contributes directly to improved train stability and reduced downtime, making them indispensable in the rail industry.

Metal-based sliding bearings represented 47% share in 2024 and are also expected to grow at a CAGR of 5% from 2025 - 2034. These bearings are known for their exceptional mechanical durability, wear resistance, and heat tolerance, making them ideal for rigorous rail environments. Metal-based options are widely implemented in applications ranging from axle supports to suspension joints and brake systems. Their reliable performance under high-speed and heavy-load conditions continues to drive their widespread use, particularly in markets where infrastructure upgrades are accelerating. Regions investing in large-scale freight and high-speed networks are particularly focused on these bearings for their extended lifespan and robust structural benefits.

China Railway Sliding Bearing Market held a 63.3% share and generated USD 400.3 million in 2024. The country's dominance stems from its expansive rail development strategy, which encompasses freight, metro, and high-speed train operations. The scale of its rolling stock and continued infrastructure investments have driven consistent demand for advanced sliding bearings. Local bearing manufacturers are enhancing their capabilities to produce high-performance, self-lubricating, and corrosion-resistant components that align with both domestic and global project requirements. Using sophisticated materials, tight-tolerance engineering, and maintenance-friendly features, China continues to set the pace in this segment of the industry.

Key industry participants in the Global Railway Sliding Bearing Market include JTEKT, The Timken Company, MinebeaMitsumi, NTN, NSK, GGB, ZKL Group, Schaeffler Group, Liebherr Group, and AB SKF. To strengthen their market position in the railway sliding bearing sector, companies are focusing on innovation, material advancement, and global expansion. One major strategy is the development of high-performance bearings using composite and self-lubricating materials that reduce maintenance and improve durability under extreme operating conditions. Firms are also investing in precision engineering to enhance load-bearing capacity and system compatibility with evolving bogie technologies. Collaborations with rail OEMs and infrastructure providers allow companies to customize solutions for specific rolling stock requirements. Additionally, manufacturers are expanding their footprint in emerging markets with strong rail development agendas.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Train

- 2.2.5 Sales channel

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of rail infrastructure projects

- 3.2.1.2 Rising demand for high-speed rail

- 3.2.1.3 Increasing freight transportation

- 3.2.1.4 Technological advancements in bearing materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of advanced bearings

- 3.2.2.2 Stringent quality standards & certifications

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of urban mobility systems

- 3.2.3.2 Adoption of smart bearings for predictive maintenance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.10 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Use cases

- 3.15 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Plain sliding

- 5.3 Spherical sliding

- 5.4 Cylindrical sliding

- 5.5 Flanged sliding

- 5.6 Thrust sliding

- 5.7 Custom/Composite

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Metal-based

- 6.3 Polymer-based

- 6.4 Composite bearings

- 6.5 Ceramic-based

Chapter 7 Market Estimates & Forecast, By Train, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Freight trains

- 7.3 Passenger trains

- 7.4 High-Speed trains

- 7.5 Light Rail/Trams

- 7.6 Metro/Subway systems

- 7.7 Monorails

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors/Dealers

- 8.4 Online platforms

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AB SKF

- 11.2 ABC Bearings

- 11.3 Beijing Bearing Manufacturing

- 11.4 Boca Bearings

- 11.5 China Railway Rolling Stock Corporation (CRRC)

- 11.6 Emerson Bearing Company

- 11.7 FAG Bearings

- 11.8 GGB

- 11.9 JTEKT Corporation

- 11.10 Liebherr Group

- 11.11 MinebeaMitsumi

- 11.12 NSK

- 11.13 NTN Industrial Bearings

- 11.14 Rexnord Corporation

- 11.15 RHP Bearings

- 11.16 Schaeffler Group

- 11.17 SKF USA

- 11.18 Taikisha

- 11.19 Timken Aerospace Bearings

- 11.20 ZKL Group