PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755269

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755269

Chemical Industrial Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

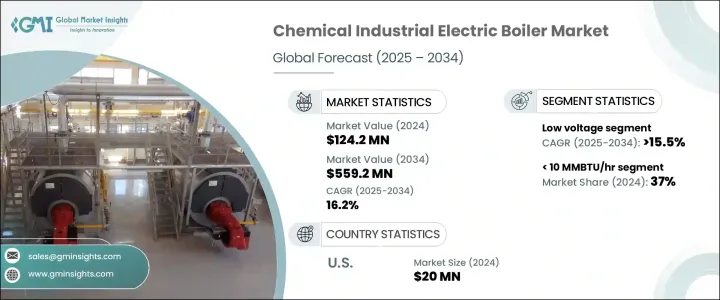

The Global Chemical Industrial Electric Boiler Market was valued at USD 124.2 million in 2024 and is estimated to grow at a CAGR of 16.2% to reach USD 559.2 million by 2034, fueled by the global shift toward clean energy and the introduction of supportive government programs aimed at promoting energy-efficient heating systems. As chemical plants increasingly adopt sustainable practices, electric boilers have emerged as a critical solution for reliable and precise heating.

Technological progress in electric boiler systems-integrated with IoT-based controls and automation-continues to drive adoption. These innovations help reduce operational downtimes through real-time monitoring and predictive maintenance, while also enhancing energy efficiency. Electric boilers can now be tailored to fit a wide range of heating capacities with minimal disruption to existing plant infrastructure. Their precision in maintaining consistent temperatures makes them ideal for chemical manufacturing processes that require tightly regulated thermal conditions. Compact boiler designs are also gaining momentum as manufacturers respond to spatial constraints in chemical facilities. These space-saving configurations allow seamless integration into older systems, further supported by modernization initiatives to replace outdated boiler units. This evolution reinforces the industry's transition toward cleaner, smarter heating technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $124.2 Million |

| Forecast Value | $559.2 Million |

| CAGR | 16.2% |

Low-voltage electric boilers in the chemical industry are projected to grow at a CAGR of 15.5% through 2034, driven by increasing regulatory pressure to reduce fossil fuel dependence, along with favorable tax incentives and financial support. These boilers are gaining traction due to their low-maintenance requirements and space-efficient design, making them ideal for industrial environments where floor space is limited. Their ability to provide a reliable, efficient alternative to traditional fuel-based systems appeal to industries looking to reduce operational costs and improve sustainability.

The 10-50 MMBTU/hr segment is expected to see a CAGR of 15% through 2034, as these units offer a perfect balance between output and efficiency. This size range is suited to medium-sized chemical operations where precise control and space efficiency are crucial for day-to-day functioning.

North America Chemical Industrial Electric Boiler Market is anticipated to grow at a 20.5% CAGR by 2034. A combination of increasing manufacturing activity, technological advancements, and strategic partnerships between private companies and state-level organizations to modernize industrial infrastructure is driving the growth of this market. These partnerships facilitate the adoption of cleaner, more efficient electric boilers to meet environmental and operational goals.

Key players contributing to the development and growth of the chemical industrial electric boiler industry include Bosch Industriekessel, Thermona, PARAT Halvorsen AS, ALFA LAVAL, Precision Boilers, Cleaver-Brooks, Chromalox, Thermodyne Boilers, Ecotherm Austria, Reimers Electra Steam, Thermon, Babcock Wanson, Klopper-Therm, LACAZE ENERGIES, Ross Boilers, Acme Engineering Products, Cerney, FERROLI, Danstoker A/S, and Chromalox. Industry leaders in the chemical industrial electric boiler market are investing significantly in R&D to enhance the energy efficiency, control precision, and adaptability of their boiler systems. Many are introducing compact models that integrate with existing infrastructure, enabling faster installations and reducing retrofitting costs. Several companies prioritize IoT and automation capabilities in their product offerings to meet the demand for predictive maintenance and real-time monitoring. Additionally, strategic collaborations with regional governments and industrial clients pursue to expand reach and gain access to incentive-backed infrastructure projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low voltage

- 5.3 Medium voltage

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 < 10 MMBTU/hr

- 6.3 10 - 50 MMBTU/hr

- 6.4 50 - 100 MMBTU/hr

- 6.5 100 - 250 MMBTU/hr

- 6.6 > 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Hot water

- 7.3 Steam

Chapter 8 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Dealer

- 8.4 Retail

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Germany

- 9.3.7 Russia

- 9.3.8 Austria

- 9.3.9 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Philippines

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Egypt

- 9.5.5 Nigeria

- 9.5.6 Kenya

- 9.5.7 Morocco

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Colombia

- 9.6.4 Chile

Chapter 10 Company Profiles

- 10.1 ALFA LAVAL

- 10.2 Acme Engineering Products

- 10.3 ACV

- 10.4 Babcock Wanson

- 10.5 Bosch Industriekessel

- 10.6 Cerney

- 10.7 Chromalox

- 10.8 Cleaver-Brooks

- 10.9 Danstoker A/S

- 10.10 Ecotherm Austria

- 10.11 FERROLI

- 10.12 Klopper-Therm

- 10.13 LACAZE ENERGIES

- 10.14 PARAT Halvorsen AS

- 10.15 Precision Boilers

- 10.16 Reimers Electra Steam

- 10.17 Ross Boilers

- 10.18 Thermodyne Boilers

- 10.19 Thermon

- 10.20 Thermona

- 10.21 Vapor Power