PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755270

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755270

Smart Hearing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

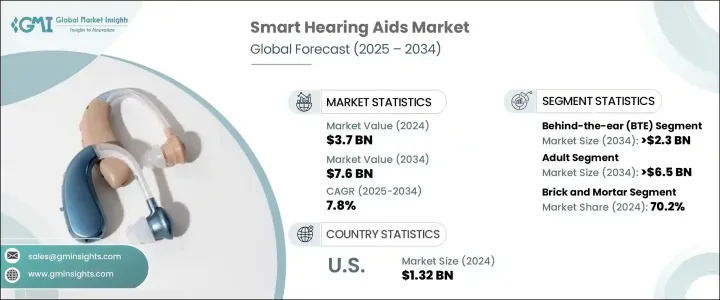

The Global Smart Hearing Aids Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 7.6 billion by 2034. The growth is driven by rapid innovation in hearing technologies, rising awareness about hearing health, early diagnosis rates, a growing elderly population, and increasing consumer interest in customizable, user-friendly solutions. Today's smart hearing aids are powered by artificial intelligence and machine learning, allowing devices to adapt to different sound environments. This ensures better clarity and improved listening experience. Bluetooth connectivity enables seamless integration with smartphones, TVs, and other digital devices, transforming hearing aids into versatile, multi-functional tools that extend far beyond traditional amplification.

Smart hearing aids are advanced electronic devices that enhance hearing by incorporating AI, Bluetooth, and app-based control features. These devices can stream audio directly from compatible electronics and adjust sound settings according to ambient noise. In some models, users benefit from features like remote programming, fitness tracking, and environmental adaptation. Market growth is being accelerated by innovation in digital signal processing, strong demand for personalized solutions, and increasing attention toward accessible and affordable hearing technologies. With Bluetooth compatibility, these devices allow users to experience high-quality streaming and communication on the go.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 7.8% |

The behind-the-ear (BTE) category is expected to grow at a CAGR of 6.8%, to reach USD 2.3 billion by 2034. BTE hearing aids are widely chosen due to their ability to handle various degrees of hearing loss, ranging from mild to profound. Their larger form factor supports integrating advanced features like directional microphones, AI-driven sound optimization, noise reduction, and wireless connectivity. This design also enables easier use and control, particularly for elderly users or individuals with dexterity limitations. BTE devices deliver comfort over long periods and offer durability and low maintenance, making them ideal for extended wear.

The brick-and-mortar segment captured a 70.2% share in 2024. Physical audiology clinics and hearing centers remain vital in the purchase journey for smart hearing aids, primarily because in-person diagnosis and custom fitting ensure optimal device performance. Services such as audiograms and real-ear measurements, often delivered by certified professionals, help tailor the product to a user's hearing profile. Many consumers prefer hands-on care and guidance when dealing with personal medical technology. Older adults tend to rely on professional advice before making high-value purchases. Personalized service, post-sale support, and face-to-face consultations continue to drive growth in physical retail spaces.

United States Smart Hearing Aids Market generated USD 1.32 billion in 2024. American consumers continue to show high receptivity toward new technology, especially hearing aids that offer Bluetooth streaming, fitness tracking, adaptive noise filtering, and app integration. The widespread adoption of smartphones further supports this trend. The introduction of over-the-counter (OTC) hearing aids has also increased access to hearing care products for individuals with mild to moderate hearing loss. This regulatory shift promotes innovation and opens opportunities for tech companies and retail chains such as Walgreens and Best Buy to enter space, reshaping the competitive landscape.

Key players in the Smart Hearing Aids Market include Sonova, EARGO, Audina Hearing Instruments, Starkey, WS Audiology, Clariti Hearing, GN Store Nord, RION, Siemens Hearing Aids, Audio Service, SeboTek Hearing Systems, Nano Hearing Aids, Demant, Zounds Hearing, and Ear Technology. These companies are focused on long-term strategies to enhance their presence and maintain leadership in a highly competitive market. Strategic priorities include expanding R&D to improve product intelligence and connectivity, investing in miniaturization without sacrificing power, and entering emerging markets through partnerships with local distributors and clinics. Many players are also leveraging direct-to-consumer channels, offering remote hearing tests, and adopting AI-based tools to drive user engagement and satisfaction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of hearing loss

- 3.2.1.2 Growing aging population

- 3.2.1.3 Rising adoption of digital and connected health solutions

- 3.2.1.4 Surge in consumer demand for discreet and multifunctional devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of smart hearing aids

- 3.2.2.2 Limited awareness in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Behind-the-ear (BTE)

- 5.3 Receiver in the ear/receiver in canal (RITE/RIC)

- 5.4 Completely-in-the-canal/invisible-in-canal (CIC/IIC)

- 5.5 In-the-ear (ITE)

- 5.6 In-the-canal (ITC)

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 RION

- 9.2 Audina Hearing Instruments

- 9.3 Audio Service

- 9.4 Clariti Hearing

- 9.5 Demant

- 9.6 Ear Technology

- 9.7 EARGO

- 9.8 GN Store Nord

- 9.9 Nano Hearing Aids

- 9.10 SeboTek Hearing Systems

- 9.11 Siemens Hearing Aids

- 9.12 sonova

- 9.13 Starkey

- 9.14 WS Audiology

- 9.15 Zounds Hearing