PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755279

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755279

E-Brokerage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

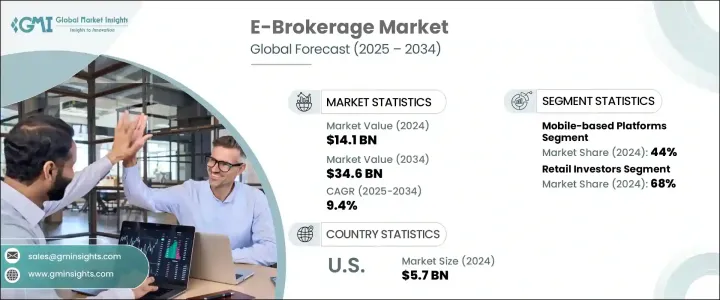

The Global E-Brokerage Market was valued at USD 14.1 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 34.6 billion by 2034. The growth is driven by the rising involvement of retail investors, growing acceptance of low-cost investment models, and significant advancements in digital trading platforms. Broader internet access and increased smartphone adoption are expanding the reach of digital trading, especially in developing economies. With greater mobile connectivity, more individuals are entering capital markets through intuitive and accessible online platforms. This digital shift is fueling a move away from traditional brokerages and toward streamlined, cost-effective alternatives. The appeal of self-managed investing and automated financial services is also driving market acceleration, as investors look for more control and customization in managing their portfolios.

The adoption of commission-free trading continues to reshape the e-brokerage space, eliminating traditional cost barriers and attracting a new generation of investors focused on affordability and ease of use. By removing fees that once discouraged frequent or small-scale trading, these platforms have democratized access to financial markets. This shift has opened the doors to younger, first-time investors who prioritize low-cost, tech-driven solutions and prefer managing their portfolios independently. Commission-free models also encourage higher trading activity and user engagement, which in turn generate revenue through alternative channels such as payment for order flow, margin lending, premium account tiers, and subscription-based financial tools.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.1 Billion |

| Forecast Value | $34.6 Billion |

| CAGR | 9.4% |

Mobile trading segment held 44% share in 2024 and projected to grow at a CAGR of 9.8% through 2034. These platforms are preferred for their instant accessibility, real-time insights, and seamless transaction capabilities. Enhanced features like voice activation, biometric login, integrated analytics, and user-friendly dashboards further enhance their appeal. The inclusion of educational tools, gamified experiences, and social trading functions is also contributing to increased engagement among users, particularly younger investors.

Retail investors segment held 68% share in 2024 and is projected to maintain a CAGR of 9.8% through 2034. This dominance stems from the broader democratization of investment access, enabled by easy-to-use mobile applications and the removal of traditional entry barriers. The availability of fractional shares, extended trading hours, and digital assets such as ETFs and cryptocurrencies has made it easier for individuals with limited capital to invest actively. Rising awareness of financial planning and investment opportunities, supported by digital communities and real-time learning resources, continues to drive strong growth in this segment.

North America E-Brokerage Market held 92% share and generated USD 5.7 billion in 2024. The country's leadership in the space is bolstered by high internet usage, widespread adoption of mobile finance apps, and a consumer base well-versed in digital investing. A well-established regulatory structure, combined with advanced tools for market analysis and data tracking, supports continuous platform innovation. The expanding interest in assets like cryptocurrencies and options, along with robust consolidation activity, is helping platforms evolve, differentiate, and scale within an increasingly competitive environment.

Leading names in the E-Brokerage Industry include SoFi Invest, Interactive Brokers, Fidelity Investments, Robinhood, Ally Invest, Vanguard, Upstox, Groww, Charles Schwab Corporation, and Merrill Edge (Bank of America). To strengthen their market foothold, major e-brokerage players are focusing on innovation, strategic acquisitions, and user-centric enhancements. Many firms are expanding their service offerings by integrating features such as robo-advisory tools, AI-driven analytics, and real-time market alerts. Platforms are also investing in global expansion strategies, targeting emerging markets where internet and smartphone use are rapidly rising. Strategic alliances with fintech firms, simplified onboarding processes, and the rollout of educational content for new investors are also critical approaches.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type of service

- 2.2.3 Platform

- 2.2.4 Investor

- 2.2.5 Asset class

- 2.2.6 Ownership

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased internet and smartphone penetration

- 3.2.1.2 Integration of cryptocurrencies and digital assets

- 3.2.1.3 Growing demand for DIY investing and robo-advisory

- 3.2.1.4 Shift toward commission-free trading

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cybersecurity and data privacy concerns

- 3.2.2.2 High competition and margin pressure

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and analytics

- 3.2.3.2 Rise of Gen Z and millennial investors

- 3.2.3.3 Expansion into crypto and alternative assets

- 3.2.3.4 API and embedded brokerage services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases

- 3.11 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type of Service, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Full-service brokerage

- 5.3 Discount brokerage

- 5.4 Robo-advisors

Chapter 6 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Web-based platforms

- 6.3 Mobile-based platforms

- 6.4 Hybrid platforms

Chapter 7 Market Estimates & Forecast, By Investor, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Retail investors

- 7.3 Institutional investors

Chapter 8 Market Estimates & Forecast, By Asset Class, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Equity trading

- 8.3 Derivatives trading

- 8.4 Forex trading

- 8.5 Mutual funds and ETFs

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Ownership, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Privately held

- 9.3 Publicly held

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ally Invest

- 11.2 Charles Schwab

- 11.3 E*TRADE (Morgan Stanley)

- 11.4 eToro

- 11.5 Exness

- 11.6 Fidelity Investments

- 11.7 Firstrade

- 11.8 Futu Holdings (Moomoo)

- 11.9 Groww

- 11.10 Interactive Brokers

- 11.11 Merrill Edge (Bank of America)

- 11.12 Robinhood

- 11.13 SoFi Invest

- 11.14 Tastytrade

- 11.15 Tiger Brokers

- 11.16 TradeStation

- 11.17 Upstox

- 11.18 Vanguard

- 11.19 Webull

- 11.20 Zerodha