PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911745

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911745

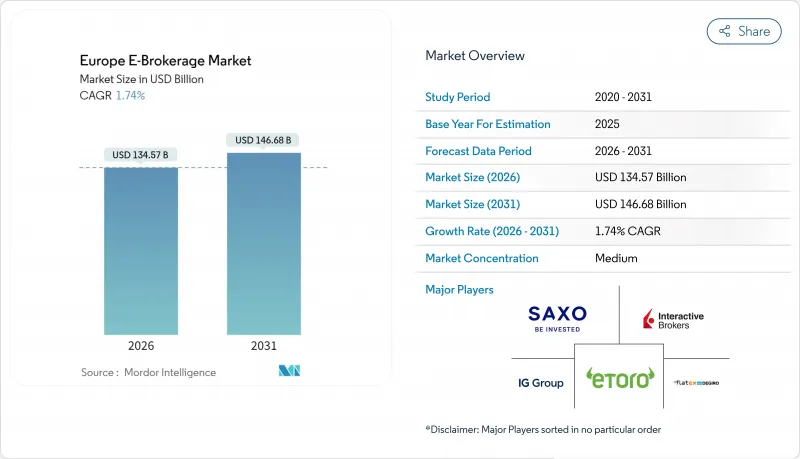

Europe E-Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe e-brokerage market was valued at USD 132.27 billion in 2025 and estimated to grow from USD 134.57 billion in 2026 to reach USD 146.68 billion by 2031, at a CAGR of 1.74% during the forecast period (2026-2031).

Measured expansion signals a maturing competitive arena in which regulatory compliance costs and mounting price pressure reshape revenue models, while technology innovations such as embedded finance and Banking-as-a-Service unlock fresh income streams. MiFID II amendments, DORA enforcement from January 2025, and the Payment-for-Order-Flow ban due July 2026 together redefine operating rules, elevating transparency and resilience expectations. Discount platforms have forced fee compression that reverberates throughout the European e-brokerage market, and major players now concentrate on scale, profitability, and superior digital experience to defend margins. Cross-border activity intensifies as consolidated tape initiatives harmonize execution data, bolstering liquidity and encouraging investors to diversify across European venues.

Europe E-Brokerage Market Trends and Insights

PSD-2 Driven Account Aggregation Adoption

Second-generation payment services rules let investors consolidate multi-bank portfolios on one screen, widening access to integrated wealth dashboards that combine savings, credit, and trading accounts . Licensed third-party providers now exceed 3,000 across the EU, powering neobanks that fold brokerage into daily banking flows. Dutch and German consumers exhibit the strongest uptake, and aggregated data enables brokers to offer personalized tax and portfolio insights formerly reserved for private-bank clients. Lower churn and deeper engagement translate to 25% lower acquisition costs for platforms with mature aggregation engines. PSD-2 security standards also form a regulatory moat that limits copy-cat entrants lacking robust data-protection frameworks.

MiFID II Fueled Demand for Commission Transparency

Revised MiFIR rules from 2024 force granular cost disclosure and dismantle bundled fee models, pushing investors toward platforms with clear, low-charge structures. Discount brokers use transparent pricing to capture share from legacy full-service houses still adjusting to unbundled research and dual UK-EU compliance frameworks. French retail clients reacted quickly; low-fee brokers gained 15% share in 2024 as investors shifted away from bank-owned networks. Independent research providers flourish under unbundling, while large banks lose the soft advantage once held by proprietary analysis. Compliance outlays that approach EUR 50 million a year for top brokers entrench scale benefits enjoyed by market leaders.

Proposed EU FTT (Financial-Transaction-Tax)

Draft legislation imposes 0.1% on equity and 0.01% on derivatives trades, which models suggest could shave 15-25% off retail volumes and redirect liquidity to offshore venues. France's 2012 levy already cut local turnover by 18%, offering precedent for market migration risks. Discount brokers operating on thin spreads are least able to absorb the charge, raising questions about the endurance of free trading post-implementation. Cross-border trades, 34.9% of Nordnet flows, face the greatest disruption as investors may shift orders outside the EU to avoid tax drag. Asset-management groups warn the tax could reduce EU GDP 0.28% a year by suppressing capital-market efficiency.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Zero-Commission Freemium Pricing Models

- Cloud-Native Trading Cores Lowering Barrier to Entry

- Heightened Cyber-Resilience Mandates (DORA) Raising Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Retail investors controlled 69.62% of the European e-brokerage market in 2025, reflecting an era of democratized finance powered by mobile onboarding, fractional trading, and social-network features . Their 8.41% CAGR to 2031 outpaces institutional growth as Gen-Z savers swap savings deposits for ETF portfolios and crypto allocations. Platforms such as Trade Republic steward more than EUR 100 billion of retail assets and extend multilingual apps across eighteen countries, confirming pan-continental appetite for low-friction investing. Institutional desks pivot to white-label APIs from Saxo Bank, which services 150 partners managing EUR 118 billion in client funds, proving digital rails now underpin both segments . Robust KYC automation, PSD-2 data feeds, and DORA-compliant infrastructure together uphold trust critical for scaling mass-market propositions.

Leading brokers exploit network effects by adding community feeds, thematic baskets, and ESG filters that deepen engagement and generate data for tailored cross-selling offers. Trade Republic's profitability milestone in 2023 shows that scale can offset compressed commissions when alternative revenue lines mature. Institutional traders embrace algorithmic order management through Banking-as-a-Service stacks, trimming custody expenses while meeting MiFID II research unbundling obligations. Convergence blurs lines: some retail apps now offer level 2 depth and options chains; conversely, institutional portals adopt consumer-grade UX. The European e-brokerage market still prizes regulatory compliance as a baseline, and large actors with dedicated governance teams cement loyalty among both investor classes.

The Europe E-Brokerage Market Report is Segmented by Investor Type (retail, Institutional), Services Offered (full-Service Brokers, Discount Brokers), Operation (domestic, Foreign), and Geography (United Kingdom, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- eToro Ltd.

- DEGIRO / flatexDEGIRO AG

- Saxo Bank A/S

- IG Group Holdings plc

- Interactive Brokers LLC

- Plus500 Ltd.

- Hargreaves Lansdown plc

- Trade Republic Bank GmbH

- BUX B.V.

- FinecoBank S.p.A.

- Comdirect Bank AG

- CMC Markets plc

- Charles Schwab Corp.

- Robinhood Markets Inc.

- Nordnet AB

- Keytrade Bank SA

- Bank inter SA

- Banco Best S.A.

- Fineco UK Ltd.

- AJ Bell plc

- Scalable Capital

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 PSD-2-driven account aggregation adoption

- 4.2.2 MiFID II-fuelled demand for commission transparency

- 4.2.3 Rise of zero-commission "freemium" pricing models

- 4.2.4 Cloud-native trading cores lowering barrier to entry (under-reported)

- 4.2.5 Embedded-brokerage APIs in neobanks & "super-apps" (under-reported)

- 4.2.6 Tokenised securities pilots on DLT rails (under-reported)

- 4.3 Market Restraints

- 4.3.1 Proposed EU FTT (Financial-Transaction-Tax)

- 4.3.2 Heightened cyber-resilience mandates (DORA) raising compliance costs

- 4.3.3 Declining order-flow payments amid regulatory scrutiny

- 4.3.4 Retail order-execution quality investigations (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Investor Type

- 5.1.1 Retail

- 5.1.2 Institutional

- 5.2 By Services Offered

- 5.2.1 Full-Service Brokers

- 5.2.2 Discount Brokers

- 5.3 By Operation

- 5.3.1 Domestic

- 5.3.2 Foreign

- 5.4 By Geography (Europe)

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 eToro Ltd.

- 6.4.2 DEGIRO / flatexDEGIRO AG

- 6.4.3 Saxo Bank A/S

- 6.4.4 IG Group Holdings plc

- 6.4.5 Interactive Brokers LLC

- 6.4.6 Plus500 Ltd.

- 6.4.7 Hargreaves Lansdown plc

- 6.4.8 Trade Republic Bank GmbH

- 6.4.9 BUX B.V.

- 6.4.10 FinecoBank S.p.A.

- 6.4.11 Comdirect Bank AG

- 6.4.12 CMC Markets plc

- 6.4.13 Charles Schwab Corp.

- 6.4.14 Robinhood Markets Inc.

- 6.4.15 Nordnet AB

- 6.4.16 Keytrade Bank SA

- 6.4.17 Bank inter SA

- 6.4.18 Banco Best S.A.

- 6.4.19 Fineco UK Ltd.

- 6.4.20 AJ Bell plc

- 6.4.21 Scalable Capital

7 Market Opportunities & Future Outlook

- 7.1 EU-wide consolidated tape unlocking cross-border liquidity

- 7.2 Gamified ESG fractional-share products for Gen-Z investors