PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755291

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755291

Automotive Fault Circuit Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

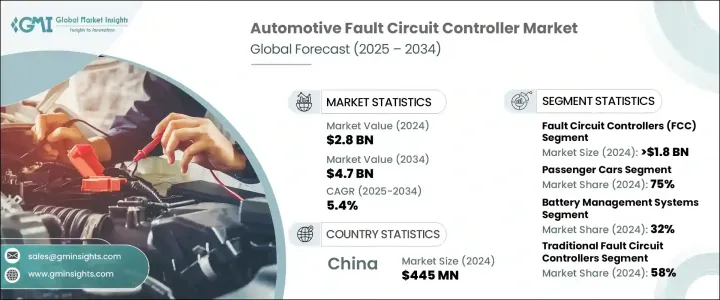

The Global Automotive Fault Circuit Controller Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 4.7 billion by 2034. This growth is largely driven by the increasing shift towards electric vehicles (EVs) and hybrid models, which require more sophisticated electrical safety systems due to their complex power electronics and high-voltage batteries. Fault circuit controllers are integral to the safe operation of these vehicles, as they identify and isolate faults quickly, protecting essential components from damage.

As the adoption of EVs continues to rise, especially with stricter emission regulations and government incentives, the demand for FCCs is growing. These devices help ensure vehicle safety, minimize downtime, and maintain the reliability of electrical systems, which is crucial as vehicles become increasingly dependent on advanced electronics for performance, navigation, and driver assistance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 5.4% |

The rise of connected and autonomous vehicles (AVs) introduces a new layer of complexity to automotive systems. These vehicles rely heavily on advanced sensors, communication networks, and artificial intelligence (AI) algorithms to make real-time decisions and navigate environments. As these technologies evolve, so does the demand for highly reliable and secure electrical systems. Fault circuit controllers (FCCs) play a pivotal role in ensuring that these intricate systems remain operational, even in the face of electrical disruptions. In autonomous vehicles, even a minor fault in the powertrain or communication system leads to catastrophic outcomes, making these protective devices critical for maintaining vehicle safety and performance.

In 2024, the fault circuit controller (FCC) segment generated USD 1.8 billion. FCCs are particularly critical in electric vehicle powertrains, where high-voltage systems can cause significant failures if faults are not detected quickly. With electric vehicles operating within voltage ranges of 400V to 800V, the role of FCCs in preventing potential disasters by isolating faults at the earliest stages cannot be overstated. Their ability to detect abnormal current flow and disconnect faulty circuits is essential for maintaining the safety of these vehicles. Consequently, this market segment has grown rapidly as EV manufacturers increasingly incorporate these safety devices into their automobiles.

The battery management systems segment captured a 32% share in 2024 and is expected to see notable expansion through 2034. Battery monitoring units within these systems play a pivotal role in ensuring the safety and reliability of electric vehicles. These units track key parameters like voltage, temperature, and current, allowing early identification of faulty cells or circuits. When paired with fault circuit controllers, these systems help prevent power failures and thermal issues, thus enhancing battery longevity and overall vehicle performance. Battery disconnects units, which act as safety switches, further contribute to ensuring the safety of the vehicle's electrical system during faults or maintenance.

Asia Pacific Automotive Fault Circuit Controller Market held a 43% share and generated USD 445 million in 2024. China's status as the largest EV market globally is a key factor in the demand for FCCs, as local manufacturers are rapidly expanding their electric vehicle offerings. As regulatory requirements for vehicle safety become stricter, Chinese automakers are increasingly adopting advanced FCCs for overcurrent protection in battery management systems, power electronics, and e-drive units. The country's push toward enhancing vehicle safety and reliability has made FCCs a vital component in electric drivetrains, further accelerating market growth.

Key players in the Global Automotive Fault Circuit Controller Market include Siemens, Mitsubishi Electric, Honeywell International, Infineon Technologies, ABB, Panasonic Corporation, Eaton, Bosch Automotive Electronics, General Electric (GE), and Schneider Electric. To strengthen their position in the automotive fault circuit controller market, companies are focusing on developing cutting-edge, reliable, and efficient solutions that meet the evolving safety standards of the automotive industry. They are investing heavily in research and development to innovate fault protection technologies, ensuring their products are optimized for high-voltage electric vehicles and connected cars. Additionally, these companies are expanding their partnerships with automotive manufacturers to integrate FCCs seamlessly into modern powertrains and battery management systems. Offering customized solutions that cater to the specific needs of different vehicle models and types has also become a priority. Companies enhance their market foothold by expanding their production capabilities and increasing their presence in emerging markets, where the adoption of electric vehicles rises.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 Technology

- 2.2.6 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in vehicle electrification and high-voltage architecture adoption

- 3.2.1.2 Growing emphasis on passenger safety and regulatory compliance

- 3.2.1.3 Expansion of connected and autonomous vehicle technologies

- 3.2.1.4 Integration of fault detection systems in advanced driver-assistance systems (ADAS)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High complexity and cost of integration

- 3.2.2.2 Reliability issues in harsh automotive environments

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in electric vehicle (EV) manufacturing

- 3.2.3.2 Integration with advanced driver assistance systems (ADAS)

- 3.2.3.3 Regulatory push for electrical safety compliance

- 3.2.3.4 Growth in emerging automotive markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD, Million, Units)

- 5.1 Key trends

- 5.2 Fault circuit controllers (FCC)

- 5.3 Circuit protection devices

- 5.4 Sensors & monitoring units

- 5.5 Control modules

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD, Million, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 LCVs (light commercial vehicles)

- 6.3.2 MCVs (medium commercial vehicles)

- 6.3.3 HCVs (heavy commercial vehicles)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD, Million, Units)

- 7.1 Key trends

- 7.2 Engine management systems

- 7.3 Battery management systems

- 7.4 Lighting systems

- 7.5 Infotainment and connectivity systems

- 7.6 Safety systems

- 7.7 HVAC (heating, ventilation, air conditioning)

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD, Million, Units)

- 8.1 Key trends

- 8.2 Traditional fault circuit controllers

- 8.3 Smart/intelligent fault circuit controllers

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD, Million, Units)

- 9.1 Key trends

- 9.2 OEM (original equipment manufacturers)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Alstom

- 11.3 American Superconductor

- 11.4 Autoliv

- 11.5 Bosch Automotive Electronics

- 11.6 Continental

- 11.7 Denso

- 11.8 Eaton

- 11.9 General Electric (GE)

- 11.10 Honeywell International

- 11.11 Infineon Technologies

- 11.12 Liaoning Rongxin Electric Power Electronic Co.

- 11.13 Mitsubishi Electric

- 11.14 Nexans

- 11.15 Panasonic

- 11.16 Schneider Electric

- 11.17 Siemens

- 11.18 Superconductor Technologies

- 11.19 TE Connectivity

- 11.20 Valeo