PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755335

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755335

Seasoning Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

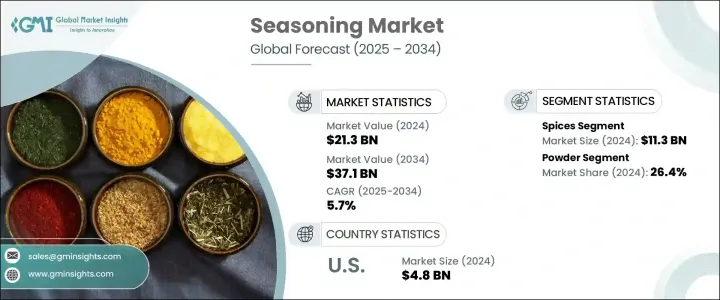

The Global Seasoning Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 37.1 billion by 2034, fueled by changing dietary habits, the rising popularity of convenient food products, and a heightened interest in enhancing food flavor. Despite fluctuations in the global economy, the demand for seasoning remains strong due to its indispensable role in household kitchens and the commercial food industry across developed and emerging economies. Seasonings have become integral not just for flavor but also for preserving authenticity in global cuisines.

Technological improvements and increasing globalization have broadened the availability of diverse herbs and spices worldwide, giving rise to more complex and tailored spice blends. These developments have enabled the seamless incorporation of seasonings into packaged and ready-to-eat food segments. As urbanization and exposure to international cuisines rise, the market thrives. Consumers are showing a clear preference for clean-label, natural, and non-GMO products, which is encouraging companies to innovate in ingredient transparency and sustainability. In addition to culinary uses, the increasing demand for functional foods further boosts the use of seasoning products enriched with health benefits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $37.1 Billion |

| CAGR | 5.7% |

The seasoning segment based on spices was valued at USD 11.3 billion in 2024 and is projected to grow at a CAGR of 5.6% through 2034. Spices remain vital in food preparation thanks to their role in enhancing both taste and nutritional value. Their widespread use in traditional dishes and contemporary recipes alike is driven by rising health consciousness and the global appreciation for regional flavors. Consumers continue to demand spices like turmeric, chili, cumin, and paprika not only for taste but for their wellness properties. The flexibility of using spices in different formats-whether whole, ground or as extracts-adds to their sustained appeal. Moreover, growing e-commerce and retail availability have made spices more accessible.

The powdered seasoning segment generated USD 18.1 billion in 2024, holding a 26.4% share, and is set to grow at a CAGR of 5.5% from 2025 to 2034 driven by the convenience and compatibility with a wide range of recipes. The consistent texture and ease of storage give powdered seasonings a significant edge, particularly in processed and packaged foods where uniform taste and longer shelf life are key. Consumers and manufacturers prefer powdered formats for applications in rubs, soups, sauces, snacks, and meal kits. Additionally, these seasonings are cost-effective to transport and store, contributing to their growing popularity.

U.S. Seasoning Market generated USD 4.8 billion in 2024 and is expected to grow at a CAGR of 6% from 2025 to 2034. The market benefits from high domestic consumption, strong food processing capabilities, and a widespread shift toward organic and natural ingredients. The growing popularity of multicultural cuisines-particularly those from Asia, the Mediterranean, and Latin America-has sparked increased demand for blended and ethnic spice combinations. Simultaneously, home cooking, social media influence, and interest in gourmet meal preparation have surged. Health-focused innovations, such as low-sodium and allergen-free spice blends, are becoming key selling points. These dynamics position the U.S. as a leader in the global seasoning industry.

Companies active in the Global Seasoning Market include: Givaudan SA, Olam International, McCormick & Company, Inc., Kerry Group plc, and Ajinomoto Co., Inc. To secure and expand their market footprint, companies in the seasoning industry are implementing targeted strategies. Many are introducing culturally diverse blends and healthier alternatives that cater to clean-label demands. Product innovation is central-brands are rolling out spice formulations that balance flavor and health, such as low-sodium and preservative-free options. Expansion into e-commerce has enabled companies to reach broader consumer segments while offering customizable packaging and subscription-based spice kits.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1.1 Regional

- 2.2.1.2 Product type

- 2.2.1.3 Form

- 2.2.1.4 Nature

- 2.2.1.5 Application

- 2.2.1.6 End use

- 2.2.1.7 Distribution channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for ethnic and exotic cuisines

- 3.2.1.2 Rising consumer interest in gourmet cooking

- 3.2.1.3 Increasing preference for clean label products

- 3.2.1.4 Growth in the food service industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuating raw material prices

- 3.2.2.2 Stringent regulations on food additives

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Herbs

- 5.2.1 Basil

- 5.2.2 Oregano

- 5.2.3 Thyme

- 5.2.4 Rosemary

- 5.2.5 Parsley

- 5.2.6 Others

- 5.3 Spices

- 5.3.1 Pepper

- 5.3.2 Cinnamon

- 5.3.3 Cumin

- 5.3.4 Turmeric

- 5.3.5 Cardamom

- 5.3.6 Cloves

- 5.3.7 Others

- 5.4 Salt & salt substitutes

- 5.4.1 Table salt

- 5.4.2 Sea salt

- 5.4.3 Himalayan salt

- 5.4.4 Low-sodium salt

- 5.4.5 Others

- 5.5 Seasoning blends

- 5.5.1 Italian seasoning

- 5.5.2 Cajun seasoning

- 5.5.3 Curry powder

- 5.5.4 Taco seasoning

- 5.5.5 Garam masala

- 5.5.6 Others

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Whole/intact

- 6.4 Crushed/ground

- 6.5 Liquid

- 6.6 Paste

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Nature, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Organic

- 7.4 Non-GMO

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Meat & Poultry

- 8.3 Snacks & convenience food

- 8.4 Soups, sauces & dressings

- 8.5 Bakery & confectionery

- 8.6 Seafood

- 8.7 Frozen foods

- 8.8 Beverages

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Food processing industry

- 9.3 Food service industry

- 9.3.1 Restaurants

- 9.3.2 Hotels

- 9.3.3 Cafes

- 9.3.4 Fast food chains

- 9.3.5 Others

- 9.4 Retail/household

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 B2B

- 10.3 B2C

- 10.3.1 Supermarkets/hypermarkets

- 10.3.2 Convenience stores

- 10.3.3 Specialty stores

- 10.3.4 Online retail

- 10.3.5 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Ajinomoto Co., Inc.

- 12.2 Ariake Japan Co., Ltd.

- 12.3 Baria Pepper

- 12.4 British Pepper & Spice Co Ltd

- 12.5 Dohler GmbH

- 12.6 DS Group

- 12.7 Everest Spices

- 12.8 Firmenich SA

- 12.9 Frontier Co-op

- 12.10 Fuchs Gewurze GmbH

- 12.11 Givaudan SA

- 12.12 Kerry Group plc

- 12.13 McCormick & Company, Inc.

- 12.14 MDH Spices

- 12.15 Nestle S.A.

- 12.16 Olam International

- 12.17 Sensient Technologies Corporation

- 12.18 Symrise AG

- 12.19 The Kraft Heinz Company

- 12.20 Unilever PLC