PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755336

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755336

Commercial Steam Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

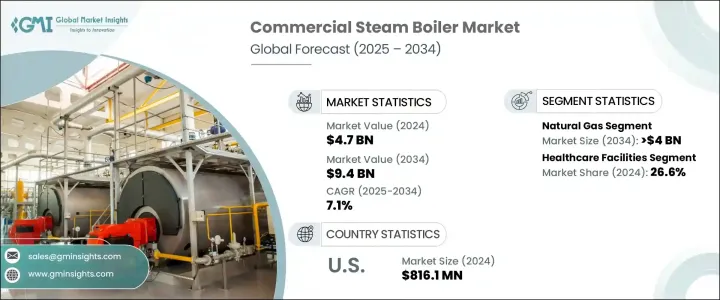

The Global Commercial Steam Boiler Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 9.4 billion by 2034. Rising investments in commercial infrastructure, such as business establishments, retail environments, and medical facilities, are playing a significant role in driving the adoption of modern steam boiler systems. These systems are increasingly favored for their ability to support energy-efficient operations and enhanced heating performance. The industry is also benefiting from a widespread shift toward eco-friendly heating solutions. Governments and private stakeholders are actively promoting cleaner fuel alternatives by encouraging a transition from traditional coal and oil-powered systems to more sustainable gas and electric boilers. These initiatives are aimed at reducing overall carbon emissions while aligning with international climate commitments.

Moreover, the integration of smart technologies such as IoT monitoring systems into commercial steam boilers is improving operational visibility and enhancing energy optimization. These advancements are enabling users to better manage performance, reduce energy waste, and improve uptime, key factors in maintaining continuity in mission-critical environments. Increasing pressure from regulatory agencies for cleaner emissions is also influencing buyer preferences. Compliance with stringent energy standards such as those set by ASME and EN is encouraging the replacement of outdated models with next-generation high-efficiency boilers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $9.4 Billion |

| CAGR | 7.1% |

Incentives provided by government bodies for upgrading heating systems in public infrastructure are further accelerating the pace of adoption. Modernization projects focused on schools, medical centers, and government buildings are facilitating broader deployment of efficient steam boiler systems. With increased awareness about the benefits of modular boiler solutions, more commercial users are adopting scalable units that are easier to install and maintain. These modular configurations are designed to handle fluctuating heating loads efficiently and can be serviced without causing operational disruptions-making them ideal for facilities that demand constant uptime.

The market is segmented by fuel type into natural gas, oil, coal, electric, and others. Natural gas continues to be the most widely adopted fuel due to its reduced environmental footprint, superior energy performance, and relatively lower operational expenses. The natural gas segment alone is projected to surpass USD 4 billion in market value by 2034. The rapid expansion of gas pipeline infrastructure and increasing access to liquefied natural gas (LNG) are contributing factors that enhance the viability of gas-powered steam boilers in commercial spaces. These systems offer superior thermal efficiency and flexibility in operations, making them a popular choice for a variety of building types.

When assessed by application, the market includes commercial establishments such as healthcare facilities, office spaces, lodging, retail environments, educational buildings, and others. Healthcare-related usage held a 26.6% share of the market in 2024, driven by continuous developments in medical infrastructure. The demand for reliable steam-based applications, including sterilization, space heating, and daily operations, is fueling installations in clinics, diagnostic labs, and hospitals.

In the United States, the commercial steam boiler market experienced steady growth, reaching USD 816.1 million in 2024, up from USD 727.4 million in 2022 and USD 771.9 million in 2023. This growth trend reflects strong national policies focused on clean energy initiatives and increased investments in commercial development. Demand is further supported by evolving regulatory requirements aimed at reducing emissions through the adoption of low-NOx burners and more advanced combustion methods.

Across North America, the commercial steam boiler market is forecast to grow at a CAGR of over 6.5% through 2034. Continuous development in healthcare-related infrastructure, in combination with government-driven efforts to expand and modernize commercial buildings, is shaping a favorable landscape for steam boiler adoption. Supportive policy frameworks and regulatory clarity are expected to contribute to long-term industry growth.

Key participants in the commercial steam boiler market include Smith Hughes Company, Fulton, LAARS Heating Systems, Cleaver-Brooks, York-Shipley, Lochinvar, Clayton Industries, Bosch Industriekessel, Precision Boilers, Babcock & Wilcox, Sellers Manufacturing, Hoval, Burnham Commercial, WM Technologies, Columbia Heating Products, Superior Boiler, Vapor Power International, FERROLI, VIESSMANN, and PARKER BOILER. These companies are focusing on innovation, energy efficiency, and product reliability to maintain their competitive edge and meet evolving customer demands across commercial sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market scope & definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Electric

- 5.6 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Offices

- 8.3 Healthcare facilities

- 8.4 Educational institutions

- 8.5 Lodgings

- 8.6 Retail stores

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Austria

- 9.3.7 Germany

- 9.3.8 Sweden

- 9.3.9 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Philippines

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Australia

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Nigeria

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Argentina

- 9.6.2 Chile

- 9.6.3 Brazil

Chapter 10 Company Profiles

- 10.1 Babcock & Wilcox

- 10.2 Bosch Industriekessel

- 10.3 Burnham Commercial

- 10.4 Clayton Industries

- 10.5 Cleaver-Brooks

- 10.6 Columbia Heating Products

- 10.7 FERROLI

- 10.8 Fulton

- 10.9 Hoval

- 10.10 LAARS Heating Systems

- 10.11 Lochinvar

- 10.12 PARKER BOILER

- 10.13 Precision Boilers

- 10.14 Sellers Manufacturing

- 10.15 Smith Hughes Company

- 10.16 Superior Boiler

- 10.17 Vapor Power International

- 10.18 VIESSMANN

- 10.19 WM Technologies

- 10.20 York-Shipley