PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755337

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755337

Polarized Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

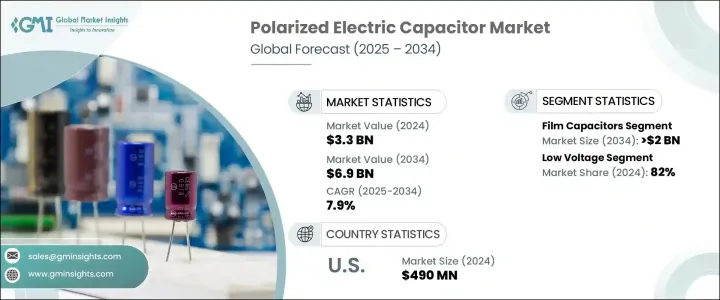

The Global Polarized Electric Capacitor Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 6.9 billion by 2034, driven by the rising adoption of electric vehicles (EVs), renewable energy systems, and smart connected devices. As these sectors demand more reliable capacitors with higher energy density and efficient energy storage-to-volume ratios, the market continues to expand. The rapid technological advancements in electronic devices, where polarized capacitors play a crucial role in energy storage, voltage regulation, and signal filtering, have increased demand for these components.

The need for capacitors with larger capacities in smaller form factors has surged as the trend toward miniaturization and sustainability becomes more prominent. Capacitor technology has also advanced to offer improved thermal stability, longer operational lifespans, and environmentally friendly materials. This has led to their wider application in industries like automotive, particularly in EVs and hybrid electric vehicles (HEVs), where capacitors are essential for power conditioning and energy storage. Moreover, industrial automation, alongside the demand for high-performance capacitors, is contributing to the market's momentum. The rise of the Internet of Things (IoT) in industrial settings, where devices operate in environments with fluctuating power loads and extreme temperatures, is driving the need for capacitors to withstand such conditions while ensuring reliable performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 7.9% |

The film capacitor segment is expected to generate USD 2 billion by 2034, driven by high demand across industries like renewable energy, automotive, consumer electronics, and industrial automation. Known for their exceptional electrical properties such as high insulation resistance and stability over a wide range of temperatures and frequencies, film capacitors are vital in modern electronics.

The low voltage segment is anticipated to dominate the market, with a share of 82% and a growth rate of 8% through 2034. The increasing need for energy storage, voltage stabilization, and filtering in compact, efficient designs is further fueling this segment's expansion. In parallel, the demand for medium voltage capacitors is rising as renewable energy systems such as wind and solar power and grid modernization require capacitors for power factor correction and voltage smoothing in various power conditioning applications.

United States Polarized Electric Capacitor Market was valued at USD 490 million in 2024 driven by technological advancements in automation, smart manufacturing, and robotics, which require durable capacitors capable of operating in challenging environments and withstanding high electrical stress. These capacitors are crucial for industrial applications, including motor drives, programmable logic controllers (PLCs), and power converters in industrial plants.

Key players in the Global Polarized Electric Capacitor Industry include: KEMET Corporation, Murata Manufacturing, TDK Corporation, Panasonic Corporation, Vishay Intertechnology, Siemens, ABB, Cornell Dubilier, Schneider Electric, WIMA GmbH, SAMSUNG ELECTRO-MECHANICS, KYOCERA AVX, Havells, TAIYO YUDEN, ELNA, Xuansn Capacitor. Companies in the polarized electric capacitor industry focus on innovation, technological improvements, and expanding their product offerings. Manufacturers are investing in developing capacitors with enhanced thermal stability and longer operational lifespans to meet the needs of high-performance applications. Companies incorporate environmentally friendly materials to align with sustainability trends, which is demanded by consumers and regulatory bodies. Many players are also advancing their production techniques to achieve more compact and efficient capacitor designs, allowing integration into smaller devices without sacrificing performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034, (USD Million, '000 Units)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitor

- 5.4 Electrolytic capacitor

- 5.5 Others

Chapter 6 Market Size and Forecast, By Voltage, 2021 - 2034, (USD Million, '000 Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034, (USD Million, '000 Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.3 Automotive

- 7.4 Communications & technology

- 7.5 Transmission & distribution

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034, (USD Million, '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cornell Dubilier

- 9.3 ELNA

- 9.4 Havells

- 9.5 KEMET Corporation

- 9.6 KYOCERA AVX

- 9.7 Murata Manufacturing

- 9.8 Panasonic Corporation

- 9.9 SAMSUNG ELECTRO-MECHANICS

- 9.10 Schneider Electric

- 9.11 Siemens

- 9.12 TAIYO YUDEN

- 9.13 TDK Corporation

- 9.14 Vishay Intertechnology

- 9.15 WIMA GmbH

- 9.16 Xuansn Capacitor