PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766315

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766315

Transmission and Distribution Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

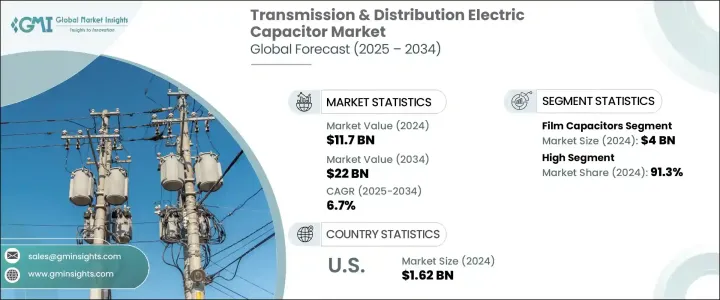

The Global Transmission and Distribution Electric Capacitor Market was valued at USD 11.7 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 22 billion by 2034. Electric capacitors help maintain consistent voltage levels by storing and releasing energy as required, preventing voltage fluctuations that could damage electronic systems or disrupt circuits. The integration of renewable energy sources like solar and wind further amplifies the need for capacitors, as they help manage the intermittent nature of these energy sources and ensure grid stability. By placing capacitors along transmission lines, utilities can optimize power flow, reduce energy losses, and improve overall efficiency.

With aging power grids in need of upgrades, capacitors are essential in enhancing grid reliability and performance, especially in projects focused on modernizing old infrastructure. Capacitors are key to the replacement cycle of transmission equipment, and their ability to improve power factor efficiency enables utilities to reduce operational costs and save energy. Moreover, regulatory measures aimed at reducing electrical losses are also driving the demand for capacitors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.7 Billion |

| Forecast Value | $22 Billion |

| CAGR | 6.7% |

The ceramic capacitors segment is anticipated to grow at a CAGR of 6.7% by 2034. Ceramic capacitors are increasingly favored for their compact nature, making them a suitable option for high-voltage applications. Their small size allows for space-efficient designs, which reduces the overall costs and space needed for installation in substations. This makes them particularly advantageous in urban settings where space is limited. Additionally, their ability to handle high capacitance while occupying minimal physical space offers utilities more flexibility in designing and upgrading electrical infrastructure.

The low-voltage segment was valued at USD 285.4 million in 2024 driven by supporting localized voltage regulation and reactive power compensation. These capacitors are typically deployed at substations or on pole-mounted locations, where they provide necessary reactive power support to stabilize voltage levels. By ensuring that voltage levels remain steady, these capacitors help reduce electrical losses, improve energy efficiency, and ensure the overall reliability of local power networks.

Europe Transmission & Distribution Electric Capacitor Market is expected to grow at an impressive CAGR of 9.5% through 2034. This growth is primarily driven by the rapid adoption of renewable energy sources such as wind and solar, which has created a need for advanced capacitor technologies to support the dynamic and variable energy inputs of these sources. The integration of renewable energy into the grid requires capacitors that can stabilize fluctuations in power flow and help manage the inherent unpredictability of renewable generation. Additionally, investments in smart grid technologies across Europe are optimizing energy distribution and storage, enhancing grid management capabilities, and improving the reliability of energy systems.

Companies in the Global Transmission & Distribution Electric Capacitor Market are adopting several strategies to strengthen their positions. This includes investing in the development of new, more efficient capacitor technologies that can handle renewable energy integration, as well as enhancing their product offerings to cater to different voltage levels and grid applications. Collaborations with grid operators and utilities are also helping to gain market share by aligning product offerings with the demand for grid upgrades. Furthermore, leading companies are focusing on regional expansion in emerging markets, while also increasing their R&D investment to improve the performance and sustainability of capacitors. The market leaders are also forming strategic partnerships to offer comprehensive solutions, supporting the growing demand for capacitors in smart grid applications. Key players in the market include Siemens, ABB, TDK Corporation, and Murata Manufacturing Co., Ltd.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (Thousand Units, USD Billion)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitors

- 5.4 Electrolytic capacitors

- 5.5 Others

Chapter 6 Market Size and Forecast, By Polarization, 2021 - 2034 (Thousand Units, USD Billion)

- 6.1 Key trends

- 6.2 Polarized

- 6.3 Non-Polarized

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (Thousand Units, USD Billion)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Thousand Units, USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cornell Dubilier

- 9.3 ELNA CO., LTD.

- 9.4 Havells India Ltd.

- 9.5 KEMET Corporation

- 9.6 KYOCERA AVX Components Corporation

- 9.7 Murata Manufacturing Co., Ltd.

- 9.8 Panasonic Corporation

- 9.9 SAMSUNG ELECTRO-MECHANICS

- 9.10 Schneider Electric

- 9.11 Siemens

- 9.12 TAIYO YUDEN CO., LTD.

- 9.13 TDK Corporation

- 9.14 Vishay Intertechnology, Inc.

- 9.15 WIMA GmbH & Co. KG

- 9.16 Xuansn Capacitor