PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755372

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755372

High Voltage Power and Control Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

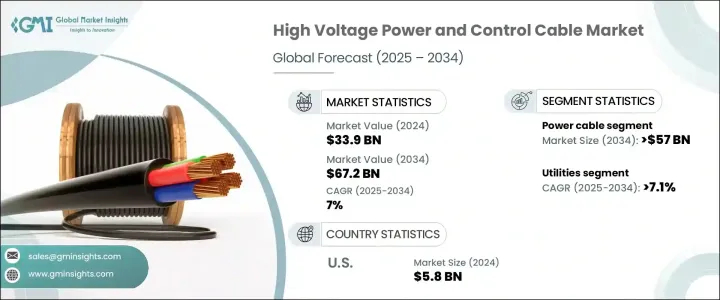

The Global High Voltage Power and Control Cable Market was valued at USD 33.9 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 67.2 billion by 2034. The growth is driven primarily by the accelerating global transition toward renewable energy sources. As countries around the world intensify efforts to decarbonize their energy systems, the demand for high-capacity, efficient transmission infrastructure has grown substantially. This shift has made high voltage cables a critical component in modern electricity transmission networks.

These cables are indispensable for transporting power over long distances, particularly from remote renewable energy installations to centralized grid systems. Governments and private sector players are investing heavily in upgrading their transmission infrastructure to support the expanding renewable energy capacity and to improve grid resilience. This trend, coupled with ongoing industrial development and urban expansion, is creating consistent demand for advanced high voltage cables.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.9 Billion |

| Forecast Value | $67.2 Billion |

| CAGR | 7% |

The increasing need for reliable electricity distribution and smart grid development, especially in developing economies, is adding to this positive outlook. In many emerging regions, rapid industrialization and urban infrastructure expansion are pushing the demand for robust power transmission systems. Simultaneously, developed economies are focusing on modernizing aging infrastructure and reducing transmission losses, further amplifying the role of high voltage cables.

Technological advancements are significantly shaping the market landscape. Manufacturers are introducing high-performance materials such as cross-linked polyethylene (XLPE) and innovating in insulation technologies to meet evolving regulatory and environmental standards. These innovations not only improve thermal and mechanical performance but also enhance safety and durability. As a result, modern high voltage cables are more efficient and dependable, making them an attractive choice for high-stakes applications across industrial, commercial, and utility sectors. Moreover, increased R&D investments are facilitating the development of cables that can handle higher voltages while minimizing power losses, which is a crucial factor for long-distance transmission from renewable sources.

The global market is also experiencing regional shifts in demand. Countries in Asia-Pacific, particularly China, India, and Japan, are allocating significant resources to power infrastructure as part of their broader economic development strategies. These regions are undergoing massive urbanization, leading to increased electricity consumption and the need for stable transmission networks. Meanwhile, North America continues to witness substantial growth supported by government programs focused on clean energy integration and grid modernization. Infrastructure projects aimed at improving electricity delivery and reducing emissions are giving a boost to market growth in the region.

By 2034, the power cable segment alone is projected to surpass USD 57 billion. This growth is largely attributed to the surging need for high-capacity transmission lines capable of accommodating the increasing power load generated from renewable energy and industrial processes. As cities expand and smart infrastructure becomes a reality, high-performance cables are becoming more critical than ever. The necessity to transport power efficiently across long distances, particularly from offshore wind farms and solar parks, adds another layer of demand for durable and high-voltage-capable solutions.

In terms of application, the utilities segment is poised to grow at a CAGR exceeding 7.1% through 2034. This is largely driven by the fast-paced development of electric transmission and distribution networks and the continued push toward grid automation. Utility providers are being pushed to modernize aging infrastructure to meet the needs of a changing energy landscape. This includes integrating new technologies, improving reliability, and preparing for a more decentralized power generation model. With global energy consumption projected to rise significantly, utility companies are under pressure to invest in infrastructure that can deliver uninterrupted power while minimizing environmental impact.

The United States continues to be a key player in this market, with its high voltage power and control cable industry valued at USD 4.9 billion in 2022, increasing to USD 5.4 billion in 2023 and USD 5.8 billion in 2024. The country's strong economic position and ongoing emphasis on clean energy and infrastructure development are contributing to steady market expansion. With growing support for modernizing the national grid, the demand for advanced cable solutions is expected to remain robust in the coming years.

Europe also plays a pivotal role in market expansion due to its accelerated shift away from fossil fuels and a focused adoption of sustainable energy practices. The region's commitment to reducing carbon emissions and integrating renewable energy is prompting widespread investments in electricity infrastructure. Countries across Europe are heavily investing in reinforcing their power transmission frameworks to ensure stable electricity flow, further strengthening demand for high-performance cable solutions.

Industry competition is shaped by major players that collectively hold over 20% of the global market share. Leading firms with strong expertise in energy systems and automation continue to set benchmarks in innovation, performance, and reliability. Their technological advantage and deep domain knowledge give them a competitive edge in supplying cables that meet the rising global demand for energy-efficient and high-capacity solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Power cable

- 5.3 Control cable

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Utilities

- 6.3 Industries

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Netherlands

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Germany

- 7.3.7 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Kuwait

- 7.5.5 South Africa

- 7.5.6 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Peru

Chapter 8 Company Profiles

- 8.1 Bahra Electric

- 8.2 Belden Inc.

- 8.3 Elsewedy Electric

- 8.4 FURUKAWA ELECTRIC

- 8.5 Havells India.

- 8.6 KEI Industries

- 8.7 Klaus Faber

- 8.8 Leoni Cables

- 8.9 LS Cables

- 8.10 NKT A/S

- 8.11 Polycab

- 8.12 Prysmian Group

- 8.13 Riyadh Cables

- 8.14 RR Kabel

- 8.15 Southwire Company LLC

- 8.16 Sumitomo Electric

- 8.17 Thermo Cables

- 8.18 Top Cables