PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755381

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755381

Automatic Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

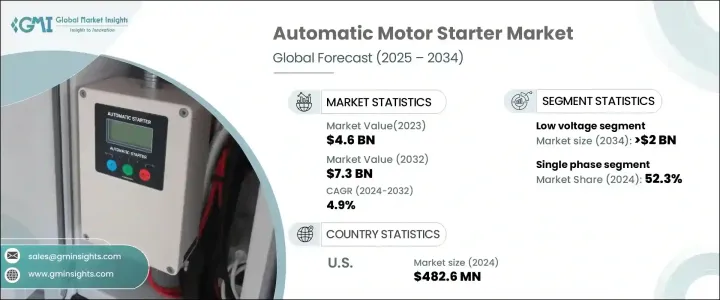

The Global Automatic Motor Starter Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 7.3 billion by 2034. The growth is fueled by the surge in industrial automation and the rising demand for energy-efficient operations. Automatic motor starters help control electric motors, enabling streamlined start-stop functions and offering protection from overloads, phase faults, and short circuits. By controlling power delivery, these devices ensure efficient motor operation, smoother startups, and safeguard against potential electrical hazards.

The expanding use of electric motors across industries such as chemicals, oil and gas, manufacturing, and water treatment is strengthening the market. As these sectors pursue sustainable practices and digital transformation, automatic motor starters are integrated with energy management systems to cut energy usage and prevent surges during startup. In addition, the advancement of industrial IoT and smart factory frameworks support the demand for these solutions. During the Trump administration, tariffs on industrial electrical parts, especially those imported from China increased production costs and supply chain disruption. Although the short-term impact was challenging, these trade restrictions also opened new opportunities for domestic production, reducing dependence on foreign sourcing and improving long-term supply stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 4.9% |

The medium voltage segment will grow at a CAGR of 4.5% by 2034. These systems are vital for high-power operations in sectors like oil and gas, mining, and water treatment, where managing large motors with precision is critical for equipment safety and operational efficiency. Medium voltage starters help reduce mechanical stress during motor startup, making them essential for facilities handling heavy-duty industrial loads under harsh conditions. The demand for these systems is further driven by infrastructure upgrades and rising energy needs across utilities and heavy industries.

The three-phase automatic motor starter segment is expected to reach USD 3.5 billion by 2034 fueled by increased installations in commercial HVAC, smart irrigation systems, and large-scale building infrastructure. These starters with intelligent communication features like Modbus and BACnet, enabling real-time system monitoring, predictive diagnostics, and seamless integration with building automation systems. This aligns with the growing trend toward smarter industrial environments prioritizing energy efficiency, system optimization, and remote-control capabilities.

United States Automatic Motor Starter Market was valued at USD 482.6 million in 2024, bolstered by the adoption of advanced microprocessor-based control systems in industrial automation. The U.S. market is also experiencing strong momentum due to an accelerated transition to digital industrial ecosystems and an increasing reliance on renewable energy. These factors create a favorable climate for expanding connected, low-emission, and energy-conscious motor control solutions.

Key players driving innovation and market competition in the Global Automatic Motor Starter Industry include Eaton, ABB, Danfoss, General Electric, Schneider Electric, Rockwell Automation, Mitsubishi Electric, Honeywell International, Siemens, WEG, Emerson Electric, Fuji Electric FA Components & Systems, L&T Electrical & Automation, Kalp Controls, CHINT Group, C&S Electric, Havells India, SKN-BENTEX GROUP, and LOVATO ELECTRIC. To strengthen their competitive edge, leading companies in the automatic motor starter market focus on developing digitally integrated and energy-efficient solutions that align with evolving industrial standards. Strategies include investing in R&D for smarter starters with real-time fault detection and remote monitoring. These brands expand their product portfolios through innovation and partnerships to meet demand across multiple industries. Localization of production to bypass trade barriers and improve lead times has also become a key focus.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low

- 5.3 Medium

- 5.4 High

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 New Zealand

- 8.4.7 Malaysia

- 8.4.8 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 South Africa

- 8.5.6 Nigeria

- 8.5.7 Kuwait

- 8.5.8 Oman

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 C&S Electric

- 9.3 CHINT Group

- 9.4 Danfoss

- 9.5 Eaton

- 9.6 Emerson Electric

- 9.7 Fuji Electric FA Components & Systems

- 9.8 General Electric

- 9.9 Havells India

- 9.10 Honeywell International

- 9.11 Kalp Controls

- 9.12 L&T Electrical & Automation

- 9.13 LOVATO ELECTRIC

- 9.14 Mitsubishi Electric

- 9.15 Rockwell Automation

- 9.16 Schneider Electric

- 9.17 Siemens

- 9.18 SKN-BENTEX GROUP

- 9.19 WEG