PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755396

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755396

Europe Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

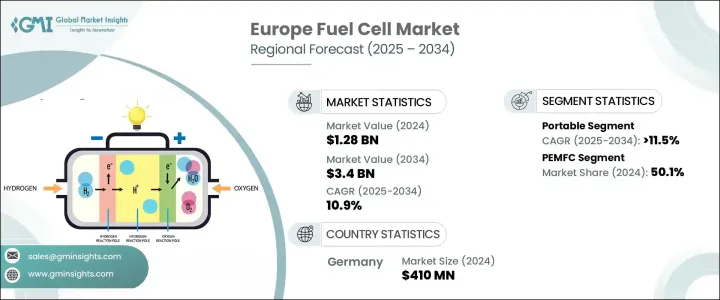

Europe Fuel Cell Market was valued at USD 1.28 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 3.4 billion by 2034, driven by increased government funding initiatives like the National Innovation Program for Hydrogen and Fuel Cell Technology (NIP), which supports research and development (R&D), demonstration projects, and the market rollout of hydrogen technologies. The expansion of aviation fuel cell projects backed by government initiatives is expected to contribute significantly to the growth of high-power fuel cell systems in Europe, aligning with advancements in aerospace technologies. With increasing investments from both the public and private sectors, there is an accelerated deployment of fuel cell technologies, promoting their wider adoption across various industries.

Fuel cells are also gaining traction as backup power solutions for critical infrastructure such as data centers and telecommunications. Partnerships with international stakeholders to secure stable hydrogen sources for Europe will further propel market growth. The industry also faces challenges due to new tariffs, particularly on imported Asian components, which could raise production costs and restrict access to essential materials, potentially impacting overall market dynamics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.28 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 10.9% |

The stationary fuel cell segment accounted for an 18.9% share in 2024 driven by the increasing need for decentralized energy systems, where reliability and resilience are crucial for sectors like healthcare, data centers, and telecommunications. As more businesses and industries prioritize energy independence and uninterrupted power supply, the demand for stationary fuel cells will continue to rise. In addition, government incentives and policies that promote the decarbonization of the power and heating sectors are further fueling market expansion, making stationary fuel cells a key component in Europe's transition to cleaner energy solutions.

Meanwhile, the molten carbonate fuel cell (MCFC) segment is set to grow at a CAGR of 14.2% through 2034 attributed to the increasing demand for high-capacity fuel cells, particularly in utility-scale and industrial cogeneration applications. MCFCs are gaining traction due to their ability to handle fuel impurities, their scalability for large projects, and their potential integration with carbon capture technologies. As Europe intensifies efforts to reduce carbon emissions in power systems, the adoption of MCFCs is expected to rise, making them a central player in achieving carbon reduction targets.

Germany Fuel Cell Market was valued at USD 410 million in 2024 and is also set for steady growth. Strong policy support, significant public funding, and the country's strategic hydrogen plans position Germany to be a leader in fuel cell technology deployment across Europe. These factors, combined with a favorable regulatory environment drive continued market expansion and innovation in the German fuel cell sector.

Key players in the Europe Fuel Cell Market include: AFC Energy, Aisin Corporation, Ballard Power Systems, Bloom Energy, Ceres, Cummins, Nedstack Fuel Cell Technology, Nuvera Fuel Cells, Panasonic Corporation, Robert Bosch, SFC Energy, TW Horizon Fuel Cell Technologies. Europe fuel cell market players are adopting several key strategies to strengthen their market positions. One of the primary strategies involves significant R&D investment to develop more efficient and cost-effective fuel cell technologies. Companies are also focusing on expanding their product offerings and improving system performance to meet the diverse needs of industries such as transportation, backup power, and large-scale utilities. Strategic partnerships and collaborations with government bodies and other private sector players are helping companies secure funding and advance their hydrogen infrastructure networks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Industry Insights

- 2.1 Industry ecosystem

- 2.2 Trump administration tariff analysis

- 2.2.1 Impact on trade

- 2.2.1.1 Trade volume disruptions

- 2.2.1.2 Retaliatory measures

- 2.2.2 Impact on the industry

- 2.2.2.1 Supply-side impact (raw materials)

- 2.2.2.1.1 Price volatility in key materials

- 2.2.2.1.2 Supply chain restructuring

- 2.2.2.1.3 Production cost implications

- 2.2.2.2 Demand-side impact (selling price)

- 2.2.2.2.1 Price transmission to end markets

- 2.2.2.2.2 Market share dynamics

- 2.2.2.2.3 Consumer response patterns

- 2.2.2.1 Supply-side impact (raw materials)

- 2.2.3 Key companies impacted

- 2.2.4 Strategic industry responses

- 2.2.4.1 Supply chain reconfiguration

- 2.2.4.2 Pricing and product strategies

- 2.2.4.3 Policy engagement

- 2.2.5 Outlook and future considerations

- 2.2.1 Impact on trade

- 2.3 Regulatory landscape

- 2.4 Industry impact forces

- 2.4.1 Growth drivers

- 2.4.2 Industry pitfalls & challenges

- 2.5 Growth potential analysis

- 2.6 Porter's analysis

- 2.6.1 Bargaining power of suppliers

- 2.6.2 Bargaining power of buyers

- 2.6.3 Threat of new entrants

- 2.6.4 Threat of substitutes

- 2.7 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Introduction

- 3.2 Company market share

- 3.3 Strategic initiatives

- 3.4 Company benchmarking

- 3.5 Strategic dashboard

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & MW)

- 4.1 Key trends

- 4.2 Stationary

- 4.2.1 < 200 kW

- 4.2.2 200 kW - 1 MW

- 4.2.3 ≥ 1 MW

- 4.3 Portable

- 4.4 Transport

- 4.4.1 Marine

- 4.4.2 Railways

- 4.4.3 FCEVs

- 4.4.4 Others

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 PEMFC

- 5.3 DMFC

- 5.4 SOFC

- 5.5 PAFC & AFC

- 5.6 MCFC

Chapter 6 Fuel Cell Market, By Fuel, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Hydrogen

- 6.3 Ammonia

- 6.4 Methanol

- 6.5 Hydrocarbons

Chapter 7 Fuel Cell Market, By Size, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Small scale

- 7.3 Large scale

Chapter 8 Fuel Cell Market, By End Use, 2021 – 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial & industrial

- 8.4 Data centers

- 8.5 Military and defense

- 8.6 Utilities & government

- 8.7 Transportation

Chapter 9 Market Size and Forecast, By Country, 2021 – 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 Germany

- 9.3 UK

- 9.4 France

- 9.5 Italy

- 9.6 Spain

- 9.7 Austria

Chapter 10 Company Profiles

- 10.1 Aisin Corporation

- 10.2 AFC Energy

- 10.3 Bloom Energy

- 10.4 Ballard Power Systems.

- 10.5 Cummins

- 10.6 Ceres

- 10.7 Nedstack Fuel Cell Technology

- 10.8 Nuvera Fuel Cells

- 10.9 Panasonic Corporation

- 10.10 Robert Bosch

- 10.11 SFC Energy

- 10.12 TW Horizon Fuel Cell Technologies