PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766180

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766180

Automotive Quantum Dot Backlight Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

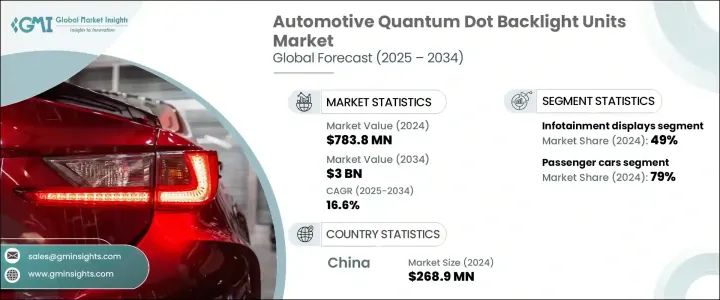

The Global Automotive Quantum Dot Backlight Units Market was valued at USD 783.8 million in 2024 and is estimated to grow at a CAGR of 16.6% to reach USD 3 billion by 2034. This growth is driven by rising consumer expectations for immersive digital displays and the accelerating adoption of infotainment and smart cockpit systems in vehicles. As automotive interiors evolve into digital command centers, the need for displays that deliver superior color fidelity, higher contrast ratios, and enhanced brightness is growing rapidly. Quantum dot (QD) backlight units are emerging as core components for delivering these advanced visual capabilities. With demand increasing for in-vehicle connectivity, real-time driving data, and multimedia functions, QD-enhanced screens offer the performance, efficiency, and durability required by today's connected vehicles.

Automakers are rethinking their cabin designs, moving toward unified display platforms that encompass infotainment, clusters, and head-up displays (HUDs). This shift supports a consistent user interface and streamlined manufacturing. As modular display systems gain traction across vehicle segments-from electric and hybrid models to high-end autonomous platforms-QD backlight units are becoming a standard feature. Their adaptability, color precision, and energy savings are reinforcing their position in the next generation of digital automotive experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $783.8 Million |

| Forecast Value | $3 Billion |

| CAGR | 16.6% |

By 2024, the passenger vehicles segment held a 79% share and is predicted to grow at a CAGR of 18% from 2025 to 2034. Within this segment, QD backlight units are transforming display performance by delivering richer color reproduction, elevated brightness, and improved energy use. These enhancements make them especially suitable for infotainment, head-up displays, and digital driver dashboards that need to perform well under variable lighting conditions. High-dynamic-range (HDR) visuals powered by Quantum Dot Enhancement Films (QDEF) bring an immersive experience while supporting safety and functionality in connected vehicle systems. Their seamless integration into LCD-based and curved display formats makes them ideal for modern cockpit layouts, particularly within mid-range to luxury EV models. QD displays also meet automotive-grade durability standards, which are essential for long-term in-vehicle deployment.

The infotainment displays segment held a 49% share in 2024 and is expected to grow at 15% CAGR through 2034. The demand for responsive, vibrant, and highly detailed in-cabin digital experiences is pushing QD integration within vehicle infotainment systems. QD backlight units enhance multimedia viewing, navigation clarity, and user interface responsiveness. Technologies such as QD-on-Glass and QDEF deliver wide color gamuts, faster refresh rates, and high brightness levels necessary for central control displays. Their ability to retain image quality in bright ambient environments enhances the interactive experience for both drivers and passengers. With user experience becoming a competitive differentiator, these displays are now integral to center-stack systems across both conventional and electric vehicles.

China Automotive Quantum Dot Backlight Units Market held a 63% share and generated USD 268.9 million in 2024, propelled by its large-scale vehicle production and strong demand for high-tech automotive displays. With the expansion of intelligent cockpit technologies, China's automotive market is rapidly shifting toward QD-enhanced systems for digital clusters, ADAS visualization, and in-car entertainment. Public policies supporting tech development, localized manufacturing, and smart mobility have further strengthened the momentum behind QD adoption. The push for high-end digital cockpit solutions is driving the integration of QD displays, especially in the growing electric and hybrid vehicle segments, which are increasingly adopting premium display technologies as standard features.

Key players actively shaping the Global Automotive Quantum Dot Backlight Units Market include Samsung Display, BOE Technology Group, Sharp, Kyulux, AU Optronics Corp. (AUO), Nanosys, CSOT (China Star Optoelectronics Technology), Sony, Innolux, and LG Display. To strengthen their market presence, companies in the automotive quantum dot backlight unit space are focusing on product innovation, strategic alliances, and capacity expansion. Firms are investing heavily in R&D to enhance the efficiency and durability of QD technologies while reducing production costs. Partnerships with automotive OEMs and Tier-1 suppliers are allowing for early integration of advanced QD systems into new vehicle platforms. Several players are also working on vertically integrated production models to ensure supply chain stability and performance consistency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Application

- 2.2.4 Technology

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-resolution displays

- 3.2.1.2 Rising integration of infotainment systems

- 3.2.1.3 Growing adoption of Advanced Driver Assistance Systems (ADAS)

- 3.2.1.4 Technological advancements in quantum dot materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of quantum dot displays

- 3.2.2.2 Toxicity concerns with cadmium-based QDs

- 3.2.3 Market opportunities

- 3.2.3.1 Integration in autonomous and semi-autonomous vehicles

- 3.2.3.2 Growing aftermarket display upgrades

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

- 3.13 Consumer behaviour & adoption trends

- 3.14 User experience & interface trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Infotainment displays

- 6.3 Instrument clusters

- 6.4 Head-Up Displays (HUDs)

- 6.5 Rear-seat entertainment systems

- 6.6 Advanced Driver Assistance System (ADAS) displays

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Quantum Dot Enhancement Film (QDEF) backlights

- 7.3 Quantum Dot on Glass (QDOG)

- 7.4 Quantum Dot on LED (QD-LED)

- 7.5 Quantum Dot Color Filters (QDCF)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AU Optronics Corp. (AUO)

- 10.2 BOE Technology Group

- 10.3 CSOT (China Star Optoelectronics Technology)

- 10.4 Helio Display Materials

- 10.5 Innolux Corporation

- 10.6 Kyulux

- 10.7 LG Display

- 10.8 Luminit LLC

- 10.9 Nanoco Group

- 10.10 Nanosys

- 10.11 Noctiluca

- 10.12 OSRAM Continental

- 10.13 PixelDisplay

- 10.14 QD Laser

- 10.15 Quantum Solutions

- 10.16 Samsung Display

- 10.17 Sharp Corporation

- 10.18 Sony Corporation

- 10.19 Toray Industries

- 10.20 Visionox