PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1889166

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1889166

Multimodal Transport Market By Configuration (Two Mode, Three Mode, Hybrid/ Others), End-use Industry (Retail, Food & Beverages, Pharmaceuticals & Healthcare, Chemicals & Materials, Manufacturing), Region - Global Forecast to 2032

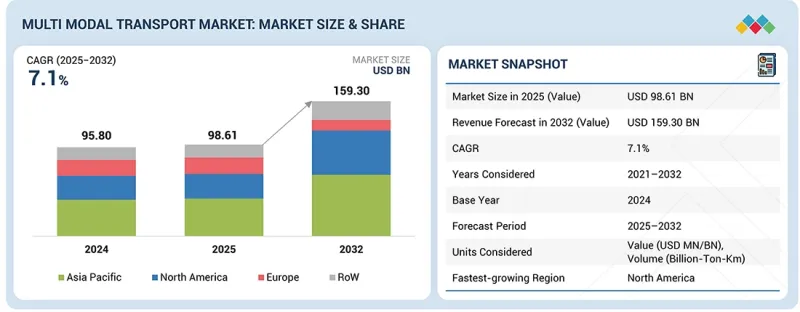

The multimodal transport market is projected to reach USD 159.30 billion by 2032 from USD 98.61 billion in 2025 at a CAGR of 7.1%. Market growth is fueled by the need to streamline freight movement across increasingly fragmented global supply chains and the shift from single-mode trucking to integrated road-rail-waterway networks. Manufacturers and exporters are increasingly relying on multimodal services to manage rising shipment volumes, improve schedule reliability, and reduce transit variability, particularly as cross-border distribution becomes more time-sensitive.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), Volume (Billion-Ton-Km) |

| Segments | By Configuration, End-use Industry, Region |

| Regions covered | Asia Pacific, Europe, North America, and Rest of the World |

Advanced digital platforms enabling end-to-end visibility, automated documentation, and dynamic route optimization, supporting greater adoption of coordinated transport under a single service umbrella. Infrastructure upgrades, including new intermodal terminals, port-rail links, the revival of inland waterways, and multimodal logistics parks, are enhancing network fluidity and enabling higher throughput with fewer handoffs. Policy measures promoting modal shift and sustainability, such as carbon-reduction mandates and incentives for rail and coastal shipping, are accelerating the transition toward lower-emission freight combinations. Geopolitical disruptions, shifting trade lanes, and nearshoring trends are prompting companies to diversify routing options and build redundancy into transport networks. The rising demand for resilience, cost discipline, and scalable capacity is also driving closer collaboration between shippers and logistics providers, positioning multimodal transport as a critical enabler of future-ready supply chains.

"Hybrid-mode configurations are expected to witness significant demand in the multimodal transport market during the forecast period."

Hybrid-mode configurations are expected to experience notable demand in the multimodal transport market during the forecast period, as companies increasingly require flexible movement of freight across changing trade conditions and network constraints. Unlike fixed two-mode arrangements, hybrid setups enable cargo to shift between different transport combinations, such as road-rail-waterways or road-air-waterways, based on capacity availability, route accessibility, and service priorities. This adaptable structure is gaining traction among industries with variable shipment patterns, including pharmaceuticals, electronics, and high-value manufacturing, where delivery timing and risk diversification are critical. Growth in cross-border distribution and seasonal volume surges is also encouraging the adoption of hybrid movements that can reroute cargo through alternative ports or inland corridors when disruptions occur. Logistics providers are supporting this shift by expanding multimodal connectivity at key gateways, enhancing coordination across carriers, and integrating digital tools that enable real-time mode switching. As supply chains shift toward more agile operating models, hybrid-mode configurations are emerging as a crucial option for shippers seeking continuity, tailored service levels, and enhanced control over international freight flows.

"The retail end-use industry held the second-largest share of the multimodal transport market in 2024."

The retail end-use industry accounted for the second-largest share of the multimodal transport market in 2024, driven by the rapid evolution of consumer buying patterns and the increasing need for synchronized product movement across diverse distribution points. With the rise of omnichannel models, where physical stores, online platforms, and regional fulfillment centers operate as a unified network, retailers require transport solutions that can handle frequent restocking, dispersed delivery routes, and fluctuating order volumes. Multimodal setups enable retailers to combine long-haul efficiency with flexible regional distribution, using sea or rail for bulk inbound flows and road for time-sensitive outbound movements to stores and urban hubs. The expansion of grocery e-commerce and temperature-controlled product lines is also creating greater reliance on integrated logistics, particularly for maintaining product integrity during transfers between modes. Additionally, high return rates, promotional spikes, and holiday-season surges demand transport models that offer predictable lead times without increasing cost burdens.

" Asia Pacific held the largest share of the multimodal transport market in 2024."

The Asia Pacific accounted for the largest share of the multimodal transport market in 2024, driven by its dominant position in global manufacturing, export-oriented production, and rapidly expanding regional trade flows. The presence of major industrial hubs across China, India, Japan, and Southeast Asia has created dense freight corridors that link factories, inland logistics zones, and maritime gateways, resulting in a high reliance on integrated road-rail-sea combinations for both domestic distribution and international shipment cycles. The region's extensive port network, including major transshipment centers such as Singapore, Shanghai, and Busan, enhances connectivity to North America, Europe, and the Middle East. The rising intra-Asia trade is increasing demand for shorter, multimodal routes between emerging consumer markets. Large-scale infrastructure programs, such as China's Belt and Road Initiative, India's multimodal logistics parks, and Southeast Asia's rail expansion projects, are improving capacity, reducing transfer bottlenecks, and enabling faster modal transitions. Additionally, rapid growth in e-commerce, urban consumption, and contract manufacturing is driving higher freight volumes that require coordinated transport solutions. As companies prioritize cost efficiency, resilience, and regional supply-chain integration, the Asia Pacific is expected to retain its leading position throughout the forecast period.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: MNC 90% and Tier I - 10%

- By Designation: C- Level 45%, Director-Level- 30%, and Others - 25%

- By Region: Asia Pacific - 35%, North America - 40%, and Europe - 25%

The multi-modal transport market is dominated by major players, including DSV (Denmark), Deutsche Post AG (Germany), Kuehne+Nagel (Switzerland), NIPPON EXPRESS HOLDINGS (Japan), and A.P. Moller - Maersk (Denmark). These companies are expanding their portfolios to strengthen their multimodal transport market position.

Research Coverage:

The report covers the multimodal transport market in terms of configuration type (two-mode, three-mode, and hybrid/others), end-use industry (retail, manufacturing, healthcare & pharmaceuticals, food & beverages, chemicals & materials, oil & gas, and others), and region. It covers the competitive landscape and company profiles of the significant multimodal transport market players.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the multimodal transport market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

- The report will also help stakeholders understand the current and future pricing trends of the multimodal transport market.

- The report will help market leaders/new entrants with information on various trends in the multimodal transport market based on configuration type, end-use industry, and region.

The report provides insight into the following points:

- Analysis of key drivers (electrification to dominate the freight movement globally, cost efficiency through optimization and dynamic mode routing), restraints (dominance of road transport due to its flexibility and reliability, hindering modal shifts, limited adoption among SMEs due to complexity and resource constraints), opportunities (market access and entry into new trade routes, reduction of trade barriers fosters smoother cross-border movement of goods), and challenges (regulatory and legal barriers, including varying policies across regions)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the multimodal transport market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the multimodal transport market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the multimodal transport market

- Competitive Assessment: In-depth assessment of shares, growth strategies, and service offerings of leading players, such as DSV (Denmark), Deutsche Post AG (Germany), Kuehne+Nagel (Switzerland), NIPPON EXPRESS HOLDINGS (Japan), and A.P. Moller - Maersk (Denmark), in the multimodal transport market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH LIMITATIONS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 MNM INSIGHTS INTO MULTIMODAL TRANSPORT

- 3.6 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MULTIMODAL TRANSPORT MARKET

- 4.2 MULTIMODAL TRANSPORT MARKET, BY REGION

- 4.3 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION

- 4.4 MULTIMODAL TRANSPORT MARKET, BY END-USE INDUSTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift from conventional diesel-powered trucks to electric vehicles in logistics sector

- 5.2.1.1.1 Growth in electric truck sales

- 5.2.1.1.2 Policy and regulatory frameworks favoring electric truck adoption

- 5.2.1.2 Rise of sustainable fuels in transportation

- 5.2.1.3 Cost efficiency through optimization and dynamic mode routing

- 5.2.1.1 Shift from conventional diesel-powered trucks to electric vehicles in logistics sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 Dominance of road transport due to its flexibility and reliability

- 5.2.2.2 Limited adoption among SMEs due to complexity and resource constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Market access and entry into new trade routes

- 5.2.3.2 Reduction of trade barriers for smoother cross-border movement of goods

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory and legal barriers

- 5.2.1 DRIVERS

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 PATENT ANALYSIS

- 6.1.1 LIST OF PATENTS

- 6.2 TECHNOLOGY ANALYSIS

- 6.2.1 KEY TECHNOLOGIES

- 6.2.1.1 Digital twins for transport networks

- 6.2.1.2 Multimodal transport management systems (TMS 2.0)

- 6.2.1.3 Blockchain

- 6.2.1.4 Autonomous & connected freight systems

- 6.2.1.5 Robotics & high-automation warehousing

- 6.2.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.2.1 Cybersecurity & secure access systems

- 6.2.2.2 RFID, NFC, and smart labeling

- 6.2.2.3 Power AR/VR for training and operations

- 6.2.3 ADJACENT TECHNOLOGIES

- 6.2.3.1 Holographic navigation interfaces

- 6.2.3.2 Urban and autonomous last-mile delivery

- 6.2.1 KEY TECHNOLOGIES

- 6.3 TECHNOLOGY ROADMAP

- 6.3.1 INTRODUCTION

- 6.3.2 PHASE 1 (2024-2026): DIGITAL FOUNDATION & VISIBILITY

- 6.3.3 PHASE 2 (2027-2030): PREDICTIVE, CONNECTED, AND INTELLIGENT OPERATIONS

- 6.3.4 PHASE 3 (2031-2035): AUTONOMOUS, HYPERCONNECTED, AND SUSTAINABLE ECOSYSTEMS

- 6.4 FUTURE APPLICATIONS

- 6.5 IMPACT OF AI/GEN AI

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES

- 6.5.3 CASE STUDIES

- 6.5.4 CLIENTS' READINESS TO ADOPT AI/GEN AI

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.3.1 EUROPEAN GREEN DEAL

- 7.3.2 TRANS-EUROPEAN TRANSPORT NETWORK (TEN-T)

- 7.3.3 PM GATI SHAKTI

- 7.3.4 INFRASTRUCTURE INVESTMENT AND JOBS ACT (IIJA)

- 7.4 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4.1 SUSTAINABILITY IMPERATIVES TRANSFORMING MULTIMODAL TRANSPORT

- 7.4.1.1 Modal shift for emission reduction

- 7.4.1.2 Electrification & alternative fuels

- 7.4.1.3 Green corridors & eco-efficient hubs

- 7.4.2 CORPORATE INITIATIVES DRIVING SUSTAINABLE MULTIMODAL OPERATIONS

- 7.4.2.1 Digital optimization & AI

- 7.4.2.2 Green warehousing & intermodal terminals

- 7.4.3 MARKET IMPACT ANALYSIS

- 7.4.1 SUSTAINABILITY IMPERATIVES TRANSFORMING MULTIMODAL TRANSPORT

8 INDUSTRY TRENDS

- 8.1 MACROECONOMIC INDICATORS

- 8.1.1 INTRODUCTION

- 8.1.2 GDP TRENDS AND FORECAST

- 8.1.3 TRENDS IN GLOBAL MULTIMODAL TRANSPORT INDUSTRY

- 8.2 ECOSYSTEM ANALYSIS

- 8.2.1 MULTIMODAL TRANSPORT OPERATORS (MTOS)

- 8.2.2 INFRASTRUCTURE & TERMINAL OPERATORS

- 8.2.3 TECHNOLOGY PROVIDERS & DIGITAL PLATFORMS

- 8.2.4 REGULATORY BODIES & STANDARDS ORGANIZATIONS

- 8.2.5 END-USE INDUSTRIES

- 8.3 PRICING ANALYSIS

- 8.3.1 AVERAGE SELLING PRICE OF FREIGHT TRANSPORT, BY MODE, 2021-2024

- 8.3.2 AVERAGE SELLING PRICE OF ROAD FREIGHT, BY REGION, 2021-2024

- 8.3.3 AVERAGE SELLING PRICE OF RAIL FREIGHT, BY REGION, 2021-2024

- 8.3.4 AVERAGE SELLING PRICE OF AIR FREIGHT, BY REGION, 2021-2024

- 8.3.5 AVERAGE SELLING PRICE, INLAND WATERWAYS, BY REGION, 2021-2024

- 8.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 8.5 INVESTMENT AND FUNDING SCENARIO

- 8.6 FUNDING, BY USE CASE

- 8.7 KEY CONFERENCES AND EVENTS

- 8.8 CASE STUDY ANALYSIS

- 8.8.1 NOKIA ACHIEVED MAJOR EMISSION SAVINGS THROUGH DHL'S MULTIMODAL SOLUTION

- 8.8.2 DSV ENABLED ALLBIRDS TO SCALE UK E-COMMERCE AND RETAIL FULFILMENT WITH TAILORED LOGISTICS SUPPORT

- 8.8.3 C.H. ROBINSON HELPED LEADING US RETAILER ACHIEVE 98 % ON-TIME DELIVERY AND SAVE 12,000 LABOR HOURS THROUGH CONSOLIDATION-LED SUPPLY-CHAIN PROGRAM

- 8.8.4 XPO LOGISTICS IMPLEMENTED RIVER-BASED MULTIMODAL DELIVERY SOLUTION TO SERVE SHOPS IN PARIS

- 8.8.5 UPS BUILT END-TO-END SUPPLY CHAIN AND FREIGHT STRATEGY TO SERVE GLOBAL MARKETS

- 8.9 IMPACT OF US 2025 TARIFFS

- 8.9.1 INTRODUCTION

- 8.9.2 KEY TARIFF RATES

- 8.9.3 PRICE IMPACT ANALYSIS

- 8.9.4 IMPACT ON COUNTRIES/REGIONS

- 8.9.5 IMPACT ON END-USE INDUSTRIES

9 MULTIMODAL TRANSPORT MARKET, BY SERVICE TYPE

- 9.1 INTRODUCTION

- 9.2 FREIGHT FORWARDING

- 9.2.1 DIGITAL TRANSFORMATION AND AI-DRIVEN ORCHESTRATION RESHAPING GLOBAL FREIGHT FORWARDING SERVICE

- 9.3 WAREHOUSING & DISTRIBUTION

- 9.3.1 DIGITAL WAREHOUSING AND INTEGRATED DISTRIBUTION NETWORKS REDEFINING MULTIMODAL LOGISTICS PERFORMANCE

- 9.4 TRANSPORTATION

- 9.4.1 OPTIMIZING END-TO-END FREIGHT MOVEMENT WITH INTEGRATED, DATA-DRIVEN TRANSPORT NETWORKS

- 9.5 VALUE-ADDED SERVICES

- 9.5.1 ELEVATING CUSTOMER EXPERIENCE THROUGH ADVANCED, CUSTOMIZED VALUE-ADDED LOGISTICS SERVICES

- 9.6 CUSTOMS BROKERAGE

- 9.6.1 STREAMLINING GLOBAL TRADE FLOWS WITH INTEGRATED, HIGH-EFFICIENCY CUSTOMS BROKERAGE SOLUTIONS

10 MULTIMODAL TRANSPORT MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- 10.2 SUPPLY CHAIN

- 10.2.1 RISING INVESTMENTS AND DIGITAL INTEGRATION TRANSFORMING MULTIMODAL SUPPLY CHAIN SOLUTIONS GLOBALLY

- 10.3 CARGO

- 10.3.1 GLOBAL INITIATIVES AND DIGITAL ADVANCEMENTS ACCELERATING CARGO SOLUTIONS IN MULTIMODAL TRANSPORT NETWORKS

- 10.4 CARRIAGE MODE

- 10.4.1 ADVANCED CARRIAGE NETWORKS AND STRATEGIC INVESTMENTS ENHANCING EFFICIENCY ACROSS GLOBAL MULTIMODAL TRANSPORT SYSTEMS

- 10.5 COURIER

- 10.5.1 DRIVING HIGH-SPEED FREIGHT MOVEMENT WITH UNIFIED, TECHNOLOGY-ENABLED COURIER SERVICES

- 10.6 TRUCK LOADING

- 10.6.1 BOOSTING MULTIMODAL EFFICIENCY WITH AGILE, DIGITALLY ENABLED TRUCK LOADING OPERATIONS

- 10.7 SHIPPING

- 10.7.1 BOOSTING MULTIMODAL EFFICIENCY WITH AGILE, DIGITALLY ENABLED TRUCK-LOADING OPERATIONS

11 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION

- 11.1 INTRODUCTION

- 11.2 TWO-MODE CONFIGURATION

- 11.2.1 STRENGTHENING GLOBAL LOGISTICS THROUGH EXPANDING DOMINANCE OF TWO-MODE MULTIMODAL CONFIGURATIONS

- 11.3 THREE-MODE CONFIGURATION

- 11.3.1 ENHANCING GLOBAL TRADE CONNECTIVITY THROUGH STRATEGIC INVESTMENTS IN THREE-MODE TRANSPORT INFRASTRUCTURE

- 11.4 HYBRID/OTHER CONFIGURATIONS

- 11.4.1 HIGHER LEVEL OF AUTONOMY AND HIGH-SPEED IN-VEHICLE NETWORKS TO DRIVE MARKET

- 11.5 PRIMARY INSIGHTS

12 MULTIMODAL TRANSPORT MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 RETAIL

- 12.2.1 EXPANDING INTERMODAL TERMINALS, UPGRADED INLAND PORTS, AND NEW TRADE CORRIDORS TO DRIVE MARKET

- 12.3 FOOD & BEVERAGES (F&B)

- 12.3.1 EXPANDING AGRICULTURAL AND FOOD COMMODITY TRADE TO DRIVE MARKET

- 12.4 CHEMICALS & MATERIALS

- 12.4.1 GROWTH OF FREIGHT VOLUMES ASSOCIATED WITH BASIC, SPECIALTY, AND HIGH-VALUE CHEMICAL SHIPMENTS TO DRIVE MARKET

- 12.5 PHARMACEUTICALS & HEALTHCARE

- 12.5.1 HIGH PRODUCT VALUE, TIME SENSITIVITY, AND STRINGENT HANDLING REQUIREMENTS TO DRIVE MARKET

- 12.6 MANUFACTURING

- 12.6.1 LARGE-SCALE MOVEMENT OF RAW MATERIALS AND FINISHED GOODS TO DRIVE MARKET

- 12.7 OIL & GAS

- 12.7.1 RISING GLOBAL OIL SUPPLY TO INTENSIFY MULTIMODAL LOGISTICS DEMAND ACROSS COMPLEX ENERGY VALUE CHAINS

- 12.8 OTHER END-USE INDUSTRIES

- 12.9 PRIMARY INSIGHTS

13 MULTIMODAL TRANSPORT MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 CHINA

- 13.2.2.1 Focus on integrated logistics, trade expansion, and green transportation to drive market

- 13.2.3 JAPAN

- 13.2.3.1 Modal shifts from road to rail and coastal shipping to reduce carbon emissions to drive market

- 13.2.4 INDIA

- 13.2.4.1 Emphasis on integrated logistics ecosystem that connects road, rail, air, and waterways to drive market

- 13.2.5 SOUTH KOREA

- 13.2.5.1 Rise in logistics infrastructure investments to drive market

- 13.2.6 REST OF ASIA PACIFIC

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 FRANCE

- 13.3.2.1 Several targeted financial aid schemes to strengthen first- and last-mile connections to drive market

- 13.3.3 GERMANY

- 13.3.3.1 Goal of increasing rail freight's modal share to 25% by 2030

- 13.3.4 SPAIN

- 13.3.4.1 Investments in intermodal terminals, rail infrastructure upgrades, and acquisition of low-emission locomotives to drive market

- 13.3.5 ITALY

- 13.3.5.1 Investments in port-rail interfaces, multimodal terminal upgrades, and digital freight management systems to drive market

- 13.3.6 POLAND

- 13.3.6.1 Infrastructure modernization to enhance rail, road, and sea connectivity to drive market

- 13.3.7 REST OF EUROPE

- 13.4 NORTH AMERICA

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 US

- 13.4.2.1 Government programs to promote zero-emission vehicles to drive growth

- 13.4.3 CANADA

- 13.4.3.1 Logistics modernization, digital documentation, and streamlined customs procedures to drive market

- 13.4.4 MEXICO

- 13.4.4.1 Upgrades to key ports, expanded highways, and industrial park developments to drive market

- 13.5 REST OF THE WORLD

- 13.5.1 ARGENTINA

- 13.5.2 BRAZIL

- 13.5.3 SAUDI ARABIA

- 13.5.4 TURKEY

- 13.5.5 OTHERS

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.5.1 COMPANY VALUATION

- 14.5.2 FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 End-use industry footprint

- 14.7.5.4 Service type footprint

- 14.7.5.5 Solution footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 List of startups/SMEs

- 14.8.5.2 Competitive benchmarking of startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 SERVICE LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 DSV

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Service launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 DEUTSCHE POST AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 KUEHNE+NAGEL

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 NIPPON EXPRESS HOLDINGS

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Service launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 A.P. MOLLER - MAERSK

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 CMA CGM GROUP

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.3.2 Expansions

- 15.1.6.3.3 Others

- 15.1.7 MARUBENI CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 C.H. ROBINSON WORLDWIDE, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 GEODIS

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Expansions

- 15.1.10 XPO, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 NYK LINE

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Service launches

- 15.1.11.3.2 Deals

- 15.1.12 EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 UNITED PARCEL SERVICE OF AMERICA, INC.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.14 HAPAG-LLOYD AG

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Service launches

- 15.1.14.3.2 Deals

- 15.1.15 KLN LOGISTICS GROUP LIMITED

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Deals

- 15.1.1 DSV

- 15.2 OTHER PLAYERS

- 15.2.1 C & S TRANSPORTATION SERVICES, LLC.

- 15.2.2 BDP INTERNATIONAL INC.

- 15.2.3 CROWLEY

- 15.2.4 DACHSER

- 15.2.5 J.B. HUNT TRANSPORT, INC.

- 15.2.6 RHENUS LOGISTICS SE & CO. KG.

- 15.2.7 RYDER SYSTEM, INC.

- 15.2.8 DP WORLD

- 15.2.9 CJ LOGISTICS CORPORATION

- 15.2.10 LOGISTEED, LTD.

16 APPENDIX

- 16.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.4.1 MULTIMODAL TRANSPORT MARKET, BY CONTAINER FREIGHT, AT REGIONAL LEVEL

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 EXCHANGE RATE, 2021-2024

- TABLE 2 TRADE AGREEMENTS IN EMERGING MARKETS

- TABLE 3 RECENT BILATERAL & REGIONAL AGREEMENTS ENHANCING CROSS-BORDER TRADE

- TABLE 4 PATENTS GRANTED, 2022-2024

- TABLE 5 CURRENT STATUS AND SHORT/MID/LONG-TERM PROSPECTS OF TECHNOLOGIES IN MULTIMODAL TRANSPORT MARKET

- TABLE 6 TOP USE CASES AND MARKET POTENTIAL

- TABLE 7 COMPANIES IMPLEMENTING AI/GENERATIVE AI

- TABLE 8 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION IN MULTIMODAL TRANSPORT MARKET

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 GLOBAL INDUSTRY STANDARDS

- TABLE 14 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2030

- TABLE 15 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 16 AVERAGE SELLING PRICE OF FREIGHT TRANSPORT, BY MODE, 2021-2024 (USD/-TON-KM)

- TABLE 17 AVERAGE SELLING PRICE OF ROAD FREIGHT, BY REGION, 2021-2024 (USD/-TON-KM)

- TABLE 18 AVERAGE SELLING PRICE OF RAIL FREIGHT, BY REGION, 2021-2024 (USD/-TON-KM)

- TABLE 19 AVERAGE SELLING PRICE OF AIR FREIGHT, BY REGION, 2021-2024 (USD/-TON-KM)

- TABLE 20 AVERAGE SELLING PRICE, INLAND WATERWAYS, BY REGION, 2021-2024 (USD/-TON-KM)

- TABLE 21 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 KEY TRENDS IMPACTING TRANSPORTATION SERVICE SEGMENT

- TABLE 23 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 24 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 25 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 26 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 27 TWO-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 28 TWO-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 29 TWO-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 30 TWO-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 31 THREE-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 32 THREE-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 33 THREE-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 34 THREE-MODE CONFIGURATION: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 35 HYBRID/OTHER CONFIGURATIONS: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 36 HYBRID/OTHER CONFIGURATIONS: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 37 HYBRID/OTHER CONFIGURATIONS: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 38 HYBRID/OTHER CONFIGURATIONS: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 39 MULTIMODAL TRANSPORT MARKET, BY END-USE INDUSTRY, 2021-2024 (BILLION-TON-KM)

- TABLE 40 MULTIMODAL TRANSPORT MARKET, BY END-USE INDUSTRY, 2025-2032 (BILLION-TON-KM)

- TABLE 41 MULTIMODAL TRANSPORT MARKET, BY END-USE INDUSTRY, 2021-2024 (USD BILLION)

- TABLE 42 MULTIMODAL TRANSPORT MARKET, BY END-USE INDUSTRY, 2025-2032 (USD BILLION)

- TABLE 43 RETAIL: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 44 RETAIL: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 45 RETAIL: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 46 RETAIL: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 47 FOOD & BEVERAGES INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 48 FOOD & BEVERAGES INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 49 FOOD & BEVERAGES INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 50 FOOD & BEVERAGES INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 51 CHEMICALS & MATERIALS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 52 CHEMICALS & MATERIALS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 53 CHEMICALS & MATERIALS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 54 CHEMICALS & MATERIALS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 55 PHARMACEUTICALS & HEALTHCARE INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 56 PHARMACEUTICALS & HEALTHCARE INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 57 PHARMACEUTICALS & HEALTHCARE INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 58 PHARMACEUTICALS & HEALTHCARE INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 59 MANUFACTURING INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 60 MANUFACTURING INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 61 MANUFACTURING INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 62 MANUFACTURING INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 63 OIL & GAS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 64 OIL & GAS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 65 OIL & GAS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 66 OIL & GAS INDUSTRY: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 67 OTHER END-USE INDUSTRIES: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 68 OTHER END-USE INDUSTRIES: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 69 OTHER END-USE INDUSTRIES: MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 70 OTHER END-USE INDUSTRIES: MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 71 MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (BILLION-TON-KM)

- TABLE 72 MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (BILLION-TON-KM)

- TABLE 73 MULTIMODAL TRANSPORT MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 74 MULTIMODAL TRANSPORT MARKET, BY REGION, 2025-2032 (USD BILLION)

- TABLE 75 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (BILLION-TON-KM)

- TABLE 76 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (BILLION-TON-KM)

- TABLE 77 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 78 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 79 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 80 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 81 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 82 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 83 CHINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 84 CHINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 85 CHINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 86 CHINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 87 JAPAN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 88 JAPAN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 89 JAPAN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 90 JAPAN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 91 INDIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 92 INDIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 93 INDIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 94 INDIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 95 SOUTH KOREA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 96 SOUTH KOREA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 97 SOUTH KOREA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 98 SOUTH KOREA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 99 REST OF ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 100 REST OF ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 101 REST OF ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 102 REST OF ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 103 EUROPE: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (BILLION-TON-KM)

- TABLE 104 EUROPE: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (BILLION-TON-KM)

- TABLE 105 EUROPE: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 106 EUROPE: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 107 EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 108 EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 109 EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 110 EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 111 FRANCE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 112 FRANCE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 113 FRANCE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 114 FRANCE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 115 GERMANY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 116 GERMANY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 117 GERMANY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 118 GERMANY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 119 SPAIN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 120 SPAIN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 121 SPAIN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 122 SPAIN: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 123 ITALY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 124 ITALY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 125 ITALY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 126 ITALY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 127 POLAND: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 128 POLAND: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 129 POLAND: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 130 POLAND: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 131 REST OF EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 132 REST OF EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 133 REST OF EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 134 REST OF EUROPE: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 135 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (BILLION-TON-KM)

- TABLE 136 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (BILLION-TON-KM)

- TABLE 137 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 138 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 139 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 140 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 141 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 142 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 143 US: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 144 US: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 145 US: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 146 US: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 147 CANADA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 148 CANADA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 149 CANADA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 150 CANADA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 151 MEXICO: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 152 MEXICO: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 153 MEXICO: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 154 MEXICO: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 155 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (BILLION-TON-KM)

- TABLE 156 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (BILLION-TON-KM)

- TABLE 157 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2021-2024 (USD BILLION)

- TABLE 158 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY COUNTRY, 2025-2032 (USD BILLION)

- TABLE 159 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 160 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 161 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 162 REST OF WORLD: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 163 ARGENTINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 164 ARGENTINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 165 ARGENTINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 166 ARGENTINA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 167 BRAZIL: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 168 BRAZIL: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 169 BRAZIL: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 170 BRAZIL: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 171 SAUDI ARABIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 172 SAUDI ARABIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 173 SAUDI ARABIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 174 SAUDI ARABIA: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 175 TURKEY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 176 TURKEY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 177 TURKEY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 178 TURKEY: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 179 OTHERS: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (BILLION-TON-KM)

- TABLE 180 OTHERS: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (BILLION-TON-KM)

- TABLE 181 OTHERS: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2021-2024 (USD BILLION)

- TABLE 182 OTHERS: MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025-2032 (USD BILLION)

- TABLE 183 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-SEPTEMBER 2025

- TABLE 184 DEGREE OF COMPETITION IN MULTIMODAL TRANSPORT MARKET, 2024

- TABLE 185 MULTIMODAL TRANSPORT MARKET: REGION FOOTPRINT, 2024

- TABLE 186 MULTIMODAL TRANSPORT MARKET: END-USE INDUSTRY FOOTPRINT, 2024

- TABLE 187 MULTIMODAL TRANSPORT MARKET: SERVICE TYPE FOOTPRINT, 2024

- TABLE 188 MULTIMODAL TRANSPORT MARKET: SOLUTION FOOTPRINT, 2024

- TABLE 189 MULTIMODAL TRANSPORT MARKET: LIST OF STARTUPS/SMES

- TABLE 190 MULTIMODAL TRANSPORT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- TABLE 191 MULTIMODAL TRANSPORT MARKET: SERVICE LAUNCHES, JANUARY 2021-SEPTEMBER 2025

- TABLE 192 MULTIMODAL TRANSPORT MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 193 MULTIMODAL TRANSPORT MARKET: EXPANSIONS, JANUARY 2021-SEPTEMBER 2025

- TABLE 194 DSV: COMPANY OVERVIEW

- TABLE 195 DSV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 DSV: SERVICE LAUNCHES

- TABLE 197 DSV: DEALS

- TABLE 198 DEUTSCHE POST AG: COMPANY OVERVIEW

- TABLE 199 DEUTSCHE POST AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 DEUTSCHE POST AG: DEALS

- TABLE 201 KUEHNE+NAGEL: COMPANY OVERVIEW

- TABLE 202 KUEHNE+NAGEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 KUEHNE+NAGEL: DEALS

- TABLE 204 NIPPON EXPRESS HOLDINGS: COMPANY OVERVIEW

- TABLE 205 NIPPON EXPRESS HOLDINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 NIPPON EXPRESS HOLDINGS: SERVICE LAUNCHES

- TABLE 207 NIPPON EXPRESS HOLDINGS: DEALS

- TABLE 208 A.P. MOLLER - MAERSK: COMPANY OVERVIEW

- TABLE 209 A.P. MOLLER - MAERSK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 A.P. MOLLER - MAERSK: DEALS

- TABLE 211 CMA CGM GROUP: COMPANY OVERVIEW

- TABLE 212 CMA CGM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 CMA CGM GROUP: DEALS

- TABLE 214 CMA CGM GROUP: EXPANSIONS

- TABLE 215 CMA CGM GROUP: OTHERS

- TABLE 216 MARUBENI CORPORATION: COMPANY OVERVIEW

- TABLE 217 MARUBENI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 C.H. ROBINSON WORLDWIDE, INC.: COMPANY OVERVIEW

- TABLE 219 C.H. ROBINSON WORLDWIDE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 GEODIS: COMPANY OVERVIEW

- TABLE 221 GEODIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 GEODIS: DEALS

- TABLE 223 GEODIS: EXPANSIONS

- TABLE 224 XPO, INC.: COMPANY OVERVIEW

- TABLE 225 XPO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 NYK LINE: COMPANY OVERVIEW

- TABLE 227 NYK LINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 NYK LINE: SERVICE LAUNCHES

- TABLE 229 NYK LINE: DEALS

- TABLE 230 EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.: COMPANY OVERVIEW

- TABLE 231 EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 UNITED PARCEL SERVICE OF AMERICA, INC.: COMPANY OVERVIEW

- TABLE 233 UNITED PARCEL SERVICE OF AMERICA, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 234 UNITED PARCEL SERVICE OF AMERICA, INC.: DEALS

- TABLE 235 HAPAG-LLOYD AG: COMPANY OVERVIEW

- TABLE 236 HAPAG-LLOYD AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 HAPAG-LLOYD AG: SERVICE LAUNCHES

- TABLE 238 HAPAG-LLOYD AG: DEALS

- TABLE 239 KLN LOGISTICS GROUP LIMITED: COMPANY OVERVIEW

- TABLE 240 KLN LOGISTICS GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 KLN LOGISTICS GROUP LIMITED: DEALS

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 9 STRATEGIC DEVELOPMENTS BY KEY PLAYERS IN MULTIMODAL TRANSPORT MARKET

- FIGURE 10 DISRUPTIVE TRENDS IMPACTING MULTIMODAL TRANSPORT MARKET

- FIGURE 11 TWO-MODE CONFIGURATION TO BE LEADING CONFIGURATION SEGMENT DURING FORECAST PERIOD

- FIGURE 12 NEW VALUE STREAMS FOR STAKEHOLDERS IN MULTIMODAL TRANSPORT MARKET

- FIGURE 13 NORTH AMERICA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 SUPPORTIVE GOVERNMENT POLICIES, E-COMMERCE GROWTH, AND BOOMING EXPORTS TO DRIVE MARKET

- FIGURE 15 ASIA PACIFIC TO BE LARGEST MARKET FOR MULTIMODAL TRANSPORT IN 2025

- FIGURE 16 TWO-MODE CONFIGURATION TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 17 MANUFACTURING END-USE INDUSTRY TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 18 MULTIMODAL TRANSPORT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES

- FIGURE 19 REGION-WISE ADOPTION OF ELECTRIC TRUCKS

- FIGURE 20 RESTRAINTS FOR SMES IN ADOPTING MULTIMODAL SERVICES

- FIGURE 21 PATENT ANALYSIS, 2015-2024

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE OF FREIGHT TRANSPORT, BY MODE, 2021-2024 (USD/-TON-KM)

- FIGURE 24 AVERAGE SELLING PRICE OF ROAD FREIGHT, BY REGION, 2021-2024 (USD/-TON-KM)

- FIGURE 25 AVERAGE SELLING PRICE OF RAIL FREIGHT, BY REGION, 2021-2024 (USD/-TON-KM)

- FIGURE 26 AVERAGE SELLING PRICE OF AIR FREIGHT, BY REGION, 2021-2024 (USD/-TON-KM)

- FIGURE 27 AVERAGE SELLING PRICE, INLAND WATERWAYS, BY REGION, 2021-2024 (USD/-TON-KM)

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 30 MULTIMODAL TRANSPORT MARKET, BY SERVICE TYPE

- FIGURE 31 FREIGHT FORWARDING: MULTIMODAL TRANSPORT MARKET

- FIGURE 32 VALUE-ADDED SERVICES IN MULTIMODAL TRANSPORT MARKET

- FIGURE 33 MULTIMODAL TRANSPORT MARKET, BY SOLUTION

- FIGURE 34 SUPPLY CHAIN SOLUTIONS IN MULTIMODAL TRANSPORT MARKET

- FIGURE 35 SHIPPING SOLUTIONS IN MULTIMODAL TRANSPORT MARKET

- FIGURE 36 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION

- FIGURE 37 MULTIMODAL TRANSPORT MARKET, BY CONFIGURATION, 2025 VS. 2032 (USD BILLION)

- FIGURE 38 MULTIMODAL TRANSPORT MARKET: BY END-USE INDUSTRY

- FIGURE 39 MULTIMODAL TRANSPORT MARKET, BY END-USE INDUSTRY, 2025 VS. 2032 (USD BILLION)

- FIGURE 40 MULTIMODAL TRANSPORT MARKET, BY REGION, 2025 VS. 2032 (USD BILLION)

- FIGURE 41 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 42 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 43 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 44 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 45 ASIA PACIFIC: MULTIMODAL TRANSPORT MARKET SNAPSHOT

- FIGURE 46 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 47 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 48 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 49 EUROPE MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 50 EUROPE: MULTIMODAL TRANSPORT MARKET SNAPSHOT

- FIGURE 51 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 52 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 53 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 54 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 55 NORTH AMERICA: MULTIMODAL TRANSPORT MARKET SNAPSHOT

- FIGURE 56 REST OF THE WORLD: MULTIMODAL TRANSPORT MARKET SNAPSHOT

- FIGURE 57 MULTIMODAL TRANSPORT MARKET SHARE ANALYSIS, 2024

- FIGURE 58 MULTIMODAL TRANSPORT MARKET: REVENUE ANALYSIS OF TOP LISTED PLAYERS, 2020-2024

- FIGURE 59 COMPANY VALUATION OF KEY PLAYERS, OCTOBER 2025 (USD BILLION)

- FIGURE 60 FINANCIAL METRICS OF KEY PLAYERS, OCTOBER 2025 (EV/EBITDA)

- FIGURE 61 MULTIMODAL TRANSPORT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 62 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 MULTIMODAL TRANSPORT MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 64 MULTIMODAL TRANSPORT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 DSV: COMPANY SNAPSHOT

- FIGURE 66 DEUTSCHE POST AG: COMPANY SNAPSHOT

- FIGURE 67 KUEHNE+NAGEL: COMPANY SNAPSHOT

- FIGURE 68 NIPPON EXPRESS HOLDINGS: COMPANY SNAPSHOT

- FIGURE 69 A.P. MOLLER - MAERSK: COMPANY SNAPSHOT

- FIGURE 70 CMA CGM GROUP: COMPANY SNAPSHOT

- FIGURE 71 MARUBENI CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 C.H. ROBINSON WORLDWIDE, INC.: COMPANY SNAPSHOT

- FIGURE 73 GEODIS: COMPANY SNAPSHOT

- FIGURE 74 XPO, INC.: COMPANY SNAPSHOT

- FIGURE 75 NYK LINE: COMPANY SNAPSHOT

- FIGURE 76 EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.: COMPANY SNAPSHOT

- FIGURE 77 UNITED PARCEL SERVICE OF AMERICA, INC.: COMPANY SNAPSHOT

- FIGURE 78 HAPAG-LLOYD AG: COMPANY SNAPSHOT

- FIGURE 79 KLN LOGISTICS GROUP LIMITED: COMPANY SNAPSHOT